- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase Global (NasdaqGS:COIN) Shares Dip 16% As Firm Eyes M&A With US$9 Billion Cash Reserve

Reviewed by Simply Wall St

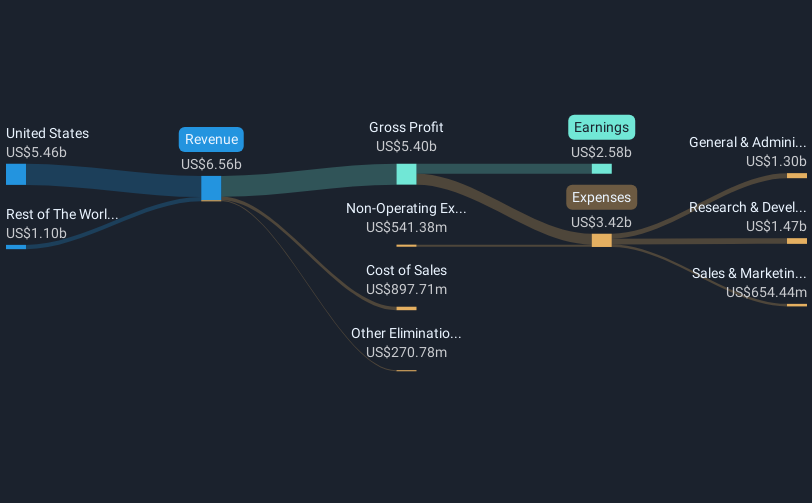

Coinbase Global (NasdaqGS:COIN) has seen a significant focus on mergers and acquisitions, as the company plans to deploy its $9 billion cash reserve to enhance its product offerings and global presence. Despite these strategic efforts, the share price decreased 16% over the past week, indicating investor concerns or skepticism about its expansion strategy. This decline comes at a time when broader market movements were volatile, influenced by political and economic uncertainties, including President Trump's tariff policies. The tech sector experienced both gains and declines, but Coinbase's focus on cryptocurrencies exposed it to additional volatility inherent in digital asset markets. Although the cryptocurrency market has shown growth potential, Coinbase’s stock performance during the week reflects broader apprehensions about market conditions and competitive pressures.

Take a closer look at Coinbase Global's potential here in our financial health report.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past three years, Coinbase Global (NasdaqGS:COIN) experienced a total return of 1.52% decline, reflecting challenges in maintaining shareholder value despite promising business moves. The tech sector's volatility and cryptocurrency market dynamics have posed hurdles. In the context of industry performance, Coinbase underperformed both the broader US market, which grew by 9.6%, and the US Capital Markets industry, which saw an 18.9% rise over the past year. Notably, Coinbase achieved substantial earnings growth, exceeding its five-year average due to a significant increase in profit margins, now standing at a very high level. Despite profitability and good relative value, these factors have not reversed the downward pressure on the company's long-term stock value, underlining investor caution amid uncertain conditions.

Several factors have influenced this longer-term performance. Coinbase’s acquisitions strategy significantly increased operational breadth and global reach, with US$9 billion in capital aimed at driving expansion. Partnerships with firms like Nayms and Worksport Ltd. sought to enhance Coinbase’s operational efficiency and regulatory compliance. However, ongoing regulatory challenges remain, highlighted by multiple lawsuits questioning securities compliance. Efforts such as the stock buyback program announced in October 2024 show attempts to bolster shareholder confidence, yet actual repurchases were not conducted as of the latest quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives