- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

A Fresh Look at Flywire (FLYW) Valuation After Q3 Earnings Growth and Buyback Completion

Reviewed by Simply Wall St

Flywire (FLYW) just released its third quarter earnings, drawing the spotlight with year-over-year revenue growth, along with a decline in net income. Investors are also watching the completed buyback and leadership updates to gauge next steps.

See our latest analysis for Flywire.

Flywire’s 1-month share price return of 7.5% suggests that the recent earnings report and completed share buyback sparked some renewed optimism. However, its total shareholder return over the past year is still down 36.5%. Over a longer period, momentum has been subdued. The three-year total shareholder return of -33.7% highlights the mixed sentiment surrounding growth prospects and ongoing challenges in profitability.

If Flywire’s turnaround efforts have you thinking bigger, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With Flywire’s revenue growing but net income under pressure, and the stock trading below analyst targets, the big question is whether investors are getting a bargain or if the market is already pricing in those future prospects.

Most Popular Narrative: 12.8% Undervalued

Flywire’s most widely followed valuation narrative sets a fair value notably above the last close price of $13.92. This points to stronger upside potential than current trading suggests. Market watchers are closely examining the revenue drivers and growth levers estimated in the narrative to see if the optimism holds.

Ongoing investment in proprietary technology, AI-driven automation, and integration capabilities is yielding significant platform efficiencies (for example, 25% operational cost improvements, 90% automated payment matching, and 40% automated customer service). These factors underpin Flywire's ability to maintain or increase net margins and deliver stronger earnings leverage as scale increases.

Curious about what forecasts put Flywire above today’s price? There is a bold margin leap, rapid scaling, and a premium profit multiple baked into this story. The real kicker is that analysts’ future numbers go far beyond current results. See which assumptions could shake up your view on value.

Result: Fair Value of $15.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory changes and ongoing margin pressure could quickly challenge any optimism that is already reflected in the current valuation outlook.

Find out about the key risks to this Flywire narrative.

Another View: Market Multiples Tell a Different Story

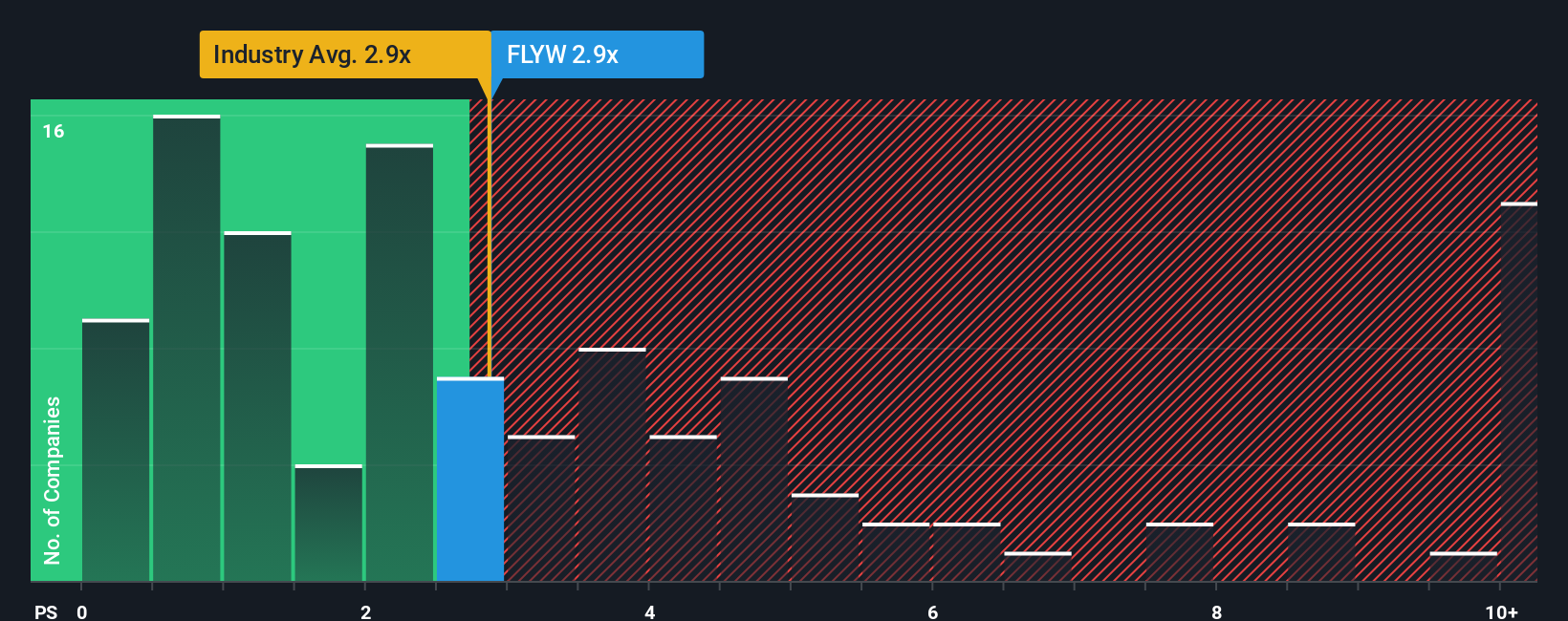

While one approach signals Flywire’s shares may be undervalued, comparing its price-to-sales ratio of 2.9x reveals a less convincing picture. This is higher than both its peer average of 2.5x and the industry norm of 2.4x, and it also surpasses the fair ratio of 2.3x. This suggests the market may be pricing in more optimism than fundamentals support. Is there hidden value here or just added valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flywire Narrative

If you see the story differently or want to dig into the numbers for yourself, you can quickly build your own perspective in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Flywire.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when tomorrow’s standout stocks could be off the radar today. Get ahead of the curve with these handpicked opportunities from the Simply Wall Street Screener:

- Target stable, long-term portfolio growth by scanning these 16 dividend stocks with yields > 3% that offer robust yields and consistent financial strength.

- Ride the wave of innovation in digital finance by checking out these 82 cryptocurrency and blockchain stocks fueling the next evolution in global payments and blockchain technology.

- Tap into emerging healthcare breakthroughs, where AI is reshaping the industry. these 32 healthcare AI stocks are already making headlines for their transformative impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives