- United States

- /

- Capital Markets

- /

- NasdaqGM:GCMG

GCM Grosvenor (GCMG): Exploring Valuation Potential After Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

GCM Grosvenor (GCMG) shares have tracked a fairly stable course lately, showing a slight uptick over the past day. This comes despite the stock trending lower for the past month. Investors might be weighing long-term growth against recent short-term fluctuations.

See our latest analysis for GCM Grosvenor.

After a stretch of subdued momentum, GCM Grosvenor's share price has begun to see a bit of movement, even though recent returns have been in the red. Taking a step back, the long-term picture is quite different. The one-year total shareholder return stands at 8.7 percent and climbs to over 82 percent across three years. This suggests those holding for the long haul have enjoyed robust results as day-to-day price swings even out.

If you’re interested in broadening your investing search beyond the usual suspects, this is a great moment to discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets, but with solid long-term returns on record, the question remains: is GCM Grosvenor currently undervalued, or is the market already factoring in its growth ahead?

Most Popular Narrative: 23.3% Undervalued

GCM Grosvenor’s fair value, according to the prevailing narrative, stands notably above its last close price, highlighting a substantial upside that has caught market watchers’ attention. The difference signals high expectations for future growth and operational leverage as the business evolves.

Ongoing investment in technology, data analytics, and operational efficiency, including advanced AI adoption, supports scalable growth and continued margin improvement. These factors are expected to further enhance net margins and operational leverage over time.

Think those technology upgrades are just buzzwords? The real story is in the financial projections supporting this valuation. How do future profit margins and ambitious growth targets work together to justify the premium placed on these shares? The playbook is anything but conventional. Uncover the bold drivers behind this narrative’s attractive fair value.

Result: Fair Value of $15.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fee pressures from clients and slow retail fund growth could challenge both the upside narrative and GCM Grosvenor’s longer-term profitability outlook.

Find out about the key risks to this GCM Grosvenor narrative.

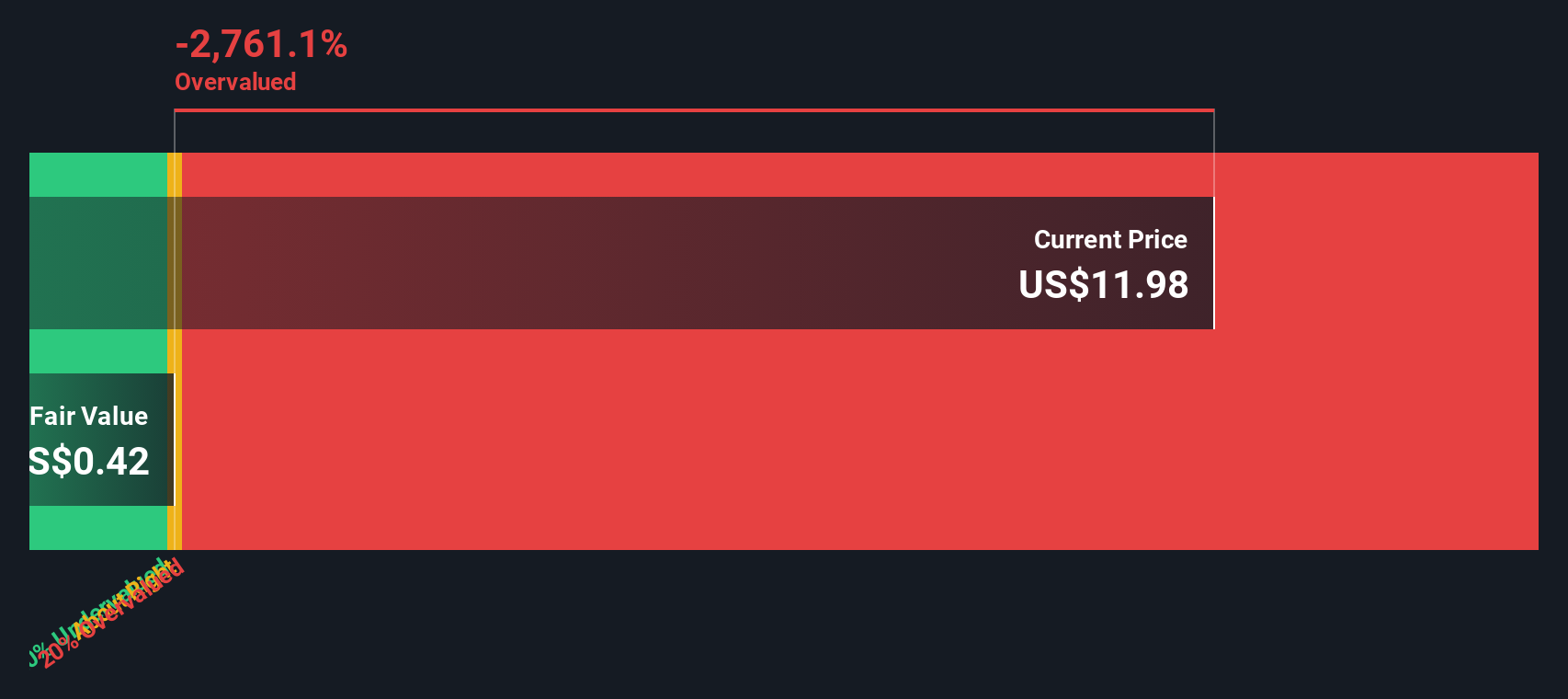

Another View: Contrasting the DCF Valuation

Looking at GCM Grosvenor from a different angle, the SWS DCF model signals a much less optimistic picture. Based on its cash flow forecasts, the DCF estimate is well below today’s share price. This suggests GCMG could be overvalued relative to its future free cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GCM Grosvenor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GCM Grosvenor Narrative

If you see things differently or have your own approach, dive into the numbers and craft a narrative of your own in just minutes with Do it your way.

A great starting point for your GCM Grosvenor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Smart investors use the Simply Wall Street Screener to spot exciting prospects across different themes and markets. Don’t wait until others find them first.

- Tap into the power of next-generation technology with these 24 AI penny stocks as they push the boundaries in artificial intelligence innovation and automation.

- Grow your wealth with these 19 dividend stocks with yields > 3% offering reliable yields and a proven track record for consistent income streams.

- Trailblaze into the digital economy by checking out these 78 cryptocurrency and blockchain stocks and learn how they lead developments in secure payments and blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCMG

GCM Grosvenor

GCM Grosvenor Inc. is global alternative asset management solutions provider.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives