- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Does Coinbase’s Recent Share Decline Signal Value After Regulatory Headlines in 2025?

Reviewed by Bailey Pemberton

- Thinking about jumping into Coinbase Global stock or just trying to figure out if it offers real value? You are not alone; many investors are asking the same questions right now.

- Despite a solid 18.2% gain so far this year and an eye-catching 522.6% return over the last three years, shares have slipped by 4.8% in the past week and 14.8% over the last month. This reveals just how quickly market sentiment can shift.

- Recent headlines have focused on mounting regulatory discussions and the ongoing evolution in the crypto industry. These two forces have shaped Coinbase's price and kept it in the spotlight. Recurring stories about new product launches and shifting US crypto policies have all contributed to the latest swings in the company's stock price.

- On our current valuation checks, Coinbase scores just 1 out of 6 for being undervalued, suggesting there are some question marks around its price tag. Before drawing any conclusions, let us dive into the different ways investors tend to value a business like Coinbase. Later, we will reveal a more insightful approach that could reshape how you view its potential.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns model estimates a company’s value based on the returns it generates over and above its cost of equity. In simple terms, it looks at how well Coinbase Global puts shareholder money to work compared to the minimum return investors expect for the risks they take.

According to this model, Coinbase’s average return on equity is 15.00%, compared to a cost of equity of $4.97 per share. After subtracting that cost from its stable earnings per share, estimated at $8.90 from seven analyst projections, you get an annual excess return of $3.93 for each share. The company’s book value per share sits at $59.62, with future estimates putting it close at $59.36.

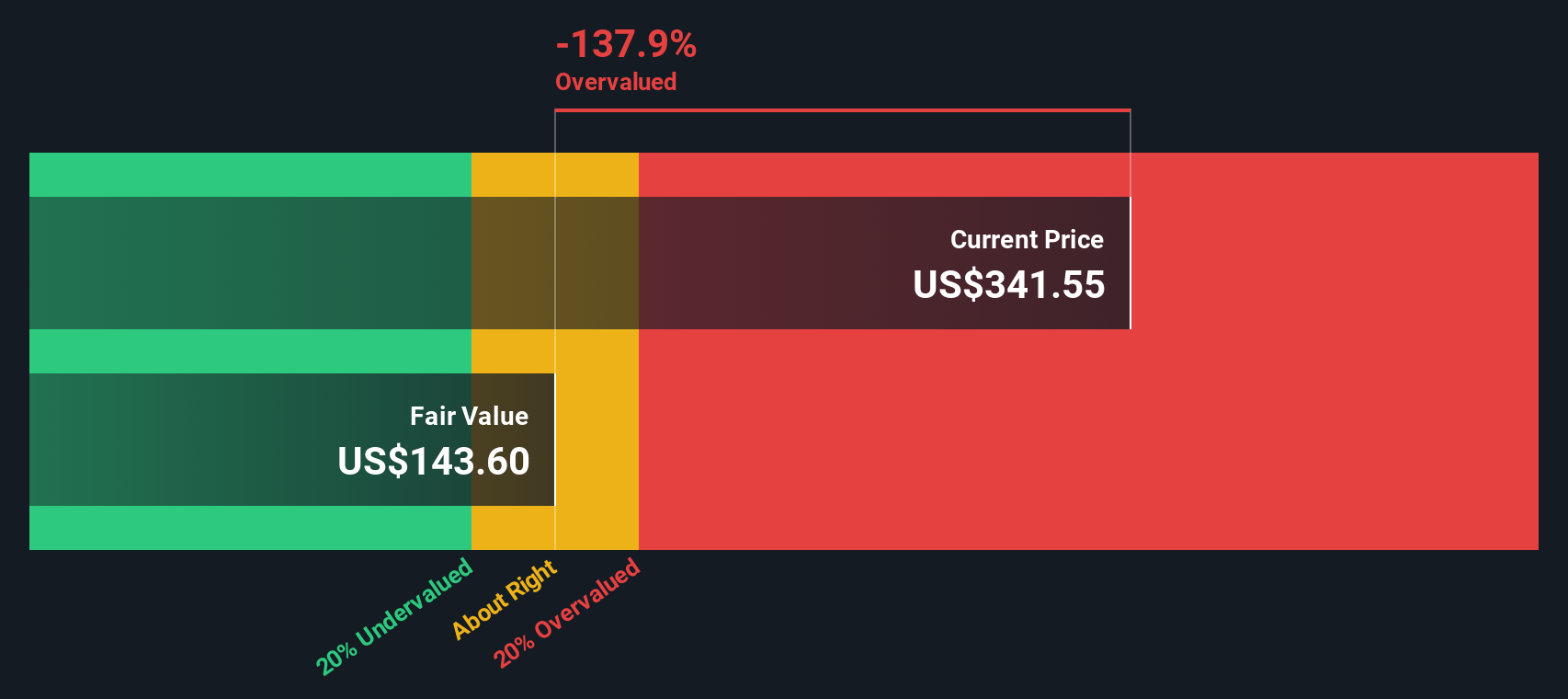

The Excess Returns approach calculates an intrinsic value that reflects how much wealth Coinbase can generate for its shareholders over time. Using these projections, the estimated fair value for Coinbase Global is $136.20 per share. When compared to the actual share price, this suggests the stock is roughly 123.2% overvalued according to the excess returns calculation.

The verdict from this method is straightforward. Investors are paying a steep premium for Coinbase’s stock relative to its intrinsic value under the Excess Returns model.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 123.2%. Discover 881 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coinbase Global Price vs Earnings

For companies that are profitable, like Coinbase Global, the price-to-earnings (PE) ratio is a popular and practical valuation tool. It helps investors gauge whether the stock price is reasonable relative to its earning power. The higher the expected growth or the lower the perceived risk, the more investors might be willing to pay for each dollar of earnings, resulting in a higher PE ratio.

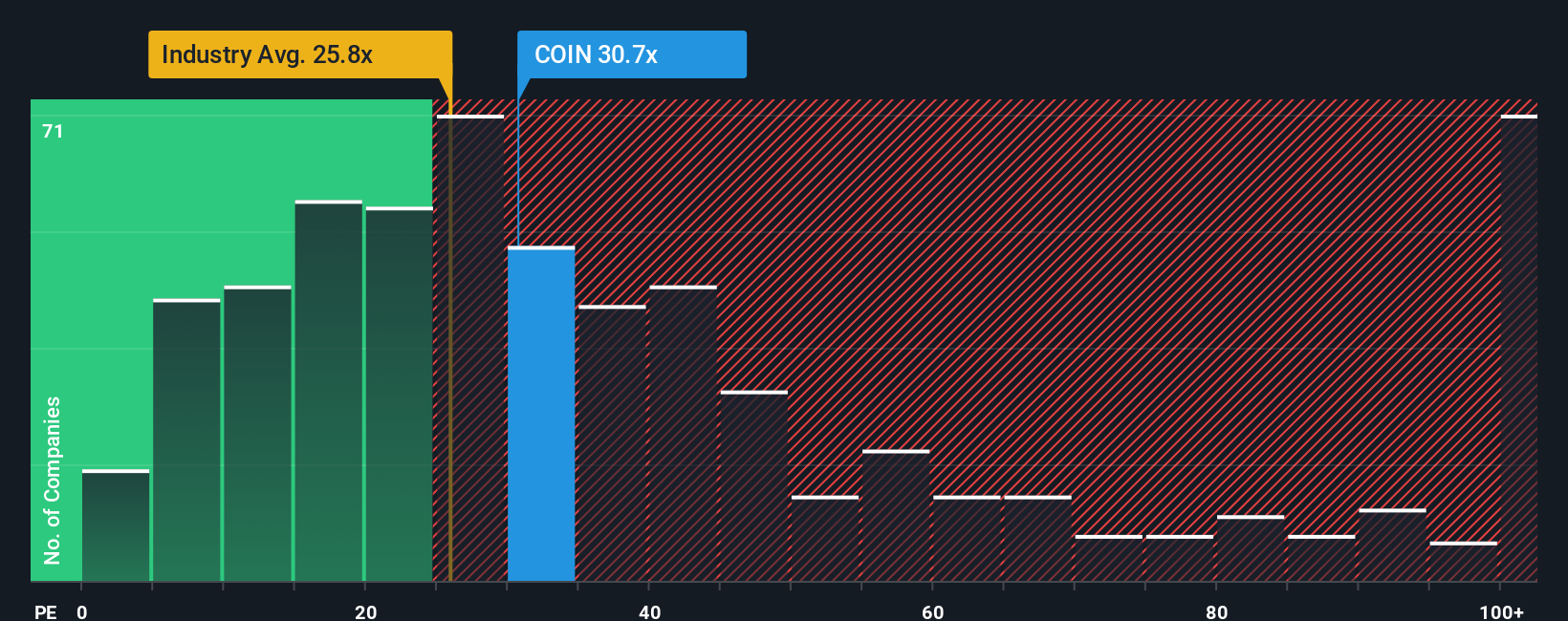

Currently, Coinbase Global trades at a PE ratio of 25.5x. Looking across the Capital Markets industry, the average stands at about 25.4x, while Coinbase's peer group averages around 31.3x. At first glance, Coinbase seems to be priced somewhat below its direct peers, though almost exactly level with the broader industry.

However, simply comparing with peers or industry averages ignores important factors like the company's unique growth profile, risk, and profitability. That is where Simply Wall St’s “Fair Ratio” comes into play. This is a tailored PE multiple based on Coinbase’s earnings growth outlook, profit margins, industry dynamics, and market cap. This fair ratio for Coinbase is calculated at 19.8x. Because this is notably lower than its current PE of 25.5x, it suggests that the market is currently assigning a premium to Coinbase, perhaps for its perceived potential despite volatility.

Comparing Coinbase's actual PE to its Fair Ratio leads to the conclusion that the stock is overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

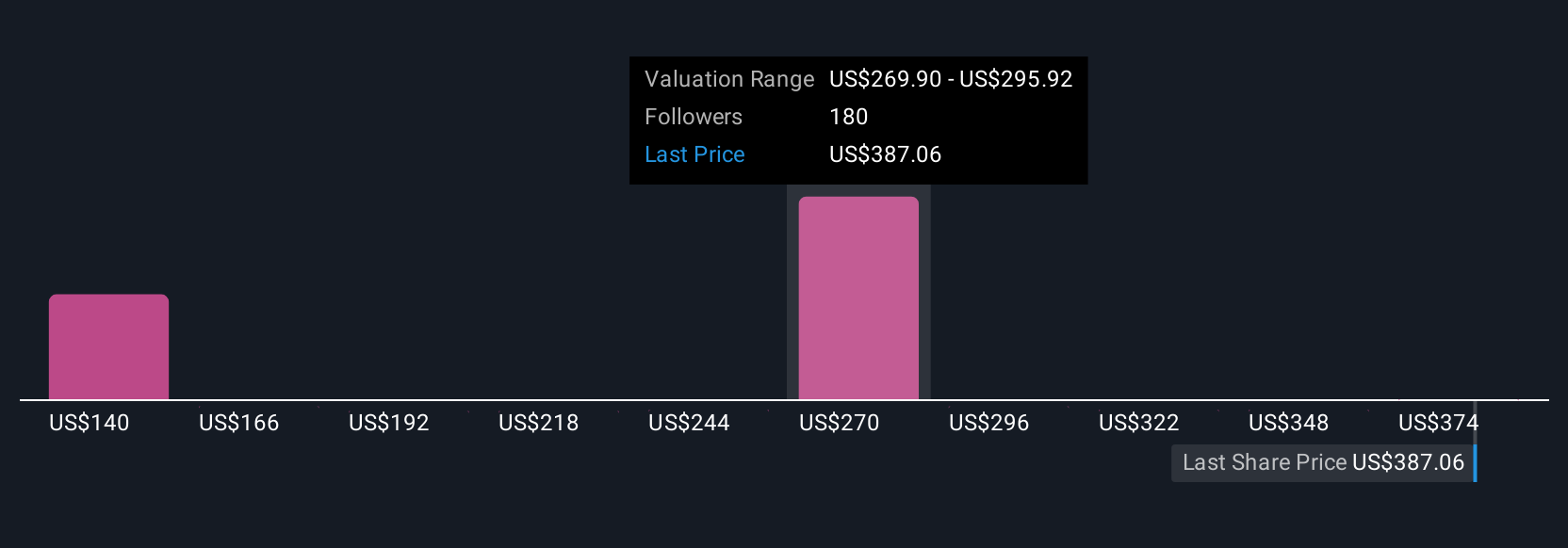

Earlier we mentioned there is an even better way to understand valuation, so let us introduce Narratives. A Narrative is a simple, dynamic explanation of the story behind a company’s numbers. It is built from your perspective and assumptions about growth, future revenue, earnings, and profit margins, all tied together. By linking these storylines to a measurable financial forecast and a calculated fair value, Narratives empower you to see whether your outlook matches up with the current share price.

Anyone can create or follow Narratives on the Simply Wall St Community page, where millions of investors share their reasoning, and the platform makes it easy to compare them. Narratives make your investment process smarter and more responsive, automatically updating when new information, news, or earnings data changes the outlook. For example, Coinbase Global’s most bullish Narrative now pegs fair value at $510 based on rapid blockchain adoption and ecosystem “lock-in.” In contrast, the most bearish expects just $185 due to trading volume declines and intensifying competition. Narratives help you decide if it is time to buy or sell by showing you your (and others’) fair value against the real market price, so you always invest with a clear, adaptable thesis in mind.

Do you think there's more to the story for Coinbase Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives