- United States

- /

- Capital Markets

- /

- NasdaqGS:GLXY

Galaxy Digital (NasdaqGS:GLXY): Evaluating Current Valuation After Recent Momentum Shift

Reviewed by Simply Wall St

Galaxy Digital (NasdaqGS:GLXY) has caught investor attention recently, with its stock shifting direction over the past month. While the headlines may not highlight any single event, there are a few trends worth keeping an eye on.

See our latest analysis for Galaxy Digital.

Momentum for Galaxy Digital has picked up again in 2024, with the stock posting a 45.3% share price return year-to-date and a stellar 47.3% total shareholder return over the last year. While recent volatility has made for a bumpier ride, the long-term performance, including an eye-catching 728% total return over three years, keeps growth potential firmly in the conversation.

If you’re keen to see which other companies are turning heads this year, why not branch out and explore fast growing stocks with high insider ownership

With a powerful rebound and double-digit growth, is Galaxy Digital's recent performance signaling an undervalued opportunity, or has the market already accounted for all of its future prospects? Is there real value left for investors today?

Most Popular Narrative: 43.8% Undervalued

Galaxy Digital’s fair value, as suggested by the most widely followed narrative, lands far above the latest close. This stark valuation gap points to catalysts that bulls believe could set the stock apart in the evolving digital assets and AI infrastructure space.

Improving regulatory clarity and ongoing legal reforms like the GENIUS Act are facilitating the integration of traditional finance with blockchain. This enables Galaxy to launch new products (e.g., stablecoins, funds, tokenized assets) and gain access to larger client pools, which is set to meaningfully increase addressable markets and topline growth.

Want to know if stunning growth forecasts justify this high price? Behind this narrative is an aggressive roadmap of expansion and network effects that analysts say could upend the industry. What key financial bets are hiding inside the math? Click for the story behind the valuation.

Result: Fair Value of $46.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with these growth projections, reliance on a major client and tightening profit margins could quickly shift Galaxy Digital’s outlook.

Find out about the key risks to this Galaxy Digital narrative.

Another View: Multiples Point to Elevated Valuation Risk

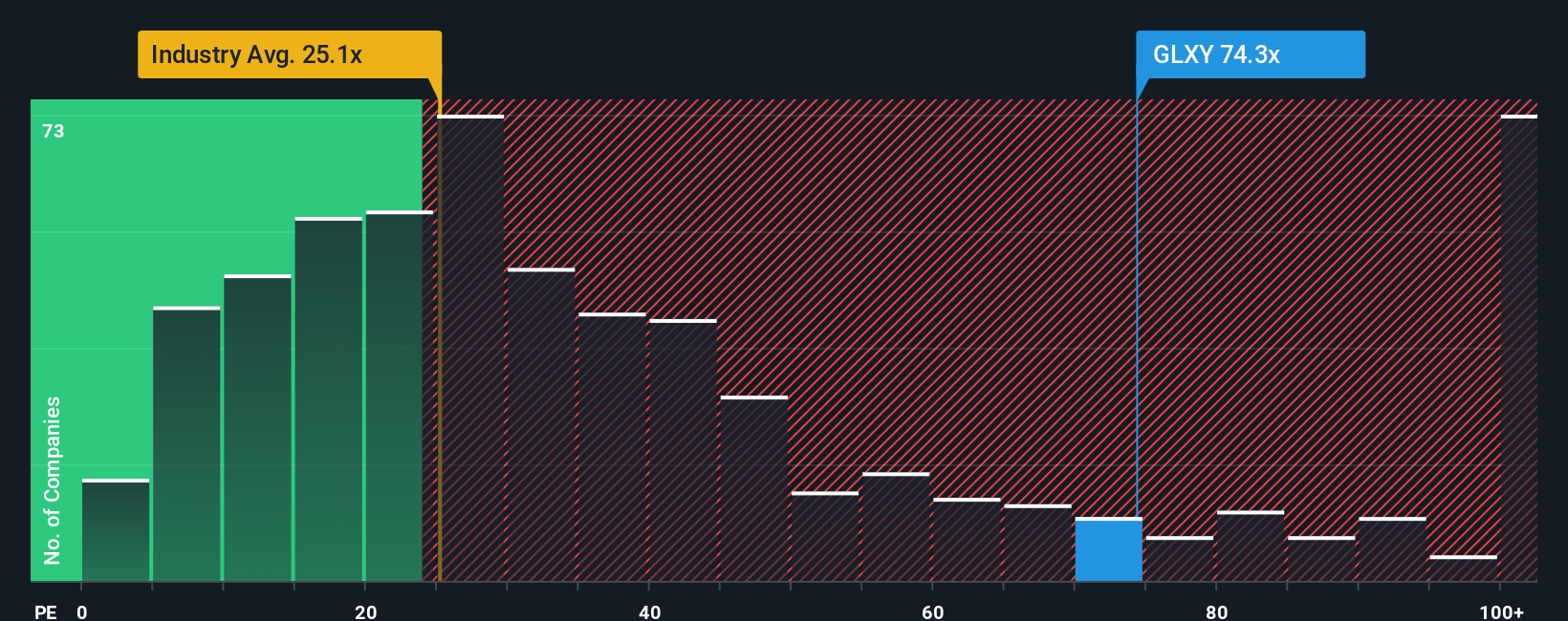

Looking from a different angle, the market’s price-to-earnings ratio for Galaxy Digital currently stands at a lofty 42.3x. This figure is more than double the US Capital Markets industry average of 23.5x, higher than peers at 19.8x, and nearly five times above its calculated fair ratio of 8.7x. Such a wide gap suggests investors are paying a premium for future growth rather than current profitability. Is the optimism justified, or could sentiment shift if growth expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If you want to challenge the popular view or trust your own research, you can dive into the data and shape your perspective in just a few minutes, Do it your way

A great starting point for your Galaxy Digital research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next investment win by actively seeking out stocks at the forefront of market innovation, income growth, and technological change through Simply Wall Street’s unique screeners. Don’t let opportunity pass you by; your next smart move could be just a click away.

- Capture potential upside by scanning these 3580 penny stocks with strong financials with strong financials before they’re on everyone’s radar.

- Boost your portfolio’s future earnings and stability via these 15 dividend stocks with yields > 3% offering attractive yields and consistent payouts.

- Step into the world of tomorrow and tap into breakthroughs with these 28 quantum computing stocks driving the evolution of computing and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLXY

Galaxy Digital

Engages in the digital asset and data center infrastructure businesses.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.