- United States

- /

- Capital Markets

- /

- NasdaqCM:DOMH

What Dominari Holdings Inc.'s (NASDAQ:DOMH) 584% Share Price Gain Is Not Telling You

Dominari Holdings Inc. (NASDAQ:DOMH) shareholders would be excited to see that the share price has had a great month, posting a 584% gain and recovering from prior weakness. The last month tops off a massive increase of 252% in the last year.

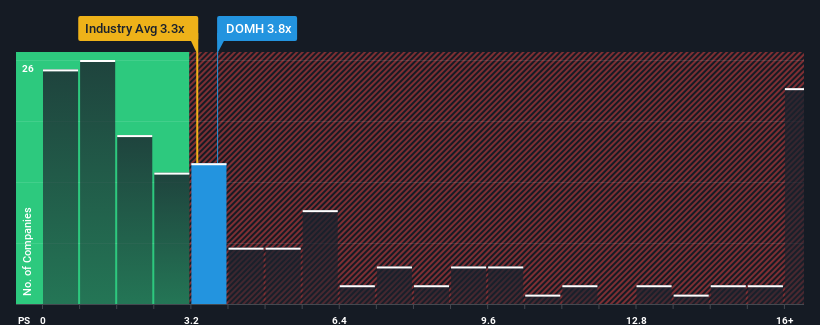

Even after such a large jump in price, there still wouldn't be many who think Dominari Holdings' price-to-sales (or "P/S") ratio of 3.8x is worth a mention when the median P/S in the United States' Capital Markets industry is similar at about 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Dominari Holdings

How Has Dominari Holdings Performed Recently?

Recent times have been quite advantageous for Dominari Holdings as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dominari Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

Dominari Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 4.8% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Dominari Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Dominari Holdings' P/S

Its shares have lifted substantially and now Dominari Holdings' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Dominari Holdings revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You need to take note of risks, for example - Dominari Holdings has 4 warning signs (and 3 which are potentially serious) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DOMH

Dominari Holdings

Through its subsidiaries, is engaged in wealth management, investment banking, sales and trading, and asset management.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives