- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Can Futu Holdings’ Client Retention Set FUTU Apart Amid Ongoing Regulatory Questions?

Reviewed by Sasha Jovanovic

- Earlier this week, CMB International Securities analyst Nika MA reiterated a Buy rating on Futu Holdings, citing robust fundamentals and an attractive valuation, even as regulatory questions persist.

- The analyst highlighted Futu's competitive platform, diverse market reach, and strong ability to retain high-net-worth clients as key differentiators shaping expectations for the company.

- We'll explore how the affirmation of strong fundamentals and high-net-worth client retention could shift Futu Holdings' investment narrative.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Futu Holdings Investment Narrative Recap

Owning shares of Futu Holdings today means believing in its ability to expand globally while maintaining strong fundamentals and high client loyalty, especially among high-net-worth customers. While CMB International’s recent affirmation highlighted growth potential amid a pullback in valuation, persistent regulatory uncertainties around cross-border expansion and compliance remain the primary short-term risk. For now, this latest analyst commentary does not materially shift either the main catalyst of global account growth or the biggest risk from ongoing regulatory change.

Among recent announcements, Futu’s Q2 2025 financial results featured standout revenue and profit growth, reinforcing the analyst’s positive tone regarding robust fundamentals. This performance supports the investment narrative that growth in international markets and high client retention are key levers for future gains, given ongoing regulatory questions.

However, despite strong headline numbers, investors should be mindful of the risks posed by evolving regulatory frameworks especially as...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' outlook anticipates HK$26.3 billion in revenue and HK$12.9 billion in earnings by 2028. This implies a 17.8% annual revenue growth and a HK$5.0 billion increase in earnings from the current HK$7.9 billion.

Uncover how Futu Holdings' forecasts yield a $207.27 fair value, a 5% upside to its current price.

Exploring Other Perspectives

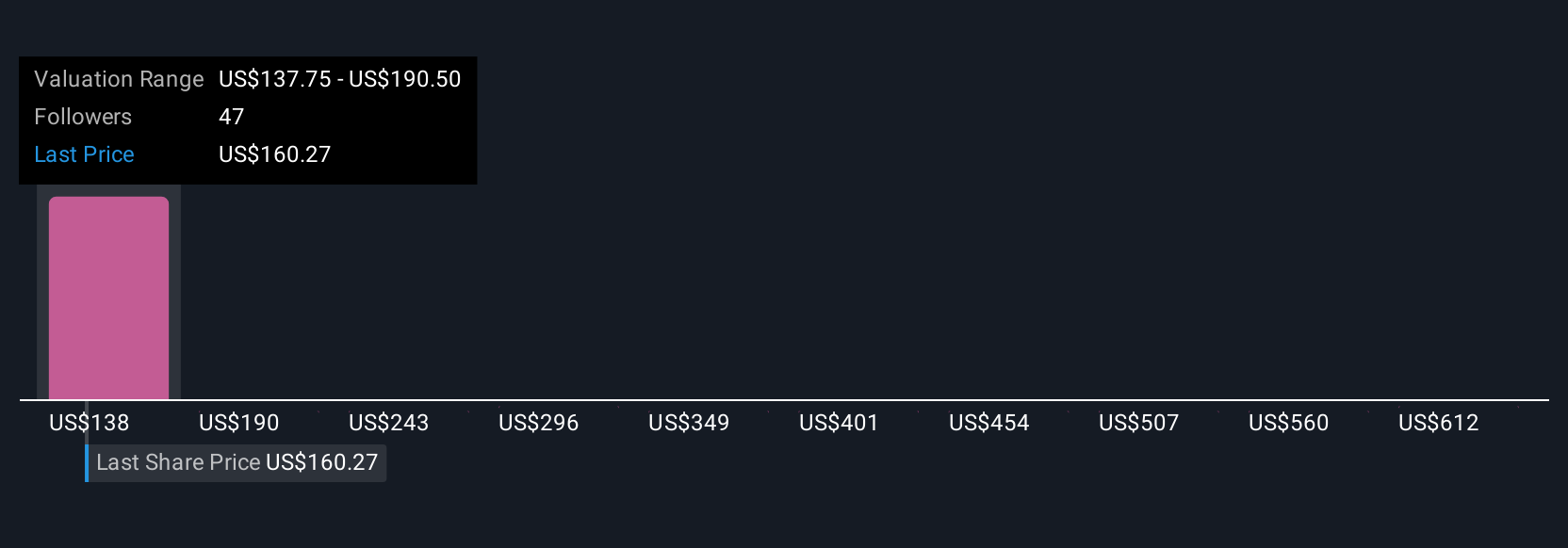

Eight distinct fair value estimates from the Simply Wall St Community range from HK$165.64 to HK$388 per share. As regulatory uncertainty persists and the company’s cross-border expansion is scrutinized, opinions on Futu’s future performance continue to differ, consider reviewing several viewpoints to inform your own outlook.

Explore 8 other fair value estimates on Futu Holdings - why the stock might be worth 16% less than the current price!

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives