- United States

- /

- Consumer Finance

- /

- NasdaqGS:EZPW

A Look at EZCORP (EZPW) Valuation Following Strong Q4 and Full-Year Results

Reviewed by Simply Wall St

EZCORP (EZPW) just released its Q4 and full year results, revealing clear growth in both revenue and net income compared to last year. This latest financial update gives investors plenty to consider as they look ahead.

See our latest analysis for EZCORP.

EZCORP’s solid Q4 and full-year results arrive as the company’s share price has climbed 43.65% year-to-date, with a 1-year total shareholder return of nearly 45% adding to the momentum. Short-term dips, such as this month’s 9.8% decline, may reflect shifting sentiment after strong gains. However, long-term shareholders have seen significant value creation in recent years as operational results improve.

If you’re interested in finding what’s fueling momentum elsewhere, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such strong quarterly numbers and the stock still trading well below analyst price targets, investors may be wondering if this is an overlooked value play or if the market has already factored in future growth potential.

Most Popular Narrative: 25.6% Undervalued

With EZCORP’s most-followed narrative assigning a fair value considerably above the last close of $17.41, the stock’s current market price hints at significant potential upside. See what’s behind that bullish gap and how analysts are justifying such an outlook.

Ongoing and accelerated store footprint expansion, particularly in large underserved markets across Latin America (e.g., recent acquisitions in Mexico and new de novo stores in Guatemala and El Salvador), diversifies geographic risk and significantly increases addressable market size. This positions the company for outsized topline and EBITDA growth.

Ready for a numbers-driven surprise? The most popular narrative centers on aggressive growth: more stores, higher margins, and a profit trajectory that diverges from market expectations. The secret formula for this valuation? Dive in and uncover the financial forecast that could catch everyone off guard.

Result: Fair Value of $23.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real risks, such as volatility in gold prices or execution missteps. These factors could challenge the bullish narrative around EZCORP.

Find out about the key risks to this EZCORP narrative.

Another View: The Numbers Behind the Ratios

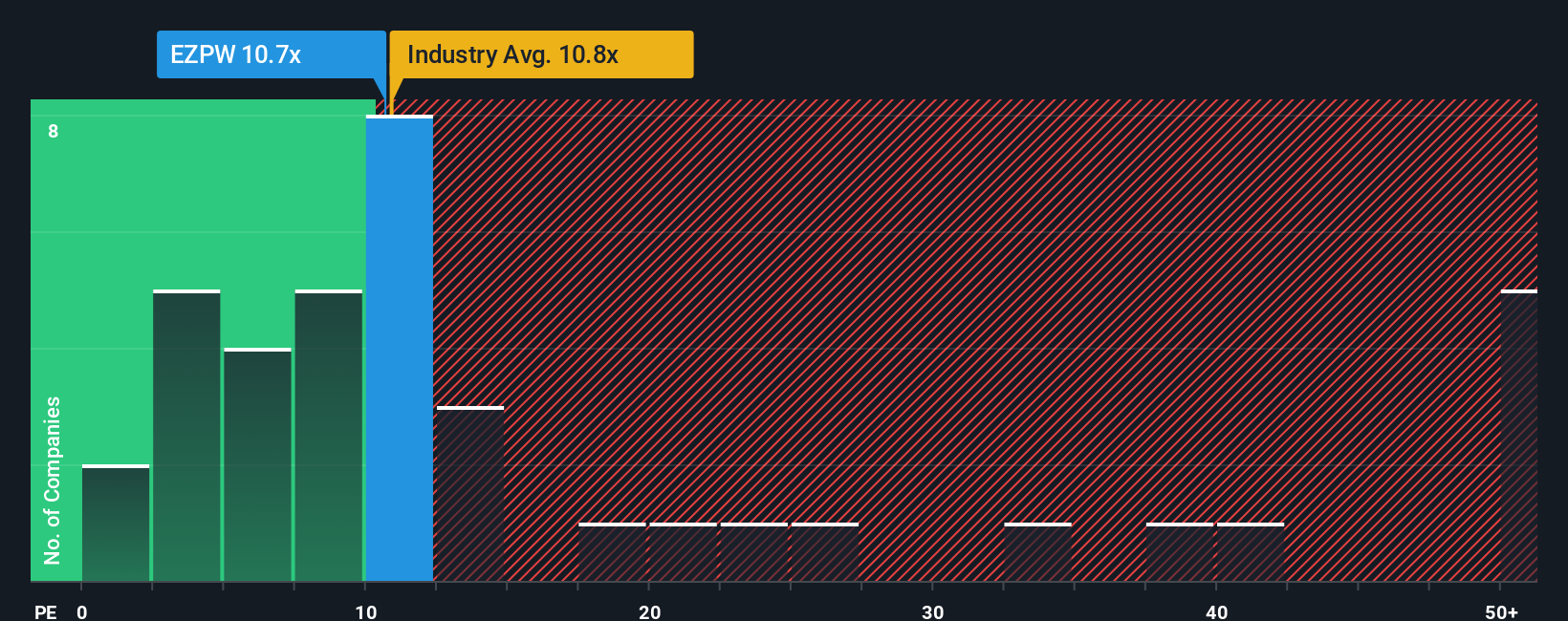

Looking at EZCORP from a price-to-earnings perspective, the shares are priced at 10.8x earnings, which is exactly in line with the US Consumer Finance industry's average. However, this is slightly higher than the value suggested by a fair ratio of 12.3x and above the peer group’s lower average of 7.9x. This narrows the margin for error and suggests less obvious value than bullish forecasts imply. Could the market be pricing in all the good news already, or is there still upside to capture?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EZCORP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EZCORP Narrative

If you’d rather crunch the numbers your own way or see a different story in the data, building a personalized view takes just a few minutes. Do it your way.

A great starting point for your EZCORP research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Winning Opportunity?

Smart investors never stand still. Unlock tomorrow’s potential by searching beyond the obvious and seizing opportunities others might overlook; great ideas are waiting right now.

- Catch the next wave in artificial intelligence by backing fast-evolving companies. Start with these 27 AI penny stocks and see which innovators are leading the pack.

- Boost your portfolio’s income with reliable picks. Browse these 15 dividend stocks with yields > 3% offering yields above 3% and financial resilience for every market cycle.

- Uncover market secrets hiding in plain sight. Target strong financials and attractive pricing through these 884 undervalued stocks based on cash flows before everyone else does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EZCORP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EZPW

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives