- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Flywire (FLYW): Assessing Valuation Following Exclusive Quasar Expeditions Partnership in Luxury Travel Payments

Reviewed by Kshitija Bhandaru

Flywire (FLYW) was recently chosen as the exclusive payments partner for Quasar Expeditions, a decision that highlights Flywire’s expanding role in high-end travel payments. This partnership also aligns with Flywire’s broader international growth ambitions.

See our latest analysis for Flywire.

Flywire’s role in luxury travel payments has landed it attention, but the stock’s story over the past year has been more volatile than triumphant. After a challenging start to the year, the company’s share price rebounded 16% over the past quarter. However, it remains down more than 35% year-to-date, with a one-year total shareholder return of -21%. This combination of recent momentum and longer-term underperformance suggests investors are still weighing Flywire’s growth narrative against risk perceptions in the fintech space.

If expanding into new sectors like luxury travel sparks your curiosity, it could be the right moment to broaden your view and discover fast growing stocks with high insider ownership

So with shares recovering recently but still well below last year’s levels, is Flywire an undervalued growth story ready for a turnaround, or are investors already pricing in all the upside ahead?

Most Popular Narrative: 11% Undervalued

With Flywire last closing at $12.93 and the widely followed narrative assigning fair value at $14.55, analysts see untapped upside despite recent volatility. The stage is set for Flywire's international ambitions and aggressive digital push to drive change in the coming years.

Flywire is experiencing robust growth outside traditional markets, with international education revenues in regions like Singapore, Spain, France, Mexico, and Japan outpacing company averages. Ongoing global expansion efforts and market share gains are expected to drive long-term revenue growth and diversify dependency on the mature Big 4 education markets.

Curious about the numbers that fueled this bullish narrative? One assumption stands out: a leap in future profitability combined with accelerating revenue growth in untapped regions. The big debate is whether Flywire can deliver on these ambitious projections or if rivals will steal the spotlight. Get the details the market is buzzing about and see which aggressive targets shaped this fair value.

Result: Fair Value of $14.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and regulatory headwinds in core education markets could quickly undermine Flywire's growth outlook and challenge analyst optimism.

Find out about the key risks to this Flywire narrative.

Another View: Expensive by Sales Ratio

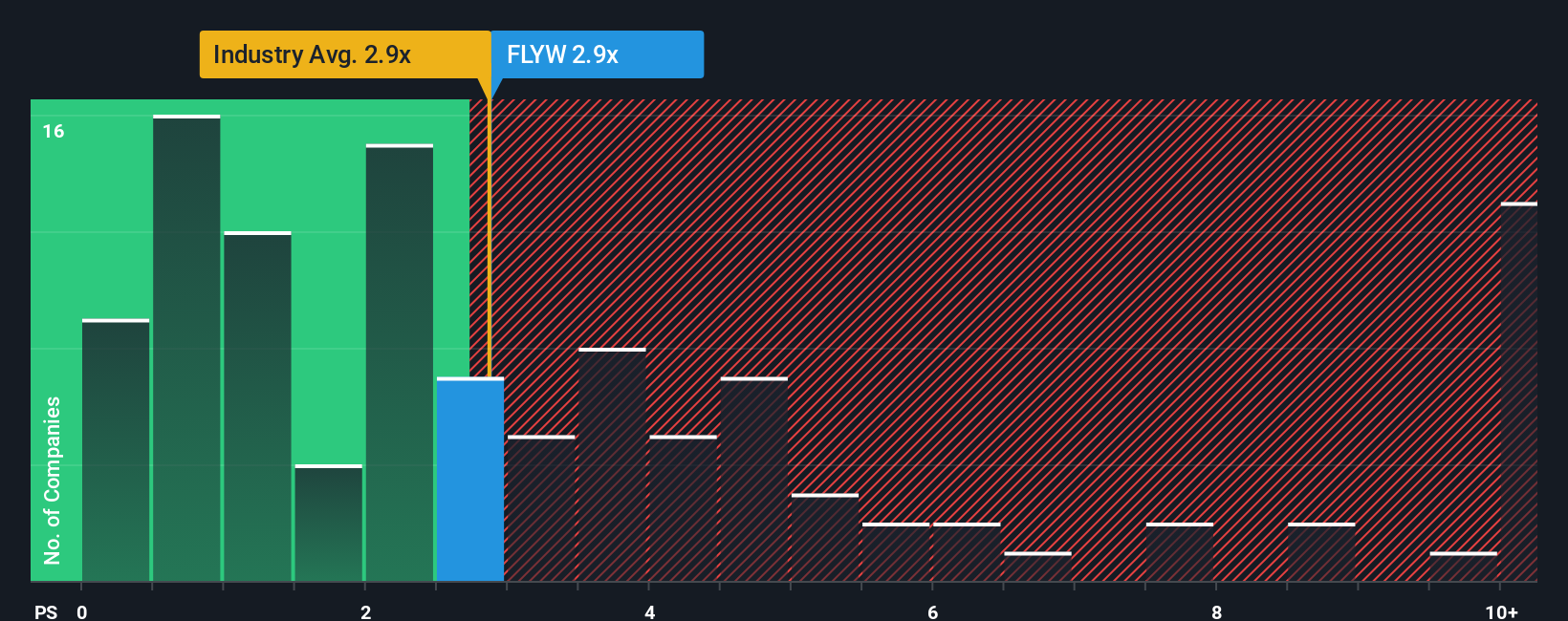

A different perspective comes from examining Flywire’s price-to-sales ratio, which is currently 2.9x. This is slightly higher than the industry average of 2.7x and its peers at 2.5x. It is also above the fair ratio our models suggest the market could move toward. This difference indicates Flywire is priced for strong growth; if results fall short, there is a limited buffer.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flywire Narrative

If these narratives do not align with your perspective, or you would rather dive into the numbers yourself, you can craft your own interpretation in just a few minutes with Do it your way.

A great starting point for your Flywire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your opportunities to just one story. The right stock could be waiting in another corner of the market. Expand your watchlist with these compelling angles:

- Capitalize on cash flow potential by zeroing in on these 888 undervalued stocks based on cash flows that have been overlooked despite strong fundamentals and earnings momentum.

- Capture growth from healthcare innovation when you assess these 32 healthcare AI stocks at the forefront of patient care breakthroughs and AI-driven medical intelligence.

- Stay ahead of the future of finance by jumping into these 78 cryptocurrency and blockchain stocks as digital assets and blockchain transform the investment landscape in real time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives