- United States

- /

- Consumer Finance

- /

- NasdaqGS:FIGR

Figure Technology Solutions (FIGR): Assessing Valuation After Strong Earnings and Blockchain Stock Offering Plans

Reviewed by Simply Wall St

Figure Technology Solutions (FIGR) is in the spotlight after announcing a follow-on equity offering and scheduling a special call to discuss its proposed Series A Blockchain Common Stock. This move follows a period of impressive quarterly earnings growth, drawing fresh attention from investors.

See our latest analysis for Figure Technology Solutions.

After last week’s flurry of announcements, Figure Technology Solutions saw a 1-day share price return of 4.65 percent. Recent momentum remains mixed with a 30-day return of -15.43 percent. The stock has still managed a year-to-date share price gain of 13.5 percent, reflecting both optimism around its blockchain initiatives and a watchful eye on execution in the months ahead.

If Figure’s blockchain moves have you scouting for the next big opportunity, broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets despite robust earnings and blockchain momentum, the question remains: Is Figure Technology Solutions presenting a true value play, or has the market already factored in future growth?

Price-to-Earnings of 134.4x: Is it justified?

Figure Technology Solutions trades at a price-to-earnings ratio of 134.4x, which is far above its consumer finance industry peers. At last close of $35.31, the valuation appears stretched when benchmarked against established players.

The price-to-earnings (PE) ratio captures how much investors are willing to pay today for a dollar of future earnings. In fintech and high-growth sectors, elevated PE values can sometimes reflect optimism about future gains, especially when new technologies are in play. For a company like Figure, with rapid expansion and a surge in blockchain initiatives, PE serves as a window into market confidence regarding sustainable growth and profitability.

However, Figure’s PE is not just high. It is dramatically above the US consumer finance industry average of 9.7x and the peer group average of 16.7x. This sharp disparity signals that investors are either betting on breakout growth or overestimating near-term prospects. No regression-based "fair ratio" is currently available for added context.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 134.4x (OVERVALUED)

However, persistent volatility in share price and an above-market valuation could quickly temper current investor enthusiasm if execution or blockchain adoption stalls.

Find out about the key risks to this Figure Technology Solutions narrative.

Another View: What Does Our DCF Model Say?

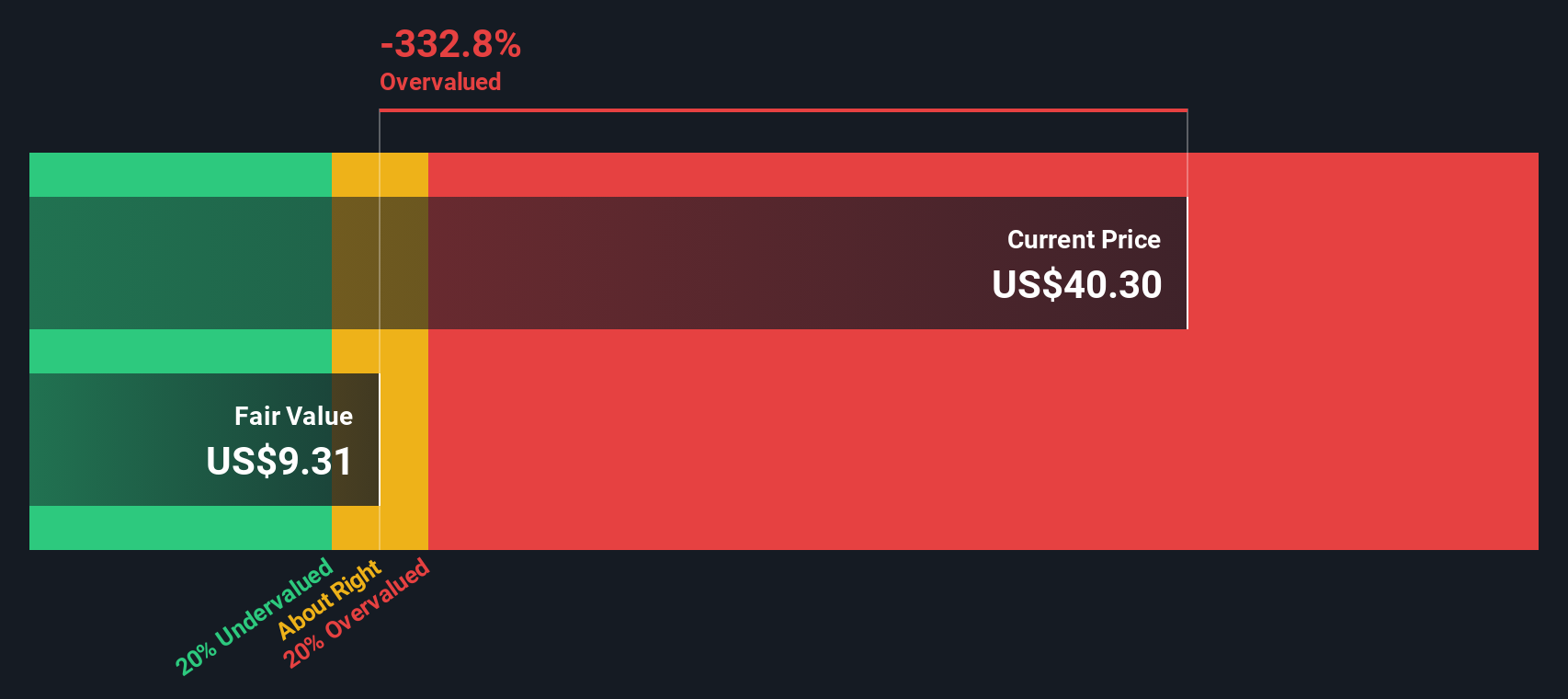

When we look at Figure Technology Solutions using our SWS discounted cash flow (DCF) model, the story shifts. The DCF suggests shares are trading well above fair value, which implies that the current price may be hard to justify by projected cash flows alone. Does this challenge the optimism seen in valuation multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Figure Technology Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Figure Technology Solutions Narrative

If you want a different perspective or prefer hands-on research, take a few minutes to explore the data and form your own narrative. Do it your way

A great starting point for your Figure Technology Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Your Next Investment Advantage?

Sharpen your portfolio by acting on opportunities others may miss. Use these handpicked screeners to access stocks that are uniquely positioned for growth, innovation, and strong financial returns.

- Unlock high-yield potential by checking out these 15 dividend stocks with yields > 3% that consistently offer dividend returns over 3 percent. This can help amplify your passive income stream.

- Target trailblazers on the frontier of artificial intelligence by reviewing these 25 AI penny stocks, which are changing industries through rapid innovation and smart automation.

- Capture value the market has overlooked by comparing these 926 undervalued stocks based on cash flows, which are priced attractively based on cash flow fundamentals and may provide opportunities for long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIGR

Figure Technology Solutions

A financial technology company, provides blockchain-based products and solutions in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success