- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

DLocal (NasdaqGS:DLO): Assessing Valuation After Strategic Partnership With Western Union in Latin America

Reviewed by Simply Wall St

DLocal (NasdaqGS:DLO) just made headlines after announcing a strategic alliance with Western Union, aimed at transforming digital remittances across Latin America. This deal is not just about streamlining payments; it is about expanding how millions of people send and receive money. By unlocking access to more local and alternative payment methods on Western Union’s digital platforms, DLocal is positioning itself at the center of a rapidly growing market for cross-border transactions and digital financial solutions.

The timing of this news adds momentum to a stock that is already attracting attention. Over the past year, DLocal has surged 68 percent, and gains in the past three months suggest renewed optimism around its growth story. Announcements such as this new Western Union deal and the recent equity offering have kept DLocal in focus as investors re-evaluate its potential role in Latin America’s digital economy, especially as digital remittances reach record highs in the region.

With this year’s rebound and the attention generated by new partnerships, the question is whether DLocal is currently trading at a bargain or if the market has already factored in years of growth potential.

Most Popular Narrative: 93% Undervalued

According to the most popular narrative, DLocal appears dramatically undervalued compared to its estimated fair value. The case for upside is based on substantial forward growth and profitability assumptions that could transform the company’s market position if delivered.

“DLocal emphasizes continuous investment in developing new products and services. The company’s pipeline is closely tied to expanding into new geographic markets, integrating new payment methods, and developing advanced tools for merchants, especially for managing collections and disbursements. The company is also innovating solutions for complex transactions, such as cross-border payments and compliance with local regulations. DLocal highlights that these efforts are not just incremental but necessary to remain competitive amid rapid technological change, the entrance of new competitors, and evolving client demands.”

This value pitch isn’t just another optimistic forecast. Want to know the bold growth blueprint driving this huge undervaluation? The real story centers on ambitious top-line, profit, and market reach projections that could change the game for DLocal. Craving details that connect these future results to the narrative’s eye-catching fair value? Keep reading to discover what’s fueling these blockbuster expectations.

Result: Fair Value of $195.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, delays in launching new services or issues with merchant adoption could quickly challenge the bullish case surrounding DLocal's ambitious growth projections.

Find out about the key risks to this DLocal narrative.Another View: What Do Market Ratios Say?

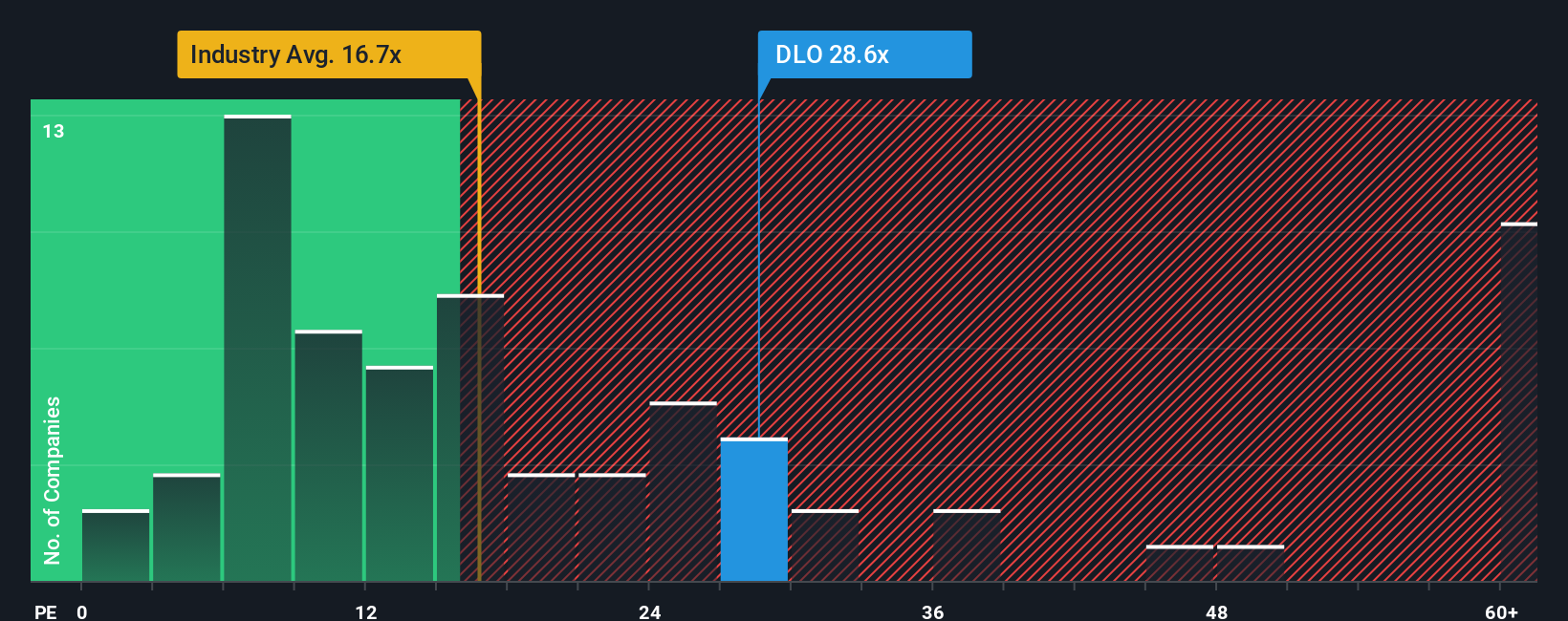

While the compelling case for a major undervaluation is based on long-term growth targets, market pricing tells a different story. Compared to other US diversified financial companies, DLocal actually trades at a much higher multiple. Could this suggest the market already expects a lot? Or is there something deeper beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DLocal Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own story in just a few minutes. Do it your way.

A great starting point for your DLocal research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors always keep their radar up for great stocks beyond their first pick. Don’t let potentially market-beating ideas slip past you. Unlock more ways to strengthen your portfolio using Simply Wall Street.

- Tap into the growth potential of digital healthcare by scanning the latest breakthroughs and smart bets among intelligent medical innovators with healthcare AI stocks.

- Capitalize on undervalued gems that can boost your returns by finding stocks overlooked by the market using undervalued stocks based on cash flows.

- Get ahead of the crowd and maximize income with top picks for steady payouts with yields over 3 percent, all through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives