- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Futu Holdings (FUTU) Sells Off After Major Stake Exit and Surging AI-Powered Global Growth—Is Risk Rising?

Reviewed by Sasha Jovanovic

- In the past week, Futu Holdings reported a year-over-year revenue surge of nearly 70% in Q2 2025, alongside expanding operating margins and rapid international account growth, supported by AI-driven product offerings like Futubull AI and moomoo AI.

- Yong Rong (HK) Asset Management Ltd fully exited its significant holdings in Futu during the third quarter, a move attributed to profit-taking and portfolio rebalancing after strong stock gains, highlighting shifting institutional investor dynamics.

- We’ll look at how Futu’s accelerating AI-powered international expansion could shift its long-term investment outlook and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Futu Holdings Investment Narrative Recap

To see value in Futu Holdings, an investor must believe in the company’s ability to translate strong user growth and AI-powered product innovation into durable global expansion and earnings strength, even as rapid stock gains introduce short-term uncertainty. While the full exit of Yong Rong (HK) Asset Management Ltd has spotlighted shifting institutional behavior, it doesn’t materially alter the main catalyst: sustaining momentum in funded account growth and widening margins, which continue to offset intense competition and volume-driven income risks.

Among the recent announcements, Futu’s Q2 2025 earnings release stands out, as the company reported revenue up almost 70% year on year and marked a 42% increase in international funded accounts. These results reinforce the importance of overseas momentum, validating product investments in areas like Futubull AI and moomoo AI as key drivers for future platform engagement and profit scalability.

Yet, against this backdrop, investors should be mindful of how increased competition, especially in Japan and the US, could eventually lead to...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' narrative projects HK$26.3 billion in revenue and HK$12.9 billion in earnings by 2028. This requires 17.8% annual revenue growth and a HK$5 billion earnings increase from the current HK$7.9 billion.

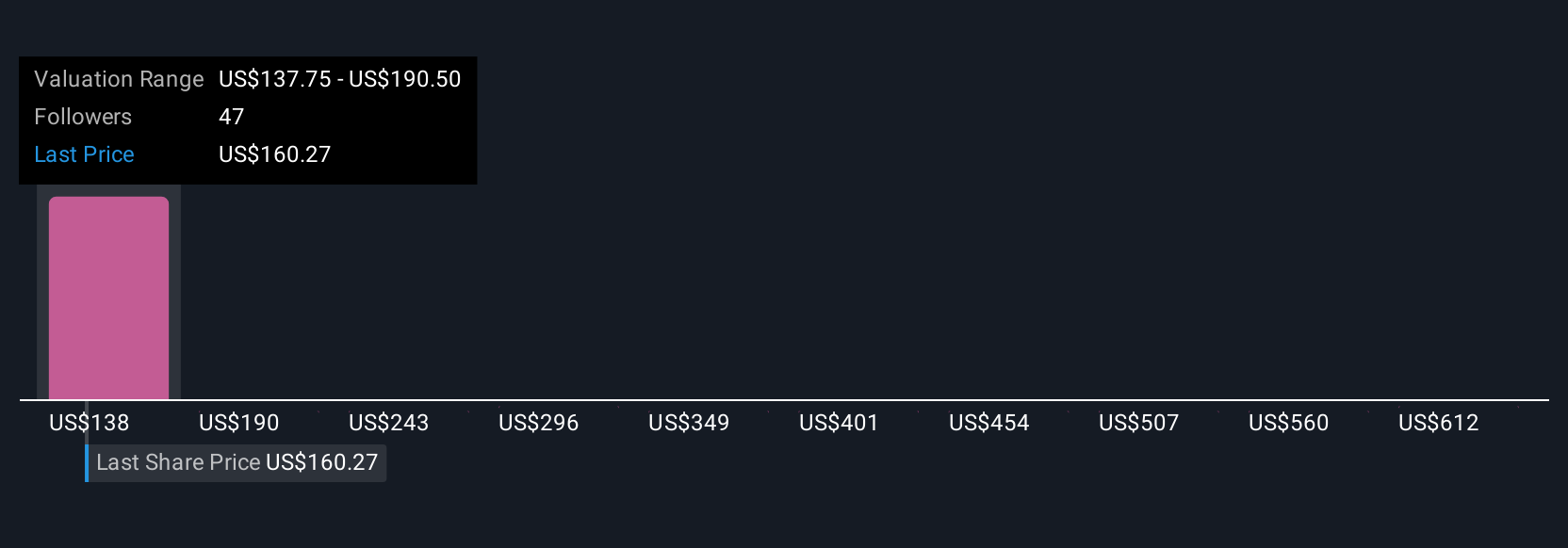

Uncover how Futu Holdings' forecasts yield a $211.37 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Nine recent fair value forecasts from the Simply Wall St Community cluster between HK$165.64 and HK$388, underscoring substantial divergence around Futu’s outlook. With competition from established brokers an ongoing question, you can see just how differently market participants size up the company’s risks and potential.

Explore 9 other fair value estimates on Futu Holdings - why the stock might be worth 12% less than the current price!

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives