- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (HOOD): Fresh Valuation Insights Following Strong Revenue Growth and Product Expansion

Reviewed by Simply Wall St

Robinhood Markets (HOOD) recently reported a surge in year-over-year revenue and net income, fueled by heightened trading activity and deeper customer engagement across equities, options, and crypto. Investors are paying close attention because these numbers reflect broad momentum.

See our latest analysis for Robinhood Markets.

Robinhood’s stock has experienced breakout momentum, with the share price rising dramatically over the past year, climbing more than 200% year-to-date and delivering a remarkable 250% total shareholder return. This surge has been fueled by upbeat earnings, rapid user growth, ambitious product launches like cash delivery and exclusive mortgage offers, and highly publicized share buybacks and executive moves. While recent weeks have brought volatility and a pullback from recent highs, the longer-term trend signals that investor enthusiasm remains strong, with Robinhood’s expansion into new financial services keeping the growth story very much alive.

If you’re curious what else is catching investor attention, it’s a great moment to broaden your view and discover fast growing stocks with high insider ownership

With such impressive results and a surge in new products, is Robinhood’s current valuation still leaving room for upside, or is the market already reflecting every bit of its future growth potential?

Most Popular Narrative: 19.3% Undervalued

Robinhood’s fair value, according to the most widely followed narrative, sits well above its latest $122.5 close. This puts today’s market price in attractive territory for growth-focused investors. This narrative fuels the debate about whether explosive expansion will keep outperforming already high expectations.

The current valuation may be assuming continued explosive growth in young, tech-savvy trader engagement and wallet share, but there are emerging signs that demographic interest may shift away from traditional equities towards alternative assets, crypto, or even decentralized finance. This would constrain Robinhood's long-term revenue growth and customer base expansion.

Want to know the assumptions behind that generous price tag? There’s a bold forecast for revenue and margin transformation at the heart of this model. Find out which future benchmarks, unlike any in the industry, are packed into the calculations driving the upside.

Result: Fair Value of $151.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid competition and rising compliance costs could compress margins. In addition, faltering trading activity may make current growth projections harder to achieve.

Find out about the key risks to this Robinhood Markets narrative.

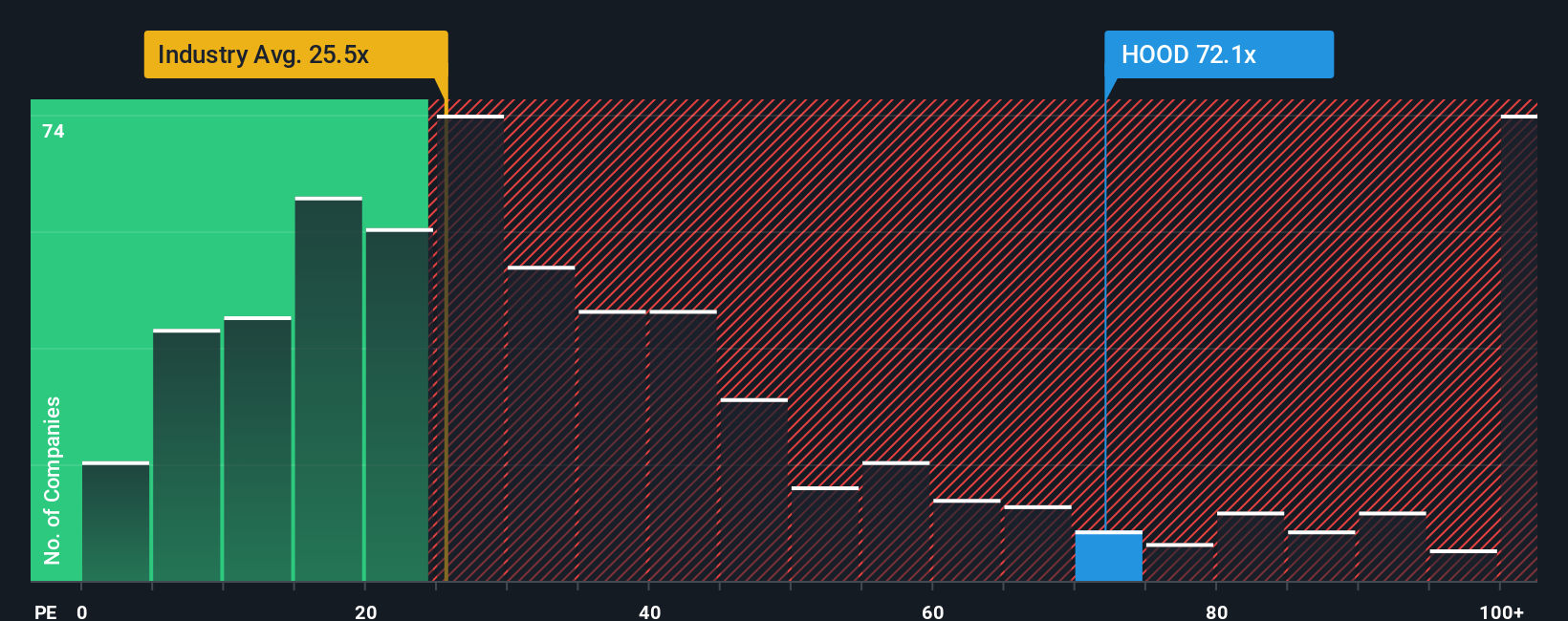

Another View: Market Ratios Paint a Richer Picture

While some see upside in the fair value estimate, looking at the current price-to-earnings ratio offers a different perspective. Robinhood trades at 50.2 times earnings, much higher than the US Capital Markets industry average of 24.9 and the peer average of 21.5. The fair ratio is just 24.4, indicating a significant premium. Does this make the stock vulnerable if expectations decline, or could this premium indicate unique staying power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robinhood Markets Narrative

If you want to dig into the stats and form your own take, you can craft a personalized thesis from scratch in just a few minutes: Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want even more exciting opportunities, don’t let these promising stocks pass you by. There’s a fresh angle for every investor.

- Capitalize on unrecognized value by checking out these 897 undervalued stocks based on cash flows, packed with companies trading below their intrinsic worth.

- Tap into game-changing innovations with these 25 AI penny stocks, focused on firms shaping the future with real AI breakthroughs.

- Boost your long-term portfolio with steady income and peace of mind by scanning these 16 dividend stocks with yields > 3%, offering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives