- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

DLocal (NasdaqGS:DLO): Assessing Valuation After Goldman Sachs Upgrade on Growth and Partnership Optimism

Reviewed by Kshitija Bhandaru

DLocal (NasdaqGS:DLO) saw its shares gain ground after Goldman Sachs issued an upgrade, reflecting optimism about the company’s business expansion and potential for higher profitability, driven by new partnerships and market share growth.

See our latest analysis for DLocal.

The upbeat momentum following Goldman Sachs' upgrade comes after a strong 90-day share price return of nearly 39 percent for DLocal, with notable excitement building around its strategic partnerships and ambitious growth plans. While short-term swings have been impressive, the real headline is the company's one-year total shareholder return of over 81 percent. This signals that investors are increasingly buying into the long-term story, even as three-year performance still lags historical highs.

If this wave of renewed confidence has you wondering what else is gaining traction, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With recent analyst optimism and impressive gains on the board, the key question now is whether DLocal’s valuation still leaves room for upside or if the current market is already reflecting expectations for rapid, future growth.

Most Popular Narrative: 92.3% Undervalued

According to WynnLevi, the most widely-followed narrative sees DLocal as trading far below its estimated fair value of $195.39, given the company’s last close at $15.11. This significant gap is driven by bullish assumptions on growth and margins that set the stage for a re-rating if they play out.

DLocal operates as a single operating segment, payment processing, offering a unified platform that supports complex cross-border and local-to-local transactions in emerging markets. The company’s core moat derives from: deep integration with local payment methods in emerging markets, especially in Latin America, Africa, and Asia; regulatory expertise and on-the-ground relationships that are hard to replicate for new entrants; the ability to serve both pay-in and pay-out transactions for global merchants, which creates high switching costs for enterprise customers.

Want to know what’s driving this sky-high fair value? This narrative hinges on aggressive forecasts for revenue expansion, market share, and margins that rival the sector’s biggest disruptors. Get the full picture, as there is a bold assumption hiding in plain sight that could shake up expectations.

Result: Fair Value of $195.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in launching new services or a loss of reputation among large clients could quickly undermine even the most optimistic growth assumptions.

Find out about the key risks to this DLocal narrative.

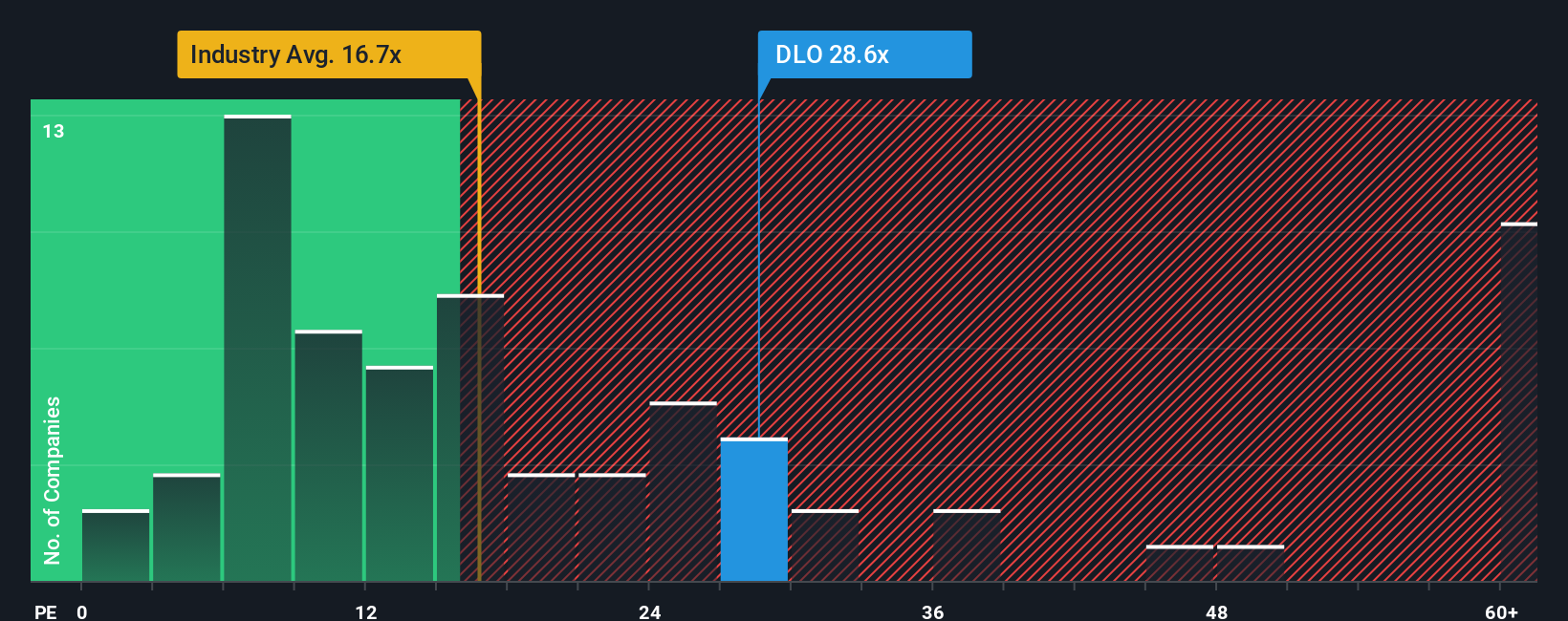

Another View: Valuation by Earnings Ratio

While the most popular narrative spotlights DLocal as deeply undervalued, a closer look at price-to-earnings tells a more cautious story. DLocal trades at 30.5 times earnings, which is almost double the industry average of 16.1 and well above its fair ratio of 21. This higher multiple means that much of the excitement may already be priced in, leaving less margin for error if expectations are not met. Investors may ask whether the market is simply looking further ahead or if optimism has pushed valuations too high.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DLocal Narrative

If you see the story differently or want to dig into the numbers on your own terms, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your DLocal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next big winner slip by. Simply Wall Street’s powerful Screener makes it easy to filter for unique opportunities you might otherwise miss.

- Unlock the potential of small-cap companies by checking out these 3596 penny stocks with strong financials poised for rapid financial growth and untapped market value.

- Capture steady income and peace of mind with these 18 dividend stocks with yields > 3% that offer strong yields and reliable payments.

- Join the technological wave by targeting these 24 AI penny stocks harnessing artificial intelligence to redefine entire industries and create lasting competitive advantages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives