- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase (COIN) Valuation in Focus After Strong Quarter, Bank Charter Pursuit, and Ark Invest Stake Increase

Reviewed by Simply Wall St

Coinbase Global (COIN) reported strong gains in both revenue and profit for the latest quarter, further strengthening its reputation as a top player in the crypto industry. In addition to these results, the company’s pursuit of a U.S. bank charter and Bitcoin’s price rally have brought fresh attention from institutional investors.

See our latest analysis for Coinbase Global.

Catching the eyes of investors once again, Coinbase’s latest quarter was bolstered by Bitcoin’s rapid rally and a flurry of institutional interest, including a hefty new stake from Ark Invest. Executive share sales made headlines but did not slow the buzz. Over the past year, Coinbase has seen a 1-year total shareholder return of -16.00%. The momentum over the past three years remains notable, with a 512.69% total return that reflects the stock’s longer-term resilience even amid short-term swings.

If you’re curious where the next big movers might come from in the digital finance world, it could be time to expand your search and discover fast growing stocks with high insider ownership

With fresh quarterly gains and major crypto tailwinds, investors are left wondering if Coinbase’s current price reflects true potential or if there is still room for upside. Could now be the moment to buy in before the next run?

Most Popular Narrative: 32.6% Undervalued

With the consensus fair value for Coinbase Global placed at $385.27 per share, well above the last close of $259.84, the most popular narrative sees room for significant upside if projected catalysts play out. This storyline highlights structural advantages in the blockchain ecosystem and sets bold expectations for growth.

Proprietary blockchain platforms and integrated payment solutions enable ecosystem lock-in and drive a shift toward higher-margin services and recurring revenue streams. Heavy dependence on trading amid falling volumes, rising cybersecurity and compliance costs, competitive fee pressures, and uncertain diversification threaten revenue stability and earnings predictability.

What’s the secret ingredient behind such a striking fair value? This forecast hinges on future ecosystem dominance and soaring high-margin services, but the narrative leaves key financial assumptions tantalizingly out of sight. It’s a bold vision, one that could reshape how investors view Coinbase’s true potential. Dive in to uncover the vital growth levers driving this high-stakes valuation.

Result: Fair Value of $385.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower retail trading or unexpected cybersecurity setbacks could quickly challenge the optimism driving Coinbase’s valuation outlook and long-term growth prospects.

Find out about the key risks to this Coinbase Global narrative.

Another View: Discounted Cash Flow Puts a Different Spin on Value

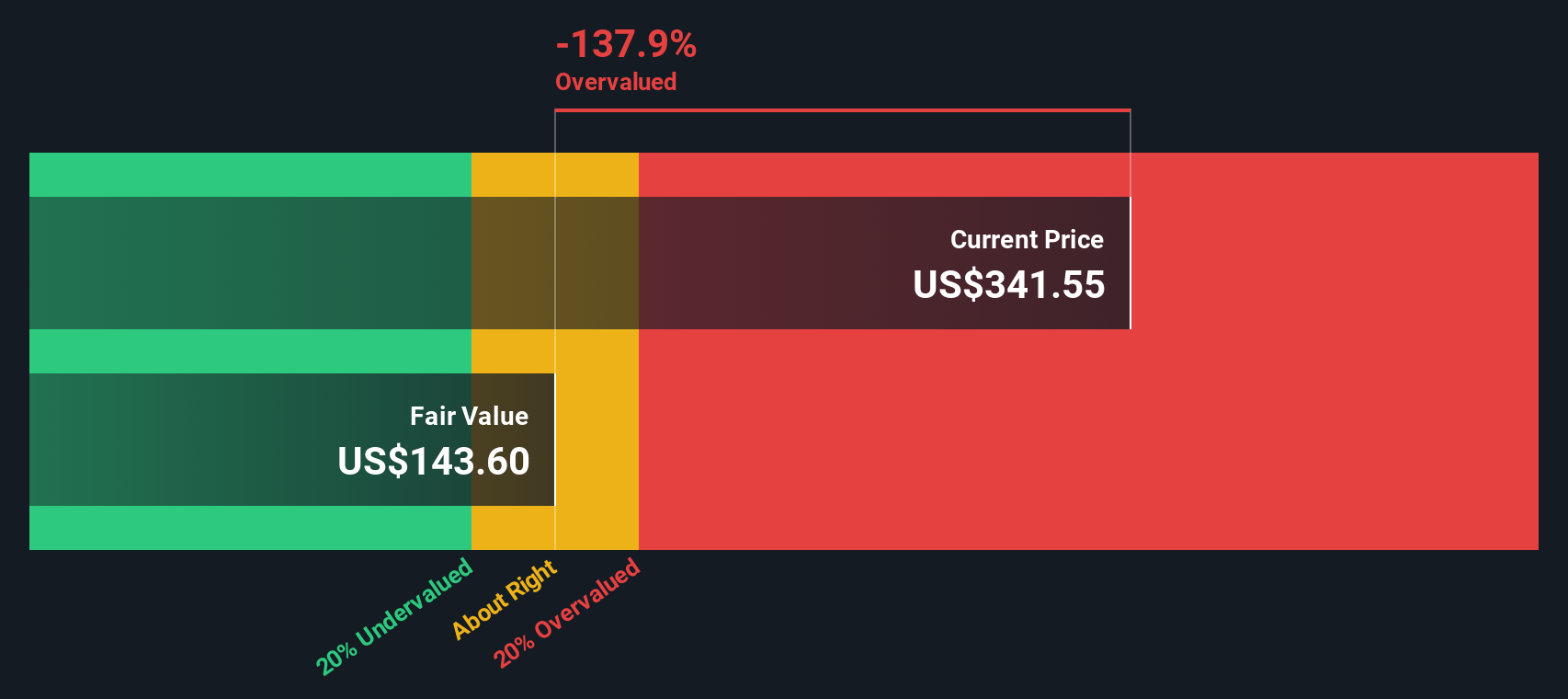

While analyst targets and peer multiples point to upside, our SWS DCF model paints a more cautious picture. According to this method, Coinbase shares are trading above the estimated fair value of $128.14, which suggests the market may be overestimating the company’s future cash flows. Is the long-term optimism justified, or could the numbers be hinting at a reality check ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coinbase Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coinbase Global Narrative

If you see the story unfolding differently or want a hands-on look at the numbers, you can craft your own perspective in just a few minutes, Do it your way

A great starting point for your Coinbase Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay one step ahead by checking out smart strategies and sectors that others are already watching closely. Don’t let these potential winners pass you by. Tap into your next big opportunity now.

- Capitalize on game-changing breakthroughs with these 25 AI penny stocks, where artificial intelligence is transforming industries and delivering future-defining potential.

- Capture stable, income-generating opportunities through these 14 dividend stocks with yields > 3%, offering yields above 3% and dependable cash flow for your portfolio.

- Seize an edge with these 923 undervalued stocks based on cash flows, highlighting stocks where market prices still lag behind underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026