- United States

- /

- Capital Markets

- /

- NasdaqGS:GLXY

Galaxy Digital (NasdaqGS:GLXY): Evaluating Valuation After Strong Share Price Gains and Crypto Sector Optimism

Reviewed by Simply Wall St

Galaxy Digital (NasdaqGS:GLXY) stock has drawn investor attention lately, largely due to its sizable swings in the crypto-related financial sector. Over the past month, shares have climbed 21%, bringing its year-to-date return close to 120%.

See our latest analysis for Galaxy Digital.

After a strong multi-month run, Galaxy Digital’s 1-month share price return of 21% shows momentum is building again. This has added to a staggering 182% one-year total shareholder return, signaling investors are seeing renewed growth potential in the crypto finance space despite occasional pullbacks.

If you’re interested in spotting other companies making big moves, broaden your search and discover fast growing stocks with high insider ownership

The key question for investors now is whether Galaxy Digital’s soaring stock still offers hidden value at these elevated levels, or if the impressive gains mean that future growth is already fully priced in.

Most Popular Narrative: 5% Overvalued

The most followed narrative sets Galaxy Digital's fair value just below its last close, suggesting its recent run has outpaced growth expectations for now. The narrative draws on forecasts of explosive sector-wide expansion, but warns that current prices reflect strong optimism about the business model shift in digital finance and AI.

The maturation of digital asset infrastructure, evidenced by large-scale, long-term data center developments and multi-phase partnerships (e.g., CoreWeave), is poised to generate significant, high-margin cash flows beginning in 2026, enhance earnings visibility, and improve the company's overall capitalization efficiency as these business lines scale.

Curious what transformation could drive such a bold price target? The mathematics behind this fair value hinge on breakneck revenue expansion and a rapid path to sustainable profits. Are analysts betting on a blockbuster shift in the company’s business model or is something else at play? Dive into the full narrative and see what’s fueling these high-stakes projections.

Result: Fair Value of $37.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Galaxy's heavy reliance on a single tenant for its data centers and the capital-intensive nature of scaling new infrastructure.

Find out about the key risks to this Galaxy Digital narrative.

Another View: What Do the Numbers Say?

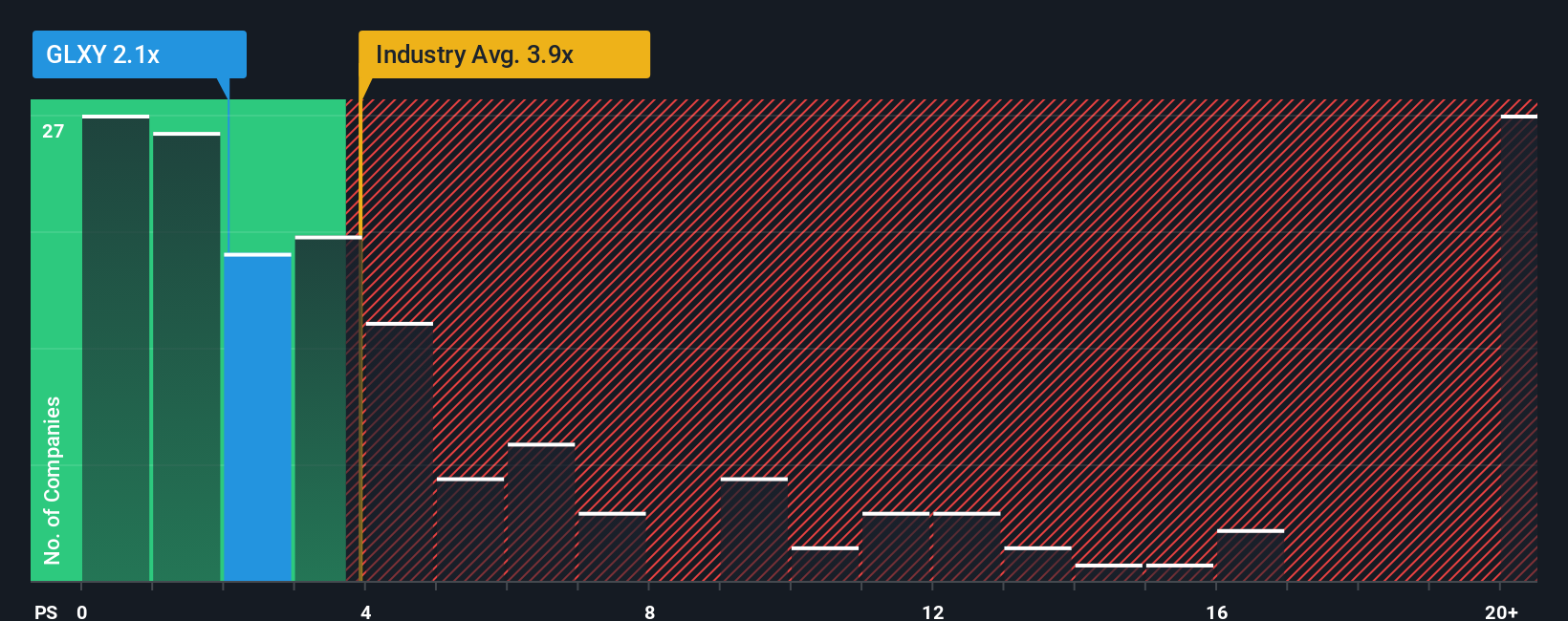

Looking beyond future earnings, Galaxy Digital currently trades at a sales ratio of 2.2x. This is lower than both its peer average (2.8x) and the broader US Capital Markets industry (4x), and well below the fair ratio of 9.5x the market might ultimately aim for. That leaves a surprisingly wide gap. Does this signal an undervalued opportunity or simply highlight heightened risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If you see a different story in the numbers or want to run your own analysis, it only takes a few minutes to build your perspective. Do it your way

A great starting point for your Galaxy Digital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at Galaxy Digital. You could be missing out on the next big winner if you don’t check out other high-potential stocks tailored to your investing style.

- Tap into long-term income growth by reviewing these 17 dividend stocks with yields > 3%, which offers reliable yields above 3% and robust fundamentals for added confidence in your portfolio.

- Capitalize on the boom in smart technology with these 24 AI penny stocks, as AI is rapidly changing the landscape and creating new opportunities.

- Enhance your crypto strategy with these 79 cryptocurrency and blockchain stocks, focusing on blockchain and digital asset innovators positioned to benefit from the next surge in demand.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLXY

Galaxy Digital

Engages in the digital asset and data center infrastructure businesses.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives