- United States

- /

- Diversified Financial

- /

- NasdaqGS:FISV

Clover Slowdown And Legal Scrutiny Might Change The Case For Investing In Fiserv (FISV)

Reviewed by Sasha Jovanovic

- Earlier in 2025, Fiserv cut its full-year revenue forecast after weaker-than-expected results and slowing growth in its Clover merchant-services segment, while also facing a securities class action tied to its guidance reset and operational execution.

- At the same time, several high-profile asset managers increased their holdings and Fiserv accelerated share buybacks, underscoring a divide between skeptical analysts and investors who see long-term value in the company’s payments and fintech franchise.

- Now, we’ll examine how the slowdown in Clover’s growth and renewed legal scrutiny may affect Fiserv’s existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Fiserv Investment Narrative Recap

To own Fiserv, you need to believe its core payments and fintech assets, including Clover, can still compound cash flows despite slower growth, execution hiccups and legal noise. The key near term catalyst is whether management can stabilize Clover’s volumes and rebuild confidence after the revenue forecast cut, while the biggest risk is that execution and litigation concerns linger long enough to further weigh on client wins and valuation.

Among recent developments, Fiserv’s aggressive share repurchase program, with more than US$11,978.23 million deployed since inception, stands out. For investors focused on catalysts, these buybacks amplify the impact of any eventual improvement in Clover and the broader “One Fiserv” plan, but they also concentrate exposure if operational or legal issues persist.

Yet investors should pay close attention to how the securities class action and related allegations could affect...

Read the full narrative on Fiserv (it's free!)

Fiserv's narrative projects $24.7 billion revenue and $5.9 billion earnings by 2028.

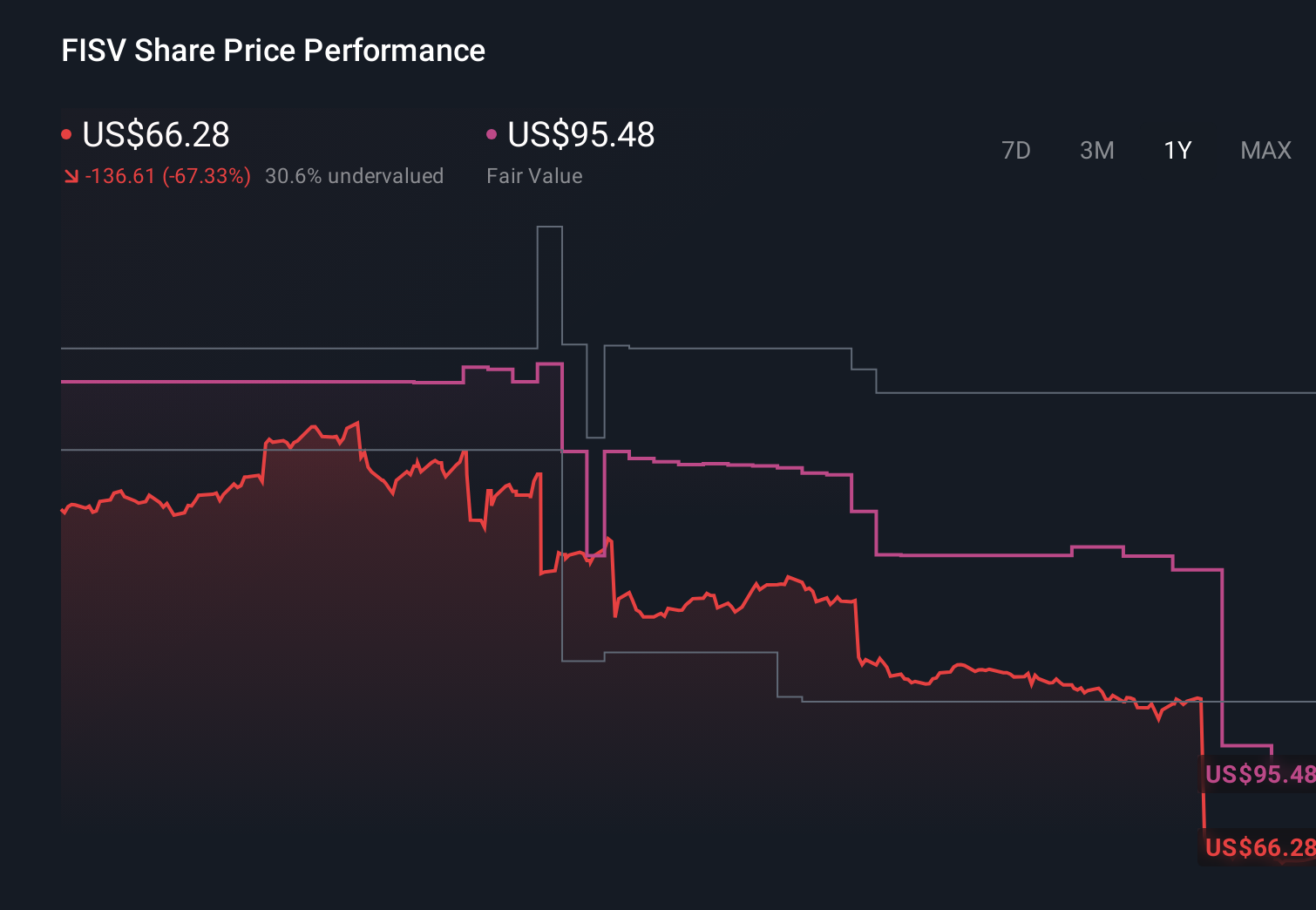

Uncover how Fiserv's forecasts yield a $95.48 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Twenty Simply Wall St Community fair value estimates for Fiserv range from US$50 to about US$231.84, underscoring how far apart individual views can be. Before recent setbacks in Clover and guidance, many of these investors were focused on long term digital payments growth, so you may want to compare several perspectives before deciding what still fits your own outlook.

Explore 20 other fair value estimates on Fiserv - why the stock might be worth 26% less than the current price!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FISV

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion