- United States

- /

- Capital Markets

- /

- NasdaqGS:ETOR

eToro Group (NasdaqGS:ETOR): Assessing Valuation After US Launch of Crypto Staking Services

Reviewed by Kshitija Bhandaru

eToro Group (NasdaqGS:ETOR) is making headlines with the rollout of cryptocurrency staking services for US users. By offering support for Ethereum, Cardano, and Solana, eToro is extending new passive income pathways for its customers.

See our latest analysis for eToro Group.

The launch of crypto staking services caps off a run of notable updates for eToro Group, including its recent addition to the S&P Global BMI Index. While these initiatives hint at future growth potential and a broader digital asset push, the share price has edged slightly lower year to date, suggesting investors are weighing both the opportunity and evolving risks around the new offerings.

If expanding digital finance is on your radar, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with the stock drifting lower this year and analyst expectations shifting, could eToro be undervalued at these levels? Or is the market already factoring in all the upside from its crypto push?

Price-to-Earnings of 18.5x: Is it justified?

eToro Group's current share price implies a price-to-earnings (P/E) ratio of 18.5x, putting it well above the peer average of 8.4x and suggesting investors are paying a premium for its business.

The P/E ratio measures how much investors are willing to pay for a dollar of earnings. It is a key benchmark for capital markets companies and provides insight into perceived future growth. This premium valuation may indicate elevated expectations for earnings growth or company-specific competitive advantages.

Notably, while eToro is expensive relative to direct peers, its valuation compares favorably against the broader US Capital Markets industry average of 26.2x. This places the stock in the middle range, higher than its closest comparables but not as high as the sector overall.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 18.5x (OVERVALUED)

However, with annual revenue contracting nearly 94 percent and shares down over 38 percent year to date, uncertainty continues to surround eToro's growth trajectory.

Find out about the key risks to this eToro Group narrative.

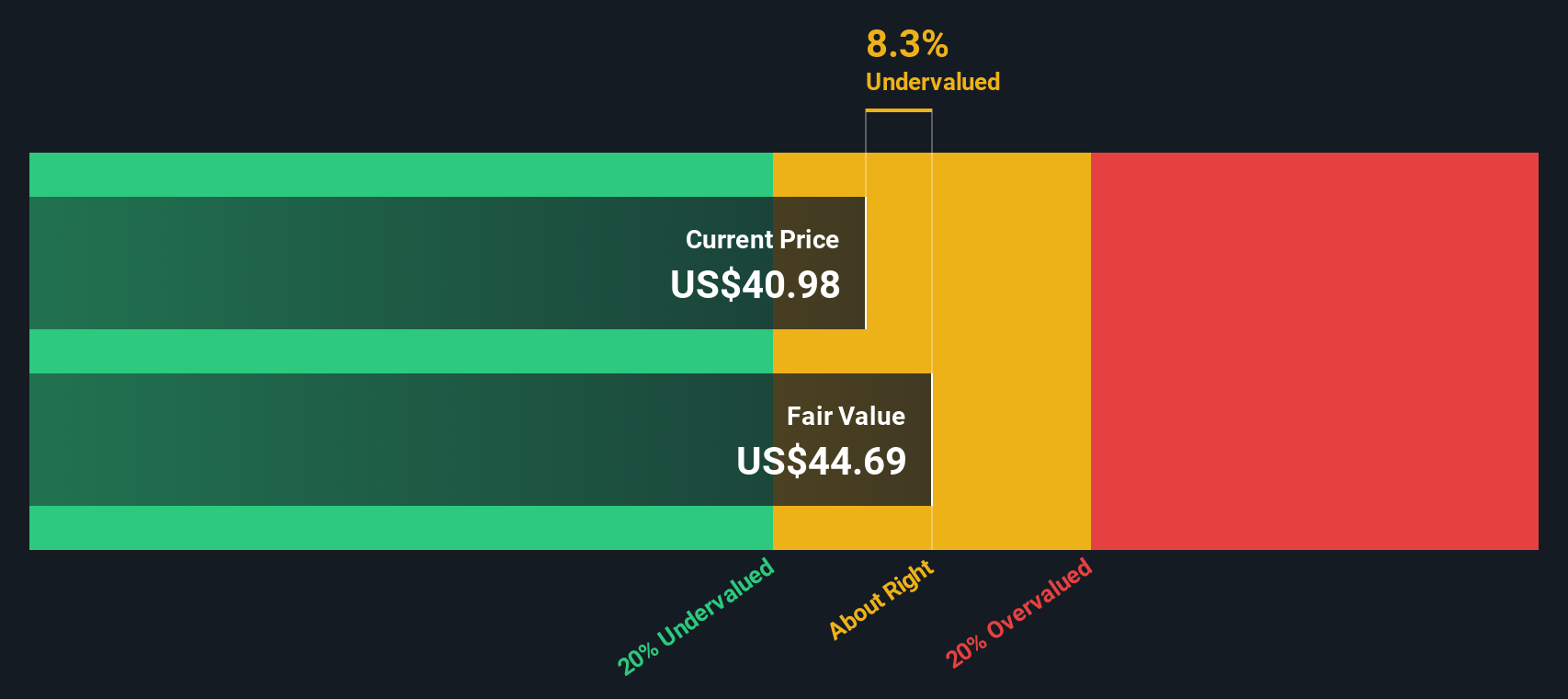

Another View: SWS DCF Model Suggests Undervaluation

While the P/E ratio paints a picture of premium pricing, our SWS DCF model tells a different story. According to this approach, eToro's shares are trading nearly 8 percent below our fair value estimate. This suggests the market may be discounting future growth, which could point to hidden upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eToro Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eToro Group Narrative

If you have a different perspective or want to dive into the numbers yourself, it's easy to build a custom view of eToro Group in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding eToro Group.

Looking for more investment ideas?

Why stick to just one opportunity when you can aim higher? Broaden your strategy with a focused look at sectors and themes that are driving today’s market momentum.

- Capture the potential for rapid growth by targeting cutting-edge companies through these 23 AI penny stocks.

- Unlock reliable income streams with steady performers by checking out these 19 dividend stocks with yields > 3%.

- Spot undervalued opportunities that the crowd may have missed by starting your search with these 914 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ETOR

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives