- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Is the Robinhood Rally Justified After Shares Jumped 11.8% This Week?

Reviewed by Bailey Pemberton

- Wondering if Robinhood Markets is actually a good buy right now? You are not alone, especially with the stock getting plenty of attention for its rapid rise and changing market perceptions.

- In just the past week the share price jumped 11.8%, reversing some of last month's 12.5% drop. The stock is up 225.8% year-to-date and 241.5% over the past year.

- Much of this excitement traces back to Robinhood's expansion into new product offerings and increased trading activity. This has captured widespread media coverage on financial news sites and social media, fueling renewed debate on whether its current valuation is justified.

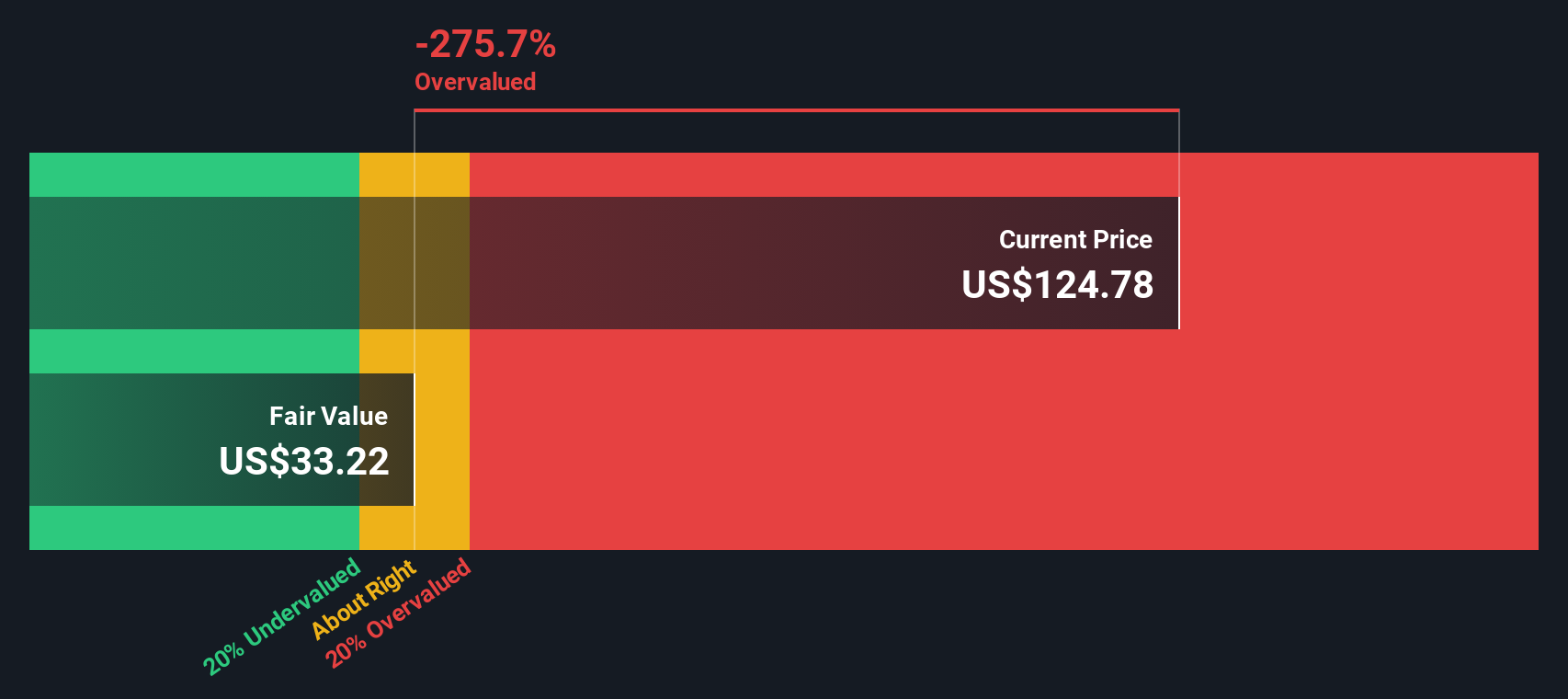

- Our transparent scoring system gives Robinhood Markets a 0 out of 6 for undervaluation. This makes it important to look deeper. Let us examine the usual valuation methods and consider a more holistic approach that could help you better assess the stock.

Robinhood Markets scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Robinhood Markets Excess Returns Analysis

The Excess Returns valuation model focuses on the return Robinhood Markets can generate above its cost of equity. Instead of looking at cash flows, this approach examines how effectively the company puts shareholders’ equity to work by measuring the difference between what the company earns on its equity and what it would cost to raise that capital.

For Robinhood Markets, the analysis shows a Book Value of $9.53 per share and a Stable EPS of $2.60 per share, as projected by weighted future Return on Equity estimates from eight analysts. The company’s Cost of Equity is $1.06 per share, and the resulting Excess Return is $1.54 per share. The average Return on Equity is 20.72 percent. Projections suggest a Stable Book Value of $12.57 per share, based on consensus from five analysts.

Using these metrics, the model calculates an intrinsic value for Robinhood Markets. The analysis currently finds the stock to be 203.9 percent overvalued according to this approach. This suggests the share price is running well ahead of the value implied by the company’s ability to generate future excess returns.

Result: OVERVALUED

Our Excess Returns analysis suggests Robinhood Markets may be overvalued by 203.9%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

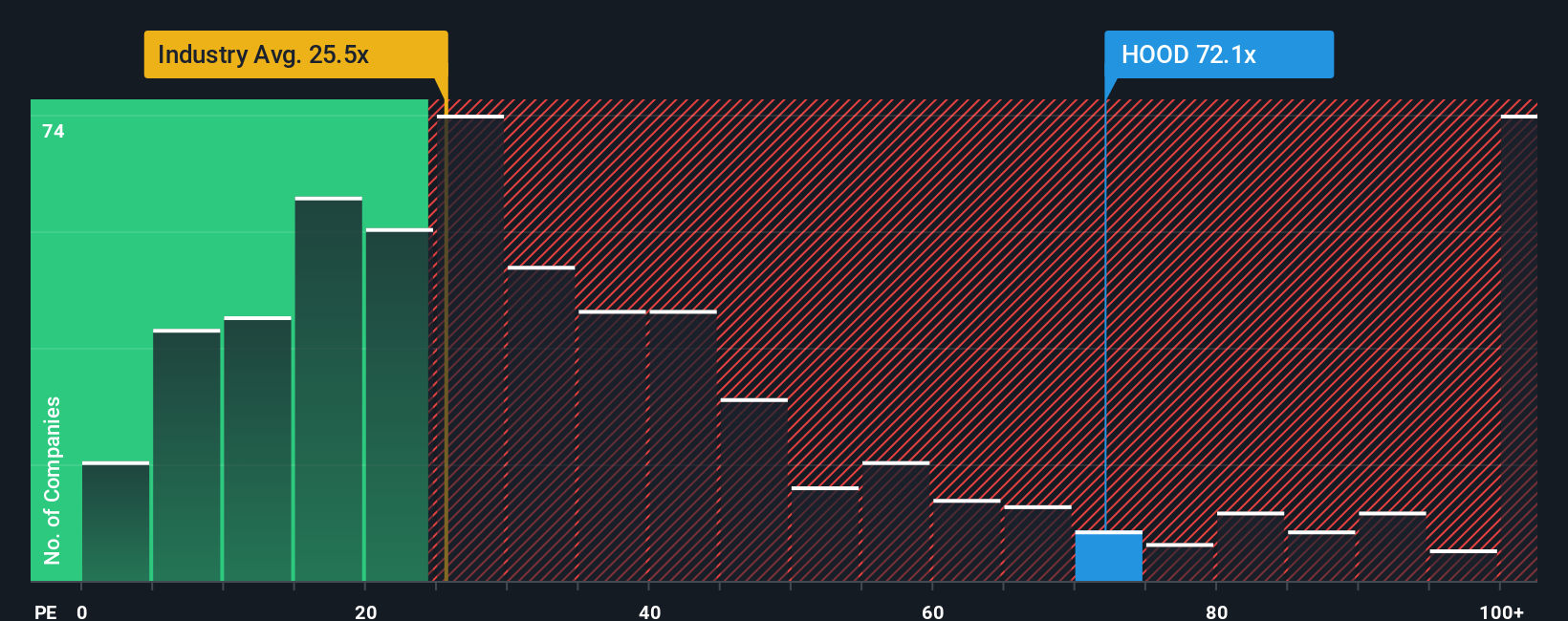

Approach 2: Robinhood Markets Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, as it relates a company’s share price to its annual net earnings. For businesses generating consistent profits, the PE ratio helps investors gauge whether the stock is trading at an attractive level given its earnings power.

A “normal” or fair PE ratio is influenced by growth expectations and business risk. Fast-growing companies or those with stable earnings and lower risk typically command higher PE ratios, since investors are willing to pay a premium for reliable and expanding profits. In contrast, companies facing greater risks or limited growth tend to have lower PE ratios.

Robinhood Markets currently trades at a PE ratio of 52.66x. This is significantly above the Capital Markets industry average of 23.84x and also above the peer average of 21.63x. On the surface, it may look expensive compared to these benchmarks.

However, Simply Wall St's proprietary "Fair Ratio" for Robinhood is 27.28x. This incorporates unique aspects such as expected earnings growth, profit margins, industry norms, company size, and risk factors. This composite benchmark is more informative than a simple industry or peer comparison, as it accounts for what makes Robinhood distinct from its competitors.

When compared to the "Fair Ratio," Robinhood’s current PE of 52.66x is well above what would be considered justified given the company’s fundamentals, signaling that the stock may be overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

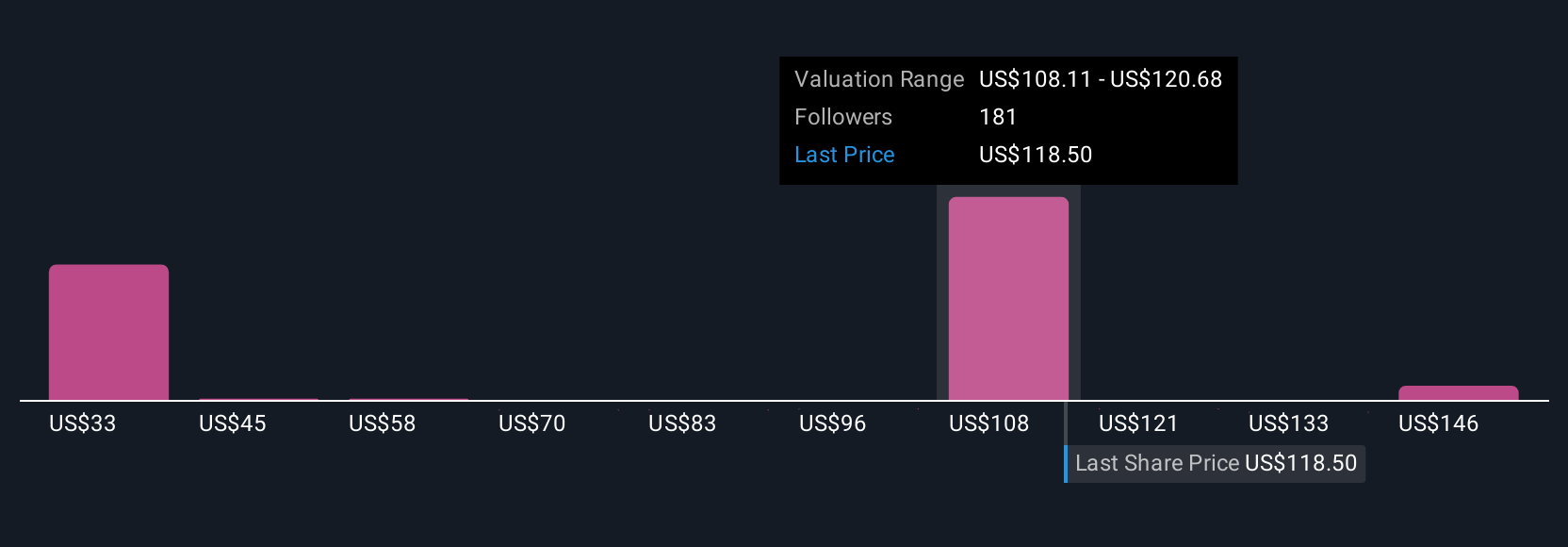

Upgrade Your Decision Making: Choose your Robinhood Markets Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your personal story or perspective about a company, supported by your own fair value estimate and forecasts for its future revenue, earnings, and margins. Narratives link Robinhood’s business story to a financial forecast, and then to an actionable fair value. This makes it easier to see the “why” behind the numbers, not just the numbers themselves.

Narratives are designed to be accessible tools within Simply Wall St's Community page, used by millions of investors. They help you decide when to buy or sell by clearly showing how your Fair Value compares to the current share price. In addition, these Narratives update dynamically with every new piece of information, such as news or quarterly results, so your perspective remains timely and relevant.

For example, in the case of Robinhood Markets, some users express a bullish Narrative, expecting strong product launches and international expansion with a Fair Value as high as $160. Others take a more cautious stance, citing competition and regulatory risk with Fair Values around $50. This demonstrates how different perspectives help you understand what needs to happen for you to invest confidently.

Do you think there's more to the story for Robinhood Markets? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026