- United States

- /

- Diversified Financial

- /

- OTCPK:FPAY

Investors Still Aren't Entirely Convinced By FlexShopper, Inc.'s (NASDAQ:FPAY) Revenues Despite 26% Price Jump

FlexShopper, Inc. (NASDAQ:FPAY) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

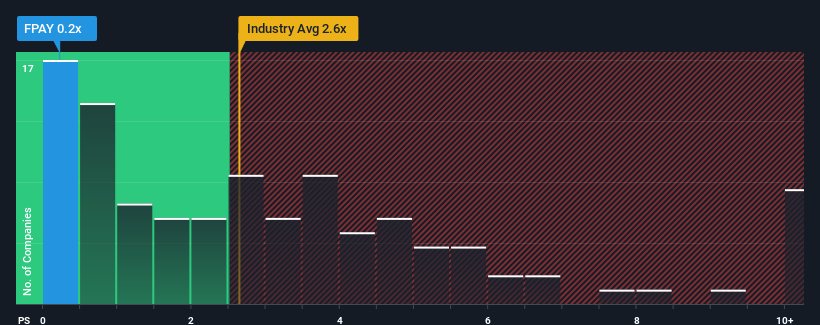

In spite of the firm bounce in price, FlexShopper's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a strong buy right now compared to the wider Diversified Financial industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for FlexShopper

How Has FlexShopper Performed Recently?

With revenue growth that's superior to most other companies of late, FlexShopper has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on FlexShopper will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

FlexShopper's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen a 9.6% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 2.7% growth forecast for the broader industry.

In light of this, it's peculiar that FlexShopper's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On FlexShopper's P/S

Even after such a strong price move, FlexShopper's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems FlexShopper currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for FlexShopper (1 is significant) you should be aware of.

If these risks are making you reconsider your opinion on FlexShopper, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:FPAY

FlexShopper

A financial technology company, operates an e-commerce marketplace to shop electronics, home furnishings, and other durable goods on a lease-to-own (LTO) basis.

Low risk and slightly overvalued.

Market Insights

Community Narratives