- United States

- /

- Capital Markets

- /

- NasdaqGM:MAAS

Why We're Not Concerned Yet About Highest Performances Holdings Inc.'s (NASDAQ:HPH) 57% Share Price Plunge

To the annoyance of some shareholders, Highest Performances Holdings Inc. (NASDAQ:HPH) shares are down a considerable 57% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 99% share price decline.

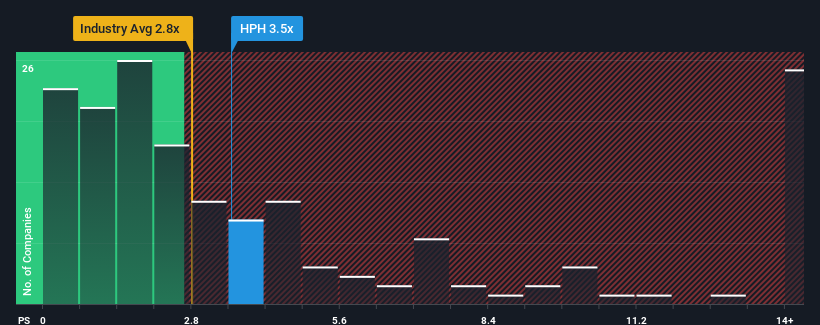

In spite of the heavy fall in price, when almost half of the companies in the United States' Capital Markets industry have price-to-sales ratios (or "P/S") below 2.8x, you may still consider Highest Performances Holdings as a stock probably not worth researching with its 3.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Highest Performances Holdings. Read for free now.Check out our latest analysis for Highest Performances Holdings

What Does Highest Performances Holdings' Recent Performance Look Like?

Recent times have been quite advantageous for Highest Performances Holdings as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Highest Performances Holdings will help you shine a light on its historical performance.How Is Highest Performances Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Highest Performances Holdings' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 2.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Highest Performances Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Despite the recent share price weakness, Highest Performances Holdings' P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Highest Performances Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Highest Performances Holdings.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Highest Performances Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MAAS

Highest Performances Holdings

Engages in the provision of financial technology services in China.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives