- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

Should DLocal's (DLO) AZA Finance Acquisition and Africa Expansion Prompt Investor Action?

Reviewed by Sasha Jovanovic

- DLocal Limited has announced it will release its third quarter fiscal 2025 results for the period ended September 30, 2025, on November 12, 2025, after market close and will hold a conference call and webcast for investors that same day.

- Alongside its upcoming results, DLocal has strengthened its market reach with the acquisition of AZA Finance, expanding into 17 African countries and boosting its treasury, FX management, and stablecoin capabilities.

- We'll examine how DLocal's expanded presence in Africa through AZA Finance could further shape its investment narrative and growth prospects.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

DLocal Investment Narrative Recap

To see DLocal as a compelling investment, shareholders need confidence in its ability to drive sustained payment volume and revenue growth in emerging markets while lowering exposure to customer concentration and regulatory volatility. The acquisition of AZA Finance broadens DLocal’s African footprint and augments its capabilities, but it does not materially affect the most immediate catalyst, which remains near-term revenue diversification, or the prominent risk of client concentration.

The completed follow-on equity offering, raising US$191.25 million, stands out as the most relevant recent announcement. This capital boost could offer DLocal more operational flexibility at a crucial time, aligning with investor focus on geographic and client diversification, though short-term risks tied to earnings volatility and customer retention persist.

However, investors should be aware that if one of DLocal’s largest clients…

Read the full narrative on DLocal (it's free!)

DLocal's narrative projects $1.7 billion in revenue and $346.3 million in earnings by 2028. This requires a 25.7% yearly revenue growth and an increase in earnings of roughly $200 million from the current $145.9 million.

Uncover how DLocal's forecasts yield a $15.17 fair value, a 7% upside to its current price.

Exploring Other Perspectives

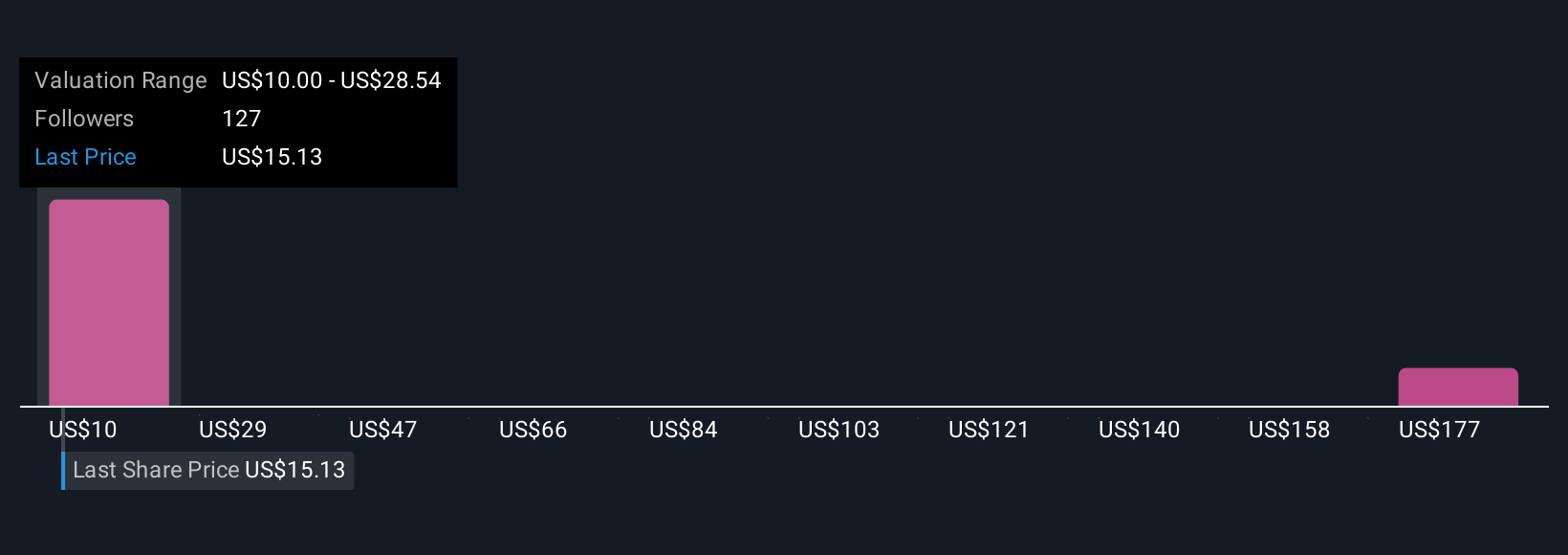

Seventeen Simply Wall St Community fair value estimates for DLocal range from US$10 to US$195.39 per share. As you weigh these wildly varied perspectives, remember that reliance on a small set of major merchants leaves earnings especially vulnerable to client churn.

Explore 17 other fair value estimates on DLocal - why the stock might be a potential multi-bagger!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives