- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

Dave (DAVE): Evaluating Valuation in Light of Leadership Change and Anticipated Q3 Earnings Growth

Reviewed by Simply Wall St

Dave (DAVE) shares are in the spotlight as investors take notice of two key developments: the appointment of Parker Barrile as Chief Product Officer and a strong market reaction in anticipation of the company’s upcoming third-quarter earnings report.

See our latest analysis for Dave.

Investors have watched Dave’s share price surge 177% year-to-date, driven most recently by excitement around leadership changes and expectations for robust earnings growth. While momentum has cooled in the past week, the longer-term story remains compelling, highlighted by an outstanding 526% total shareholder return over the past year and an even bigger multi-year gain. This suggests the market’s growing appreciation for Dave’s evolving strategy and underlying growth potential.

If you’re inspired by Dave’s trajectory and want to see what else is on the move, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares already up sharply, the key question now is whether Dave’s surge leaves more room to run, or if expectations for future growth are already fully reflected in the current stock price.

Most Popular Narrative: 12% Undervalued

The narrative’s fair value stands at $271.86, comfortably above Dave’s most recent closing price of $239.32. Investors are weighing whether the market is catching up to the company’s earnings acceleration or if further upside is still on the table.

Enhanced monetization from fee structure changes, including a successful rollout of a $3 monthly subscription fee with no measurable negative impact on retention, offers meaningful ARPU and LTV uplift. This is further supported by secular demand for transparent, low-fee banking alternatives, which directly supports revenue growth and margin expansion.

Want to know what’s fueling this bullish price target? The narrative hinges on a secret blend of earnings power and aggressive future margin projection. Which driver matters most? The real surprise is just how bold the expected financial leap is if these forecasts play out. Find out what’s behind the optimism when you explore the full story.

Result: Fair Value of $271.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny on fee structures and fierce competition from larger fintech firms could quickly change the outlook and challenge Dave's growth narrative.

Find out about the key risks to this Dave narrative.

Another View: Peer Comparisons Raise Questions

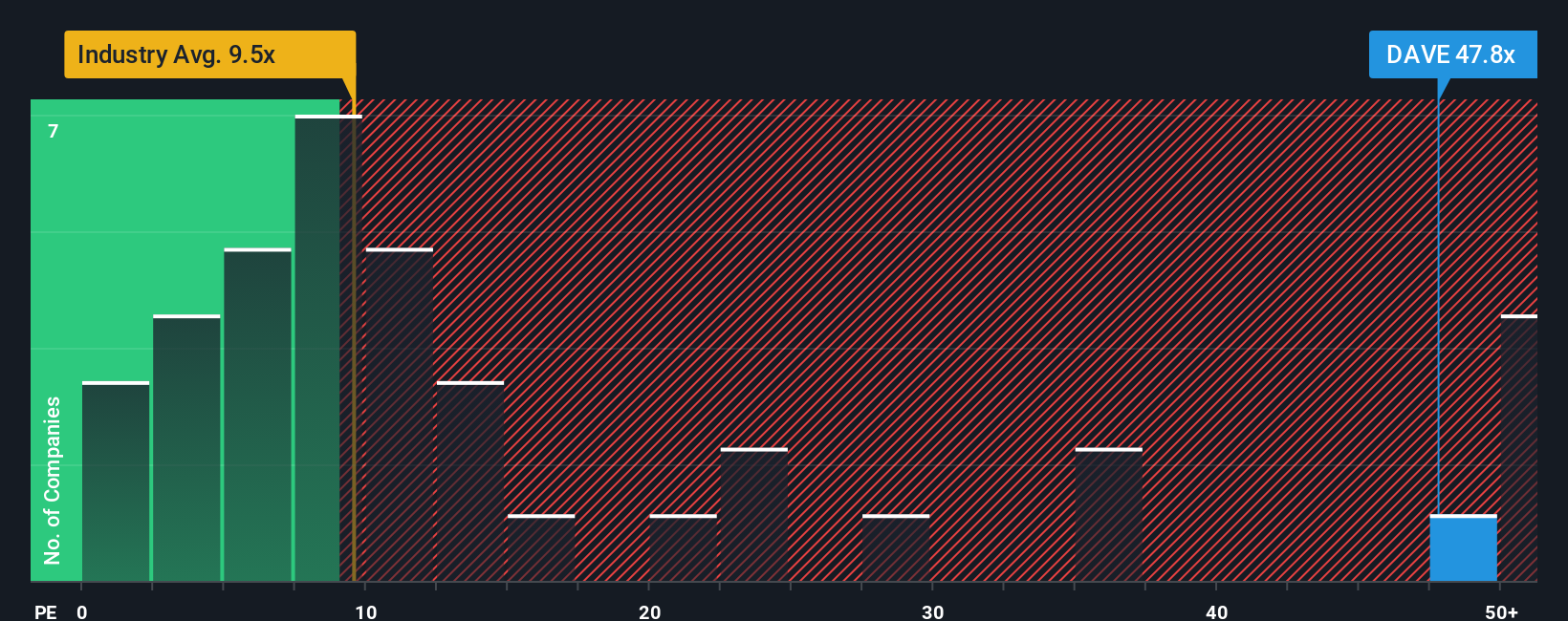

While analysts see Dave as undervalued based on projected growth, some valuation signals suggest caution. Dave trades at a price-to-earnings ratio of 58.6x, which is much higher than the US Consumer Finance industry average of 10.4x, the peer average of 8.4x, and the market’s fair ratio of 33.6x. This significant gap leaves investors wondering if the current price reflects too much optimism or signals real differentiation. Could the market be getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dave Narrative

If you’re keen to put your own stamp on Dave’s story or dig into the numbers on your terms, building a personal narrative is quick, easy, and puts control in your hands, all within just a few minutes. Do it your way

A great starting point for your Dave research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to stay ahead. These proven screeners pinpoint opportunities you might wish you’d found sooner, all ready for you to act on now.

- Capitalize on emerging themes by tapping into these 27 AI penny stocks powering breakthroughs in automation, language models, and intelligent applications.

- Boost your passive income with these 20 dividend stocks with yields > 3% that consistently offer robust yields above 3% from healthy, established businesses.

- Seize unrealized bargains using these 836 undervalued stocks based on cash flows to uncover stocks priced below their intrinsic value based on forward-looking cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives