- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase (COIN): Exploring Valuation Following JPMorgan Upgrade and Echo Acquisition

Reviewed by Simply Wall St

Coinbase Global (NasdaqGS:COIN) shares rose nearly 10% after JPMorgan raised its rating. The firm highlighted the company’s expanding reach with the Echo platform acquisition and new prospects around its Base token and USDC rewards.

See our latest analysis for Coinbase Global.

Coinbase’s recent rally adds to a strong year, with a one-day share price return near 10% following analyst upgrades and a string of high-profile acquisitions. Enthusiasm around new products like x402 and a potential Base token has helped the stock deliver a 37.8% share price gain year-to-date. Its one-year total shareholder return stands at an impressive 64%, pointing to building momentum supported by bullish sentiment and a forward-looking strategy.

If today’s crypto momentum makes you curious about other tech-driven leaders, you’ll want to check out See the full list for free.

With all this excitement and bullish analyst support, investors are left to wonder if Coinbase’s rapid price appreciation still leaves room for upside or if the market has already factored in the company’s ambitious growth story.

Most Popular Narrative: 5.4% Undervalued

With the most widely followed narrative now estimating a fair value for Coinbase Global above its last close, the debate turns to the assumptions fueling this target. This narrative encapsulates both the disruptive potential and the ongoing risks surrounding the company's future.

*Proprietary blockchain platforms and integrated payment solutions enable ecosystem lock-in and drive a shift toward higher-margin services and recurring revenue streams. Heavy dependence on trading amid falling volumes, rising cybersecurity and compliance costs, competitive fee pressures, and uncertain diversification threaten revenue stability and earnings predictability.*

What’s the driving force behind this bold valuation call? Analysts are betting on a new era for digital assets, forecasting radical shifts in margins and business mix that could redefine what’s possible for Coinbase’s top and bottom line. The quantitative leap behind these expectations might catch many by surprise. Want the full breakdown?

Result: Fair Value of $374.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained drops in trading activity or major cybersecurity incidents could quickly undermine the optimistic outlook that is powering current analyst valuations.

Find out about the key risks to this Coinbase Global narrative.

Another View: What Does Our DCF Model Say?

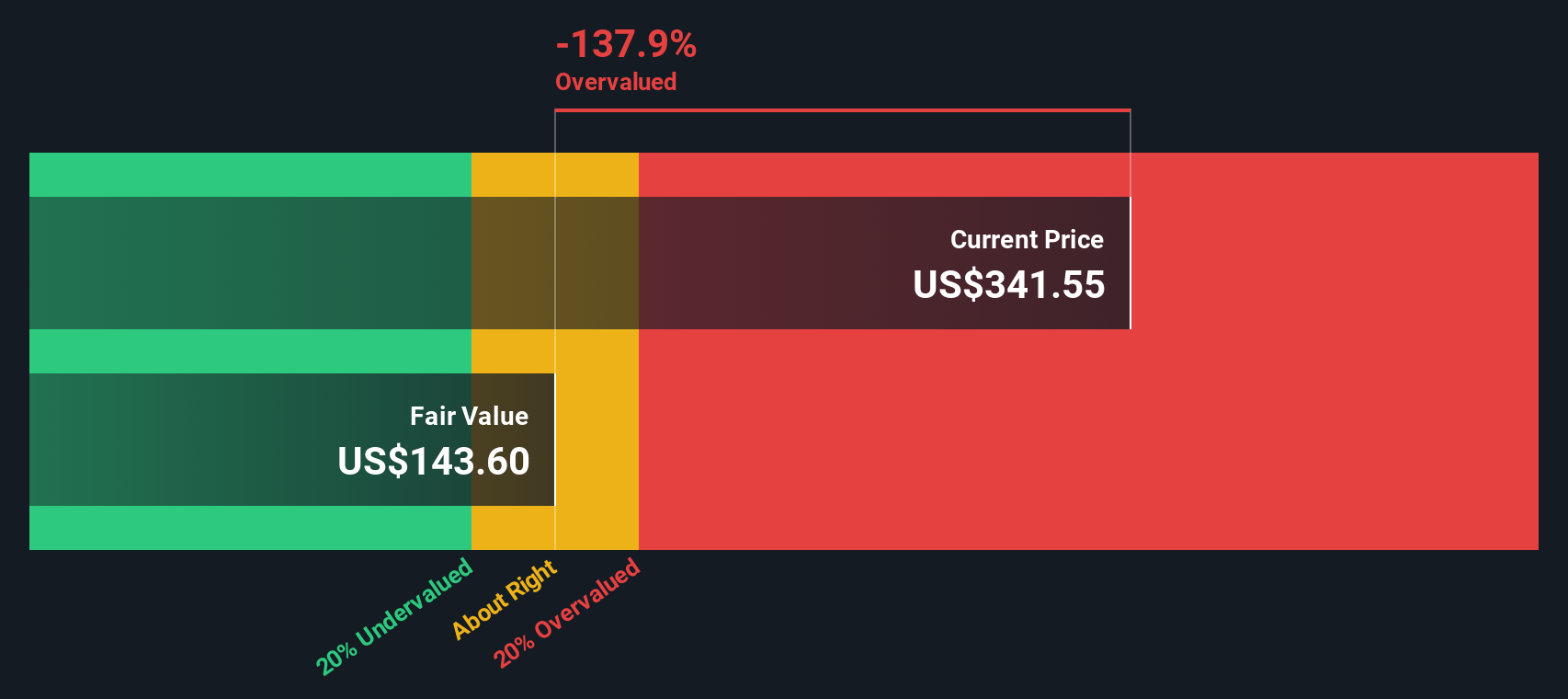

While analyst price targets suggest Coinbase is undervalued, our SWS DCF model paints a different picture. Based on conservative cash flow projections, the stock appears to be trading above its fair value estimate. This highlights just how much optimism is priced in and raises the question of whether the market might be overlooking potential risks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coinbase Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coinbase Global Narrative

If you see things differently or want to dig into the numbers at your own pace, it’s easy to craft your own take in just a few minutes. Do it your way

A great starting point for your Coinbase Global research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by while others uncover tomorrow’s market leaders. The Simply Wall Street Screener is your most powerful shortcut to innovative stocks and hidden value plays.

- Capture new income streams by checking out these 17 dividend stocks with yields > 3% which offers exceptional yields above 3% for steady, high-quality returns.

- Uncover tech breakthroughs by investigating these 28 quantum computing stocks to find pioneers pushing boundaries in quantum computing.

- Spot undervalued opportunities before the crowd with these 872 undervalued stocks based on cash flows that focuses on companies trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives