- United States

- /

- Capital Markets

- /

- NasdaqCM:DOMH

Little Excitement Around Dominari Holdings Inc.'s (NASDAQ:DOMH) Revenues As Shares Take 32% Pounding

The Dominari Holdings Inc. (NASDAQ:DOMH) share price has fared very poorly over the last month, falling by a substantial 32%. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

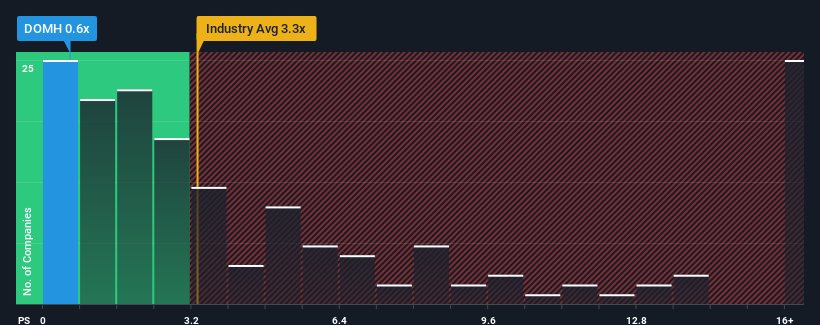

Since its price has dipped substantially, Dominari Holdings may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 3.3x and even P/S higher than 9x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Dominari Holdings

How Has Dominari Holdings Performed Recently?

Dominari Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Dominari Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dominari Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Dominari Holdings' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 10% shows it's noticeably less attractive.

With this information, we can see why Dominari Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Dominari Holdings' P/S Mean For Investors?

Having almost fallen off a cliff, Dominari Holdings' share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Dominari Holdings confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Dominari Holdings (at least 3 which are concerning), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Dominari Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DOMH

Dominari Holdings

Through its subsidiaries, is engaged in wealth management, investment banking, sales and trading, and asset management in the United States and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives