- United States

- /

- Capital Markets

- /

- NasdaqCM:STEC

Hywin Holdings Ltd. (NASDAQ:HYW) Might Not Be As Mispriced As It Looks After Plunging 28%

The Hywin Holdings Ltd. (NASDAQ:HYW) share price has fared very poorly over the last month, falling by a substantial 28%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

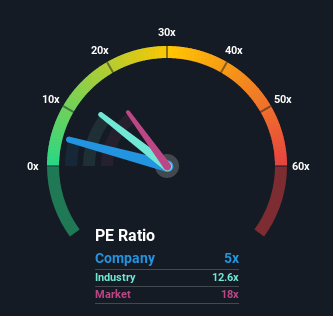

Since its price has dipped substantially, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Hywin Holdings as a highly attractive investment with its 5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Hywin Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Hywin Holdings

How Is Hywin Holdings' Growth Trending?

In order to justify its P/E ratio, Hywin Holdings would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 84% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 315% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 17% per annum over the next three years. That's shaping up to be materially higher than the 13% per year growth forecast for the broader market.

With this information, we find it odd that Hywin Holdings is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Having almost fallen off a cliff, Hywin Holdings' share price has pulled its P/E way down as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hywin Holdings currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Hywin Holdings that you should be aware of.

You might be able to find a better investment than Hywin Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Hywin Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:STEC

Excellent balance sheet moderate.

Similar Companies

Market Insights

Community Narratives