- United States

- /

- Consumer Finance

- /

- NasdaqGS:FCFS

Will FCFS Analyst Upgrades Mark a Turning Point in FirstCash Holdings’ Competitive Positioning?

Reviewed by Simply Wall St

- FirstCash Holdings was recently upgraded to a Zacks Rank #2 (Buy) after a significant upward trend in earnings estimates and improved analyst sentiment.

- This positions FirstCash Holdings among the top 20% of Zacks-covered stocks for earnings estimate revisions, highlighting its strong performance compared to sector peers.

- We’ll explore how this positive earnings outlook and analyst upgrade may influence FirstCash Holdings’ broader investment narrative going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

What Is FirstCash Holdings' Investment Narrative?

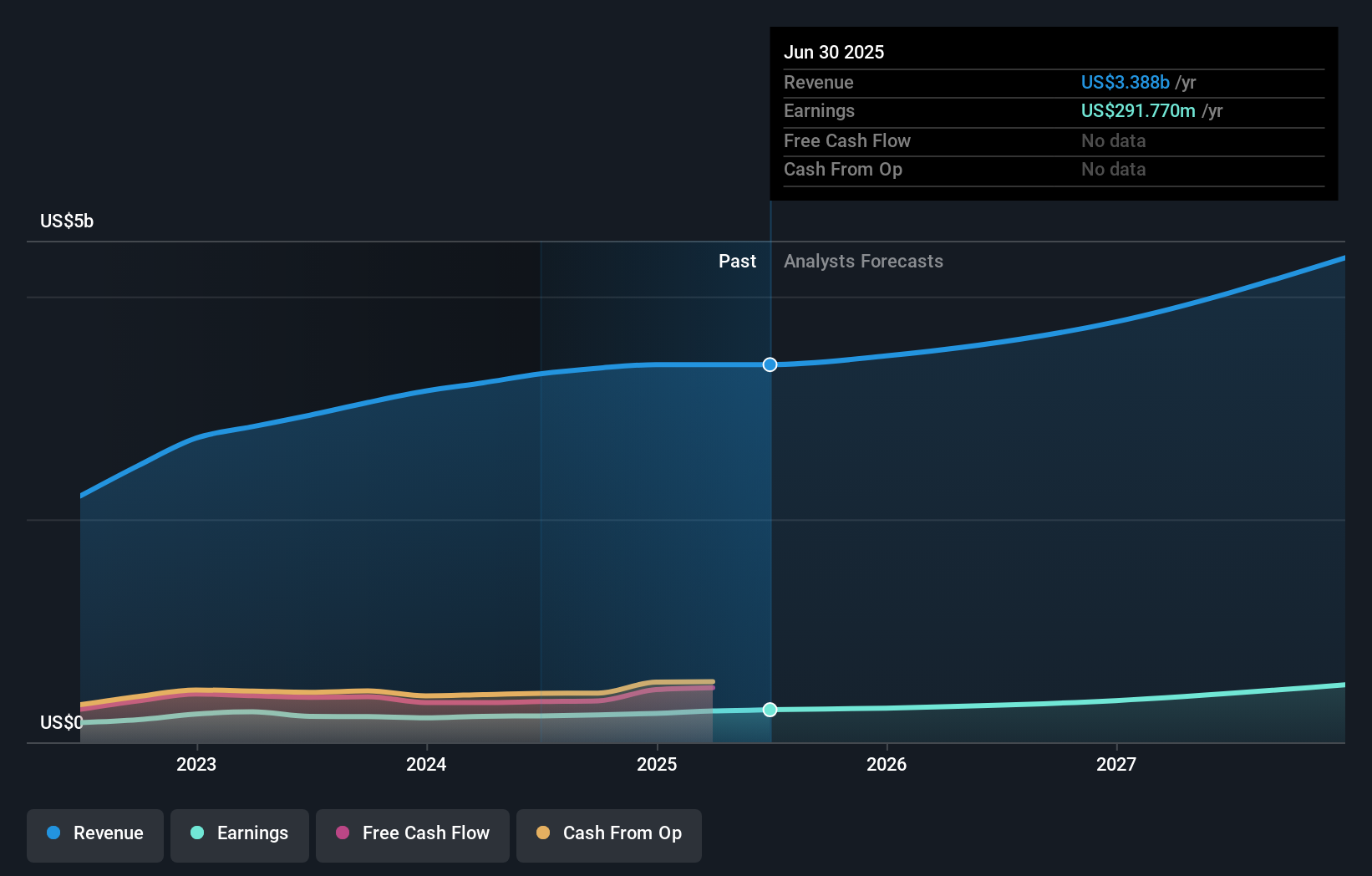

To be a shareholder in FirstCash Holdings, you’ll want to believe in the resilience of its pawn lending model, the potential for expansion in both the U.S. and Latin America, and management's ability to turn modest revenue growth into stronger earnings and improved margins. The recent Zacks Rank #2 (Buy) upgrade, sparked by improved earnings outlooks and strong price momentum, adds weight to the short-term case for the stock, especially following a year-to-date return that outpaces its sector. This upbeat analyst sentiment comes on the heels of a solid jump in earnings and dividend growth, but investors still need to weigh risks like sluggish revenue, high debt, rich valuation levels, and regulatory overhang from the recent CFPB settlement. The Zacks news certainly brightens the short-term picture and may momentarily ease concerns, but it’s not a cure-all for structural challenges. On the flip side, the company’s debt levels remain a point investors should keep a close eye on.

FirstCash Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on FirstCash Holdings - why the stock might be worth as much as 10% more than the current price!

Build Your Own FirstCash Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FirstCash Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstCash Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCFS

FirstCash Holdings

Operates retail pawn stores in the United States, Mexico, and rest of Latin America.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives