- United States

- /

- Diversified Financial

- /

- NasdaqCM:COOP

Mr. Cooper Group (COOP): Exploring Valuation After a Surge in Investor Interest

Reviewed by Simply Wall St

Most Popular Narrative: 27.7% Overvalued

According to the most popular analyst narrative, Mr. Cooper Group’s current share price appears significantly above what analysts consider its fair value, indicating the market may be too optimistic about future prospects given quantitative fundamentals.

Mr. Cooper's scaled platform, combined with continued investments in AI and digital mortgage servicing tools, is resulting in dramatic operating efficiencies. Its cost to serve is now nearly 50% below the industry average and expected to improve further. This should drive sustained net margin and earnings expansion as digital adoption and scale advantages increase.

Curious how Mr. Cooper Group's tech overhaul and aggressive cost-cutting shape its valuation outlook? Hidden inside this narrative are bold revenue ambitions, structurally higher profit margins, and a future profit multiple that could rewrite expectations. Can the company’s digital gamble pay off big? Discover the projections and financial assumptions that push this target above the market’s comfort zone.

Result: Fair Value of $172.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high mortgage rates and intense competition could limit Mr. Cooper Group’s revenue growth. These factors could potentially undermine the bullish analyst outlook.

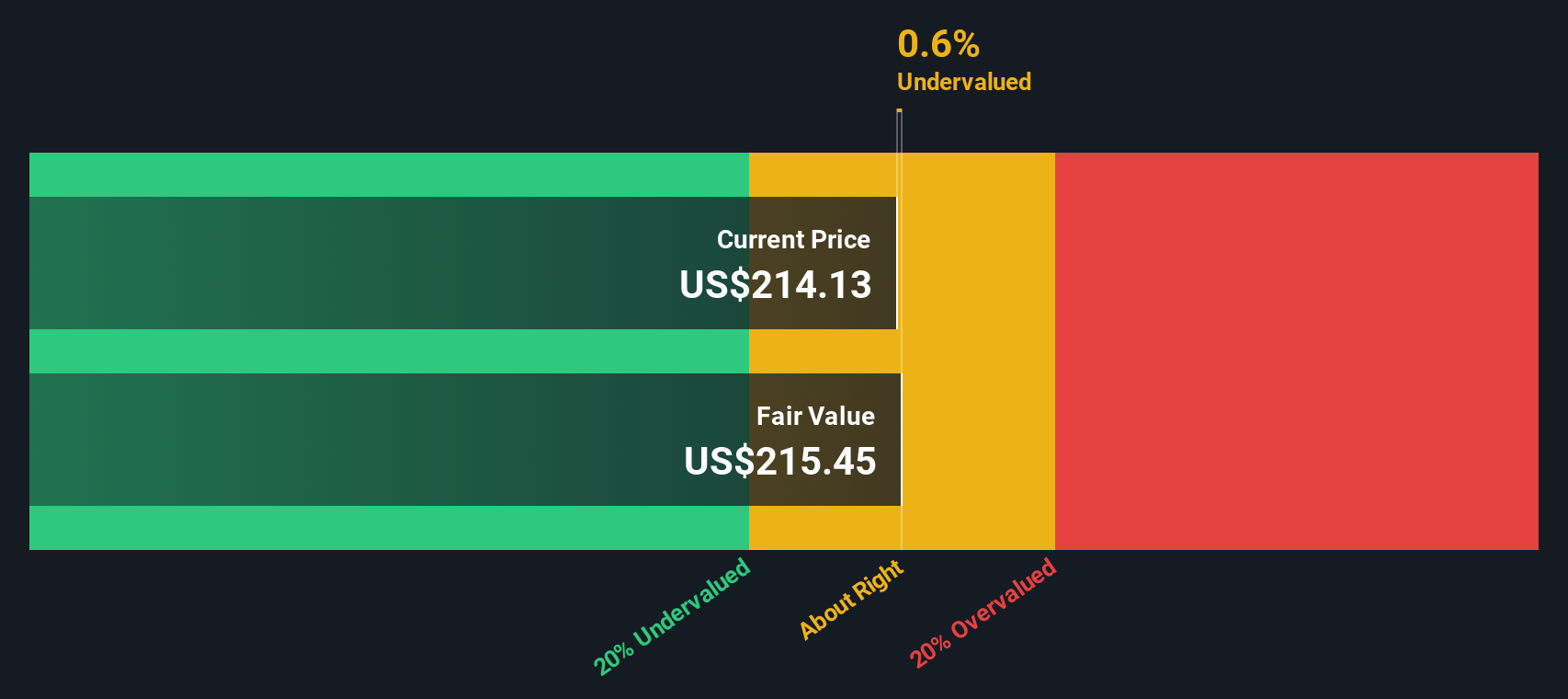

Find out about the key risks to this Mr. Cooper Group narrative.Another View: SWS DCF Model

Looking at Mr. Cooper Group through the lens of our DCF model offers a reality check for the earlier, more optimistic forecasts. This approach suggests the future cash flows may not support the current share price. Could the market be overlooking key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mr. Cooper Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mr. Cooper Group Narrative

If you want to dig into the numbers yourself or take a different perspective, you can shape your own Mr. Cooper Group story in just a few minutes. Do it your way

A great starting point for your Mr. Cooper Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors know that timing is everything, but it pays to have your eyes on the next breakthrough, trend, or income stream. Let Simply Wall Street’s advanced stock screener help you discover tomorrow’s winning ideas before the crowd catches on.

- Spot potential tech game-changers by scanning for AI penny stocks to uncover businesses pushing the boundaries in artificial intelligence innovation.

- Lock in potential long-term income with dividend stocks with yields > 3%, which showcases companies offering attractive dividend yields for serious wealth building.

- Stay ahead of the curve by checking out undervalued stocks based on cash flows and catch undervalued stocks that may be poised for a market rerating based on their solid cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COOP

Mr. Cooper Group

Operates as a non-bank servicer of residential mortgage loans in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives