- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

US Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As U.S. markets remain mixed with the S&P 500 and Dow Jones Industrial Average down, while the Nasdaq Composite shows fractional gains, investors are closely watching key economic indicators and earnings reports. In such an environment, growth companies with high insider ownership can be particularly attractive as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

| BBB Foods (NYSE:TBBB) | 22.9% | 91.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Robinhood Markets (NasdaqGS:HOOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Robinhood Markets, Inc. operates a financial services platform in the United States and has a market cap of approximately $17.14 billion.

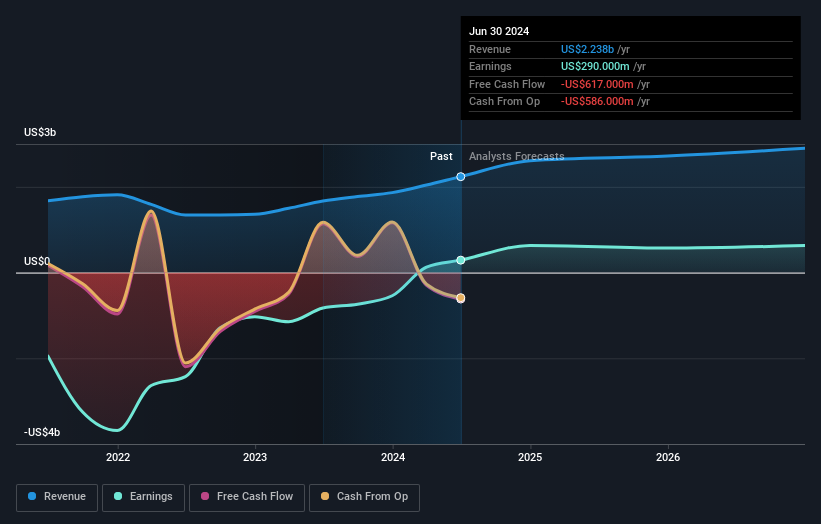

Operations: Robinhood generates revenue primarily through its brokerage segment, which brought in $2.24 billion.

Insider Ownership: 14.5%

Robinhood Markets reported strong second-quarter earnings, with revenue of US$682 million and net income of US$188 million, a significant increase from the previous year. The company's earnings are expected to grow significantly over the next three years, outpacing the broader US market. Despite slower revenue growth forecasts at 9.2% per year, it remains above market average. High insider ownership aligns management's interests with shareholders, enhancing its appeal as a growth company.

- Unlock comprehensive insights into our analysis of Robinhood Markets stock in this growth report.

- Our comprehensive valuation report raises the possibility that Robinhood Markets is priced higher than what may be justified by its financials.

PDD Holdings (NasdaqGS:PDD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDD Holdings Inc., a multinational commerce group with a market cap of $135.75 billion, owns and operates a diverse portfolio of businesses.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated CN¥341.59 billion.

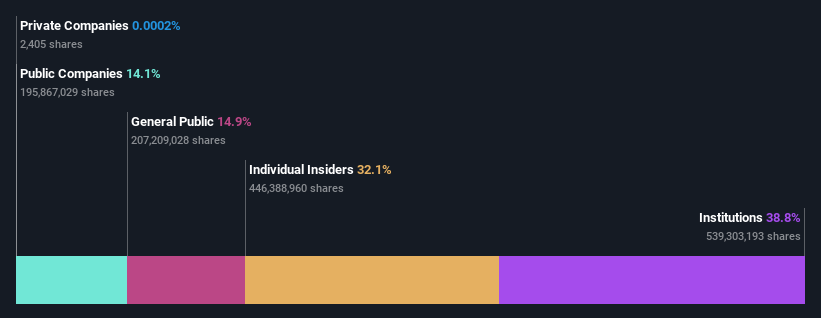

Insider Ownership: 32.1%

PDD Holdings has shown impressive growth, with earnings increasing by 139.6% over the past year and revenue for the recent quarter reaching CNY 97.06 billion, up from CNY 52.28 billion a year ago. Despite this strong performance, PDD faces legal challenges related to alleged misleading statements and security issues on its platforms. Insider ownership remains high, aligning management's interests with shareholders, but future revenue growth is expected to be below 20% per year.

- Click here to discover the nuances of PDD Holdings with our detailed analytical future growth report.

- Our valuation report unveils the possibility PDD Holdings' shares may be trading at a discount.

RH (NYSE:RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH, together with its subsidiaries, operates as a retailer in the home furnishings market and has a market cap of approximately $4.64 billion.

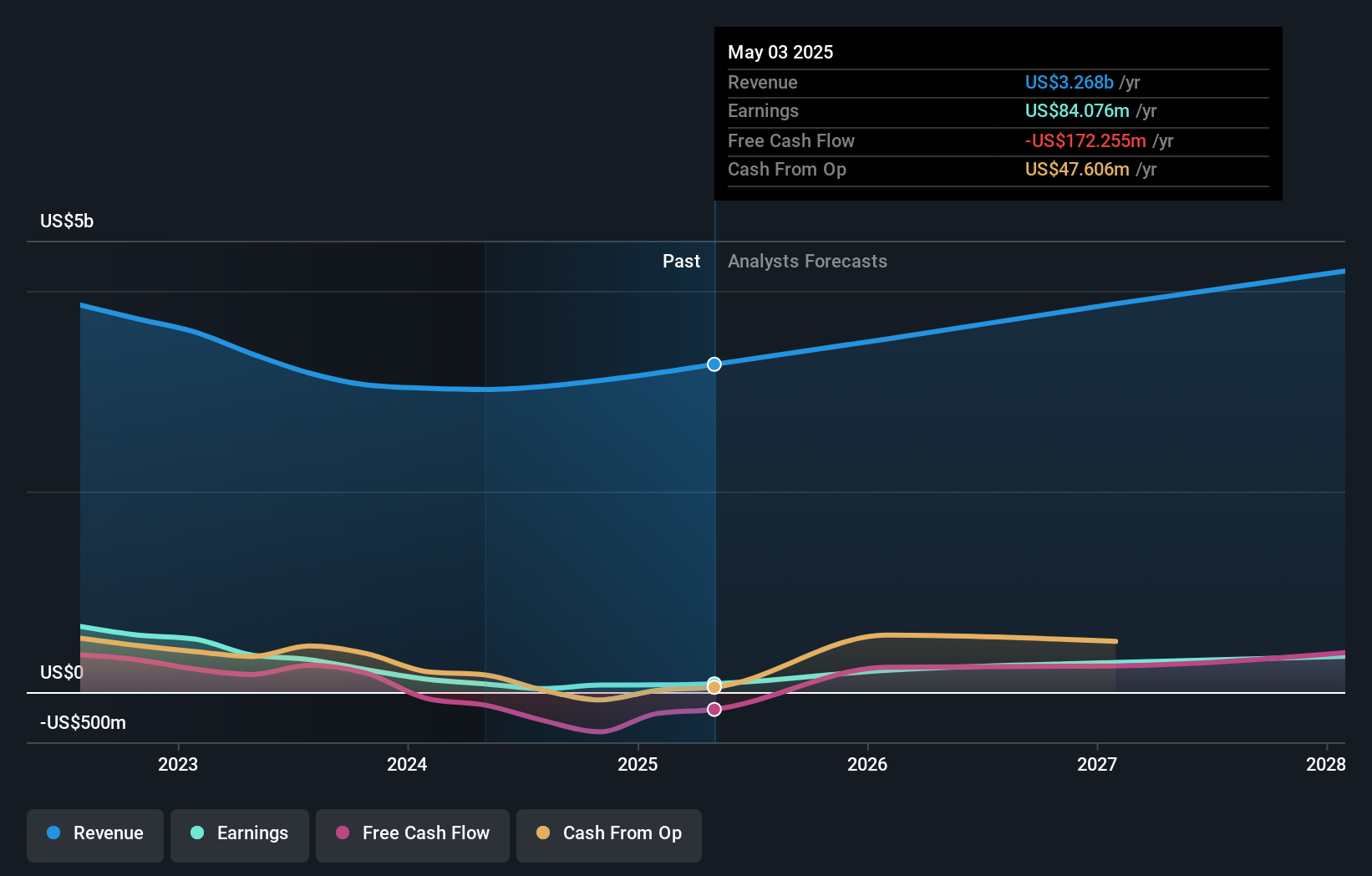

Operations: The company's revenue segments include Waterworks, contributing $194.76 million, and Restoration Hardware (RH), generating $2.82 billion.

Insider Ownership: 17.6%

RH's earnings are forecast to grow 49.74% annually, significantly outpacing the US market. Despite a recent net loss of US$3.63 million in Q1 2024, insiders have shown confidence by buying more shares than selling in the past three months. However, profit margins have declined from 10.9% to 2.7%, and interest payments are not well covered by earnings. RH trades at a discount of 10.5% below its estimated fair value, with high insider ownership aligning management's interests with shareholders'.

- Delve into the full analysis future growth report here for a deeper understanding of RH.

- The valuation report we've compiled suggests that RH's current price could be inflated.

Next Steps

- Dive into all 180 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Reasonable growth potential with acceptable track record.