- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

How the US Crypto Regulatory News Impacts Coinbase Stock’s Soaring 2025 Valuation

Reviewed by Bailey Pemberton

- Thinking about whether Coinbase Global is a bargain or already priced for perfection? You are not alone. Let's unpack what is driving all the interest around this stock's true value.

- Coinbase Global's share price has surged 8.8% in the past week, is up 4.4% over the last month, and boasts an impressive 35.5% gain year to date, with a 64.6% return over the last 12 months and an eye-catching 474.2% over three years.

- Recent reports about regulatory developments in the U.S. crypto market and institutional adoption of digital assets have been making headlines, driving investor confidence and fueling volatility. The momentum in the crypto industry as a whole is clearly spilling over into Coinbase Global's stock price.

- On traditional valuation checks, Coinbase Global currently scores just 1 out of 6. Before jumping to conclusions, let's walk through the usual valuation methods investors use, then discuss a fresh perspective that might give us a clearer picture at the end.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns model focuses on how much value a company creates above its cost of capital by examining returns from invested equity over time. For Coinbase Global, this method analyzes key metrics such as book value, earnings, and the cost of equity to estimate long-term sustainable profitability and growth.

Key numbers from this model include a current Book Value of $47.17 per share and a Stable Expected EPS (Earnings Per Share) of $9.05, based on weighted future Return on Equity projections from six analysts. The model sets the Cost of Equity at $4.67 per share and calculates the resulting Excess Return, which is the portion of earnings above what investors would expect for the risk taken, at $4.38 per share. The average Return on Equity is estimated at 15.87%, with a forecasted Stable Book Value of $57.04 per share, based on analysis from three experts.

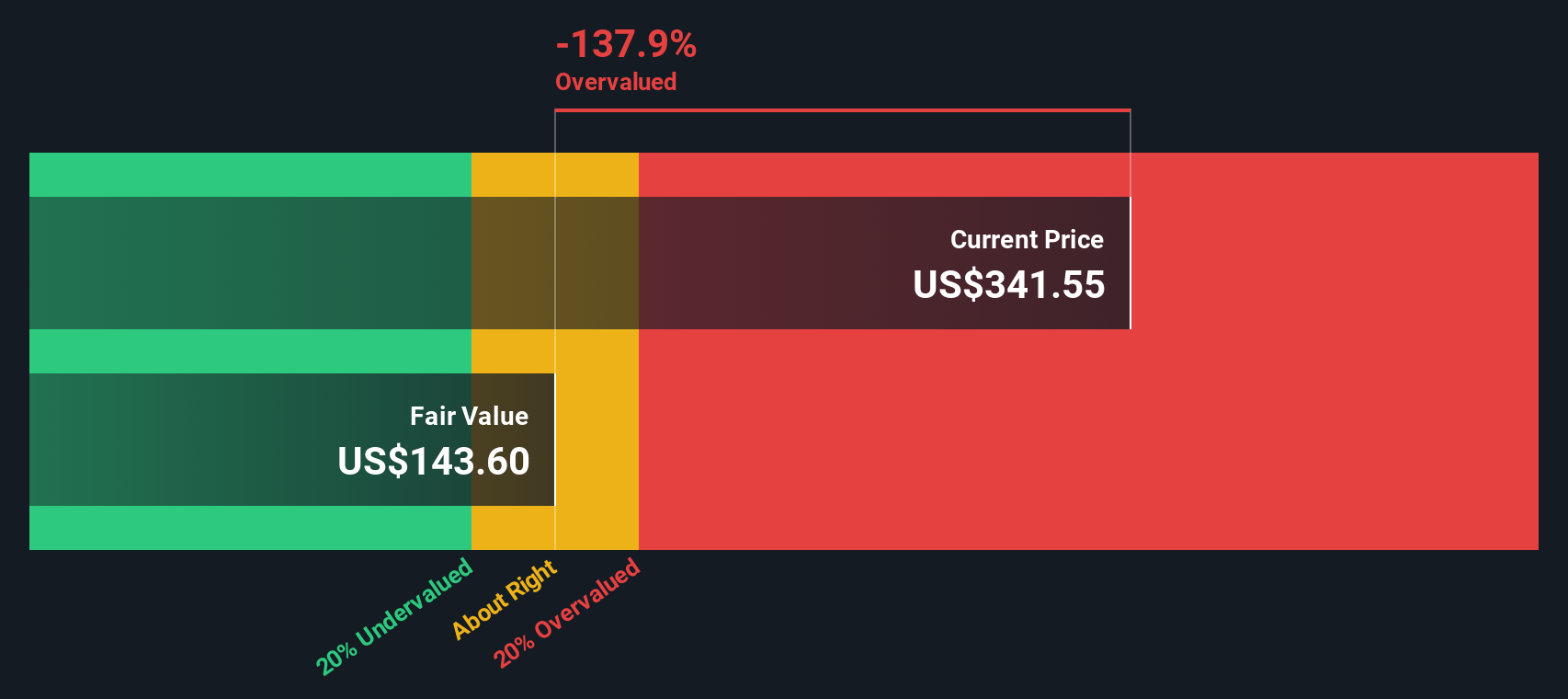

Using these financials, the Excess Returns framework estimates the intrinsic value for Coinbase Global at $142.83 per share. With the stock currently priced significantly higher, this valuation indicates that shares are 144.1% overvalued based on their excess returns prospects.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 144.1%. Discover 852 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coinbase Global Price vs Earnings

For profitable companies such as Coinbase Global, the Price-to-Earnings (PE) ratio is often the preferred valuation metric, as it tells investors how much they are paying for each dollar of the company’s earnings. Earnings are a key value driver for owners, and using PE ratios offers a straightforward, apples-to-apples comparison across businesses in the same sector.

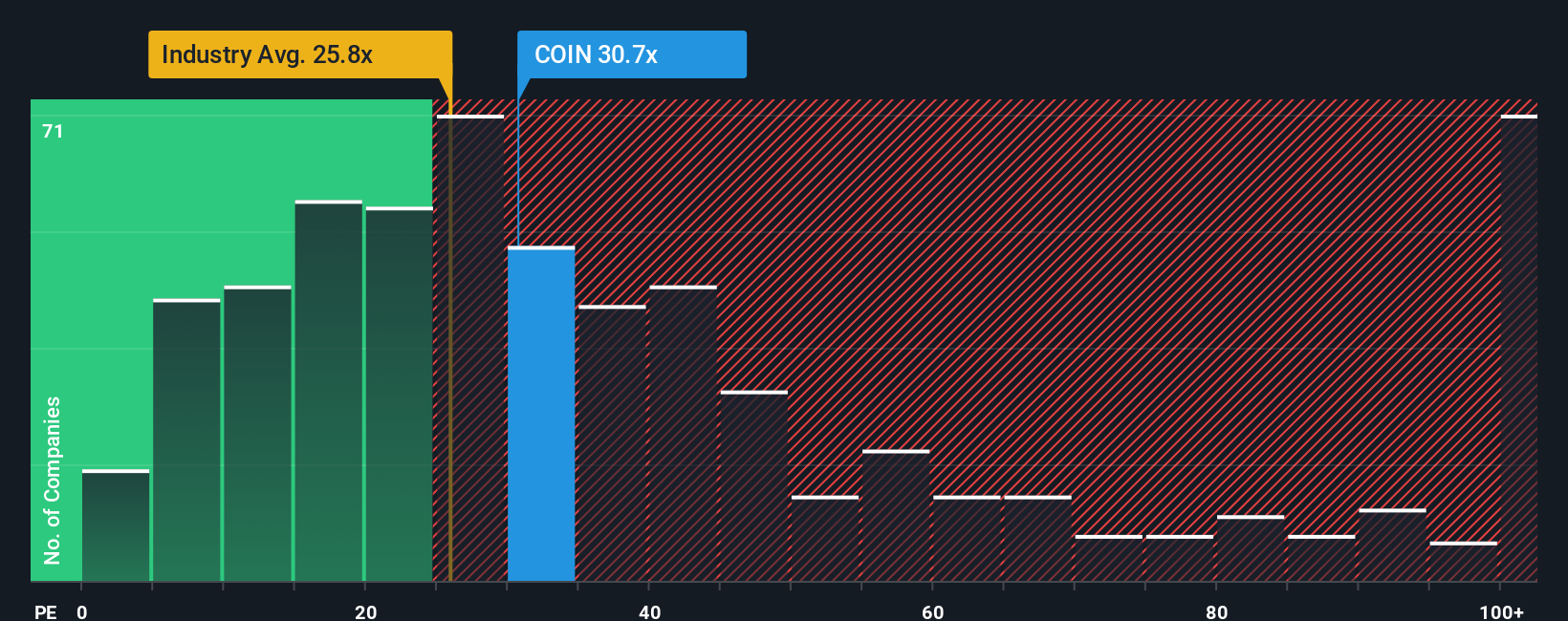

However, growth expectations and risk need to be considered to determine what a reasonable or "fair" PE ratio should be. A fast-growing, more predictable business will often command a higher PE, while slower growth or greater risk should be reflected in a lower PE. Benchmarks help provide context. Coinbase Global currently trades at a PE ratio of 31.3x. This is right in line with its peer average of 31.9x, but noticeably higher than the broader Capital Markets industry average of 25.2x.

Simply Wall St’s "Fair Ratio" goes further than these blunt comparisons. Unlike general market or peer multiples, the Fair Ratio for Coinbase Global, estimated at 20.1x, factors in the company’s unique earnings growth outlook, profit margins, market cap, and the specific risks of both the business and its industry. By tailoring the benchmark to Coinbase Global’s circumstances, the Fair Ratio provides a more precise signal of whether the stock is truly overvalued or undervalued.

Comparing Coinbase Global's actual PE of 31.3x to its Fair Ratio of 20.1x suggests the shares are trading above what would be considered reasonable based on fundamentals and growth, indicating the stock looks overvalued on a PE basis right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about the company, essentially how you see its future, which guides the numbers and assumptions you use for fair value, expected revenue, earnings, and margins. Narratives connect the company’s business journey, its industry position, and your financial outlook, stitching them together into a forecast and a fair value that actually reflect your perspective.

On Simply Wall St’s Community page, Narratives are an easy, dynamic tool accessible to all investors. Millions use them to see how differing views drive buy or sell decisions as the Fair Value is compared to the current price. What makes Narratives especially powerful is that they update automatically whenever news or financial results change, ensuring decisions are always based on the freshest insights.

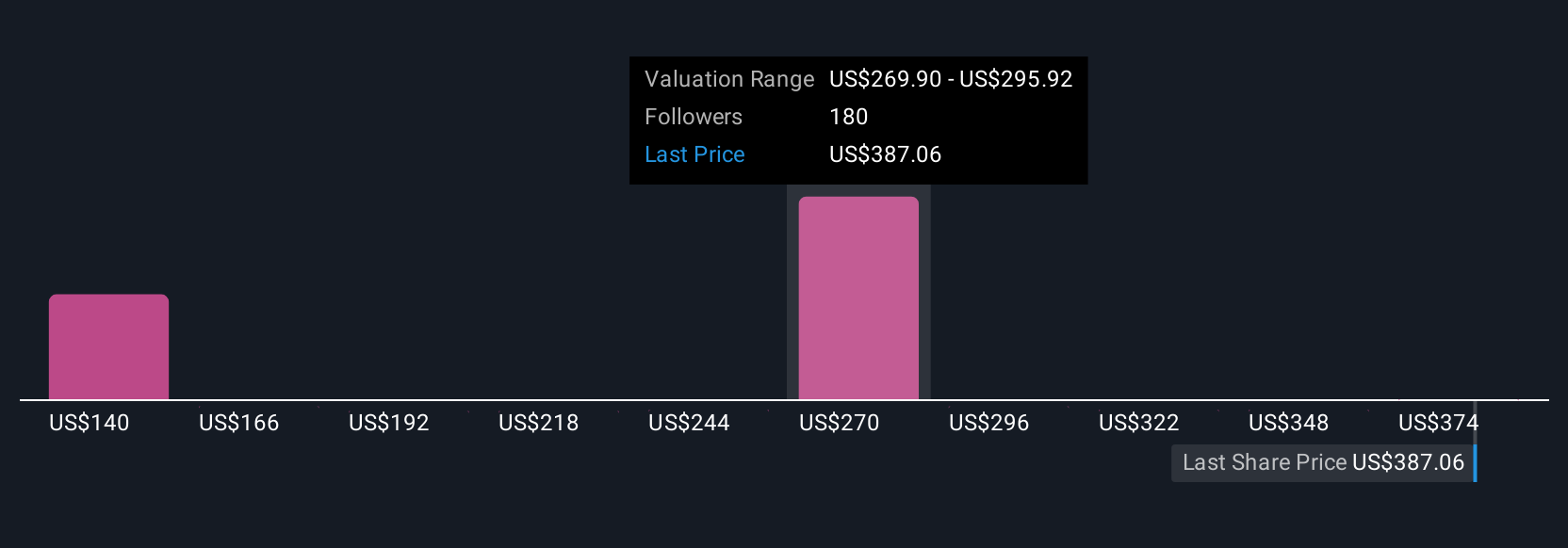

For Coinbase Global, Narratives reveal a wide spectrum of perspectives. For example, some bullish investors estimate a fair value as high as $510 per share, driven by optimism about blockchain adoption and new partnerships, while more cautious bears see fair value around $185, focused on risks from falling trading volumes and rising cybersecurity costs. By exploring and building your own Narrative, you can anchor your decision making in a story that fits your understanding and track exactly when the market price lines up with your view.

Do you think there's more to the story for Coinbase Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives