- United States

- /

- Consumer Finance

- /

- NasdaqGS:FIGR

Figure (FIGR) Is Up 10.1% After Record Q3 and Blockchain Equity Move – What’s Changed

Reviewed by Sasha Jovanovic

- Figure Technology Solutions reported record third quarter results, with US$156.37 million in revenue and US$89.58 million net income, fueled by rapid growth in its blockchain-based consumer loan platform.

- In addition to the robust financial performance, the company made headlines by filing for a blockchain-native equity share class, reflecting its commitment to redefining capital markets infrastructure.

- With earnings momentum underpinned by blockchain innovation, we'll explore how these advances are reshaping Figure's investment narrative and growth profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Figure Technology Solutions' Investment Narrative?

Stepping back, Figure Technology Solutions is an investment for those who believe blockchain can fundamentally change consumer finance and capital markets. The latest quarterly results reinforce this theme, with record revenues and profit from rapid adoption of its blockchain-enabled lending marketplace and emerging products like Democratized Prime. The confidential filing for a blockchain-native equity share class now shifts attention to how Figure might lead in digitizing public capital markets infrastructure, potentially unlocking entirely new business lines. This news could accelerate some catalysts, such as broader ecosystem adoption and institutional partnerships, while also intensifying execution risk, regulatory uncertainty, and market volatility as investors digest ambitious innovation claims. Still, share price volatility, high valuation levels, a relatively inexperienced management team, and recent insider selling keep risk squarely in focus. Whether the recent financial momentum translates into lasting market leadership remains an open question. On the other hand, leadership in such a fast-moving space carries elevated regulatory and operational risks investors should watch closely.

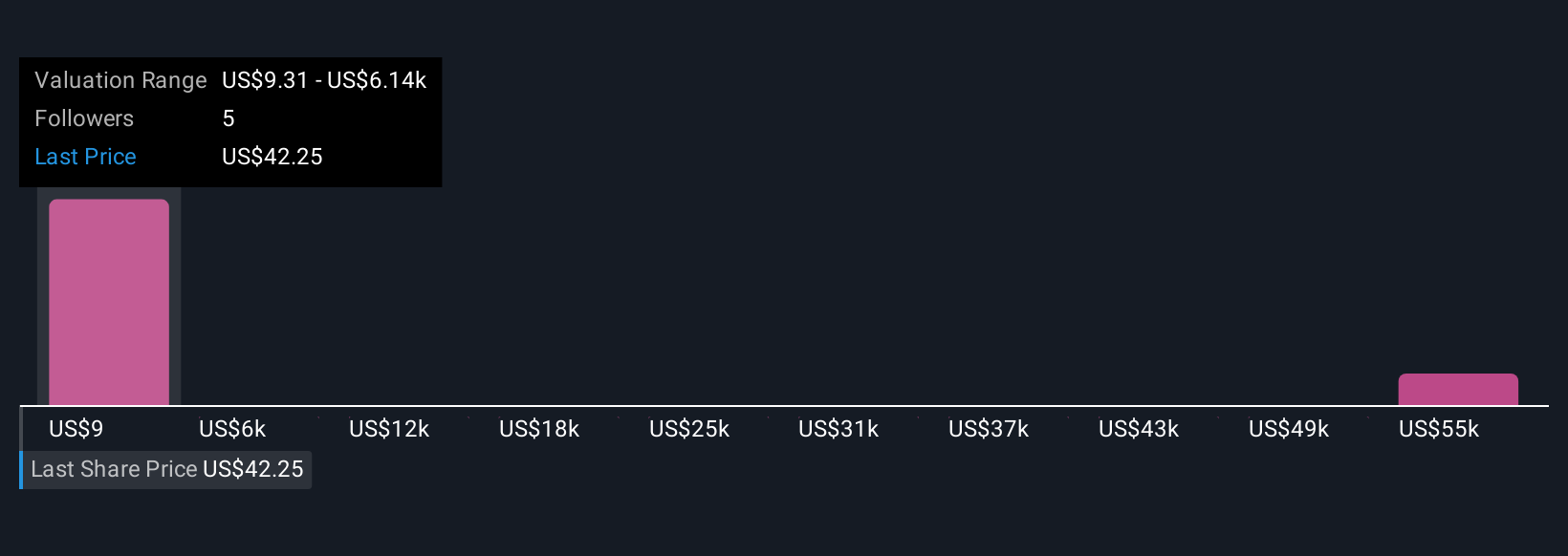

Figure Technology Solutions' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 5 other fair value estimates on Figure Technology Solutions - why the stock might be worth less than half the current price!

Build Your Own Figure Technology Solutions Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Figure Technology Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Figure Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Figure Technology Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIGR

Figure Technology Solutions

Develops and operates a blockchain-based consumer lending platform.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives