- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

What Robinhood Markets (HOOD)'s Surge in Speculative Asset Offerings Means for Shareholders

Reviewed by Sasha Jovanovic

- In recent weeks, Robinhood Markets experienced rapid user and platform asset growth, adding 210,000 funded customers in October and expanding its product suite with offerings such as prediction markets, cash delivery, and broader crypto access.

- This expansion comes amid external pressures including sharp volatility in cryptocurrency and AI-related stocks, uncertain interest rate expectations, and the cofounder’s large share sale, all influencing sentiment and highlighting Robinhood’s sensitivity to shifts in speculative investor activity.

- We’ll now explore how Robinhood’s increased exposure to speculative assets may reshape its investment narrative and growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Robinhood Markets Investment Narrative Recap

At its core, the Robinhood shareholder thesis centers on sustained user growth, expanding product breadth, and increasing assets under custody, as the company seeks to capture a larger share of retail investor activity, especially in fast-evolving sectors like crypto and AI. Recent volatility driven by swings in speculative stocks and crypto prices, combined with a large insider sale, creates meaningful risk to short-term market sentiment and could weigh on the platform’s near-term trading volumes. The impact on the long-term growth story appears limited for now, as underlying user and asset metrics remain robust.

Among Robinhood's latest announcements, the continued expansion of its prediction markets, already contributing over US$100 million in annualized revenue and heading for international growth, is the most relevant. This offering signals both product innovation and increased leverage to speculative investor trends, directly linking to the platform’s most prominent catalysts and risks in the wake of market volatility.

In contrast, while these product expansions have fueled growth, investors should be aware of increasing regulatory scrutiny that could affect Robinhood’s...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets' outlook projects $5.3 billion in revenue and $1.8 billion in earnings by 2028. This scenario requires a 14.0% annual revenue growth rate and flat earnings with no change from the current $1.8 billion level.

Uncover how Robinhood Markets' forecasts yield a $151.14 fair value, a 31% upside to its current price.

Exploring Other Perspectives

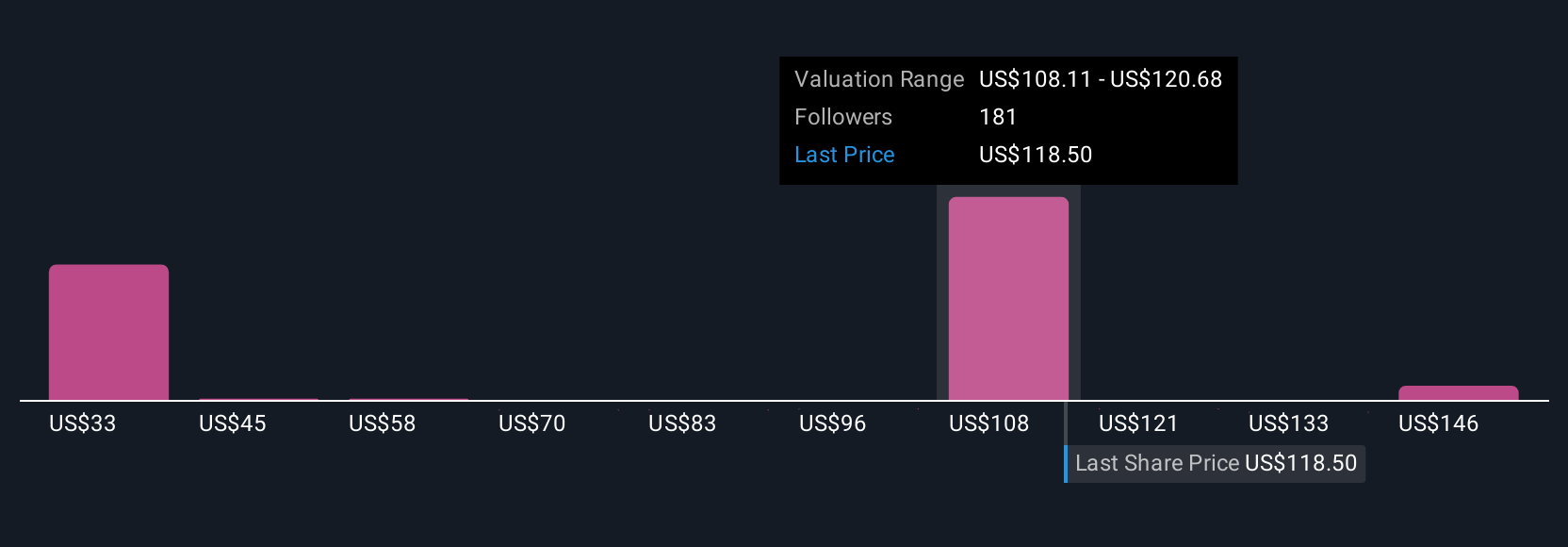

Thirty-seven fair value estimates from the Simply Wall St Community range from US$47.31 to US$158.37 per share. As investor views span from caution to optimism, questions remain about Robinhood’s increasing sensitivity to swings in speculative sectors and the implications this may have on future earnings momentum.

Explore 37 other fair value estimates on Robinhood Markets - why the stock might be worth as much as 38% more than the current price!

Build Your Own Robinhood Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robinhood Markets' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success