- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Should CME (CME) Investors Respond to Launch of New Global Commodity and Mexico Index Futures?

- CME Group has announced plans to launch FTSE CoreCommodity CRB futures and E-Mini S&P BMV IPC Index futures, both pending regulatory approval. These products offer investors direct exposure to global commodity markets and the Mexican equity market via CME’s platform.

- The addition of these broad market index futures signals CME Group’s commitment to expanding its product lineup, which could attract new market participants and support growth in trading activity and market share.

- We'll now explore how the launch of these globally focused futures products could influence CME Group’s investment outlook.

CME Group Investment Narrative Recap

To be a CME Group shareholder, you generally need to believe in the ongoing demand for liquid, global derivatives markets and the company’s ability to innovate with new products. The latest product launches in commodity and Mexican equity index futures reinforce CME’s growth story but do not materially change the near-term catalyst, which remains trading volumes driven by volatility; similarly, the most immediate risk, potential volume declines if volatility abates or margin requirements rise, remains unchanged.

Among recent developments, the launch of new FTSE CoreCommodity CRB futures stands out. By offering broad-based commodity exposure within a single contract, this initiative fits with CME’s focus on innovation and could complement other growth drivers like momentum in international contract volumes and new partnerships in global markets.

In contrast, the potential impact of heightened margin requirements and their effect on trading volumes is something investors should be aware of, especially if...

Read the full narrative on CME Group (it's free!)

Exploring Other Perspectives

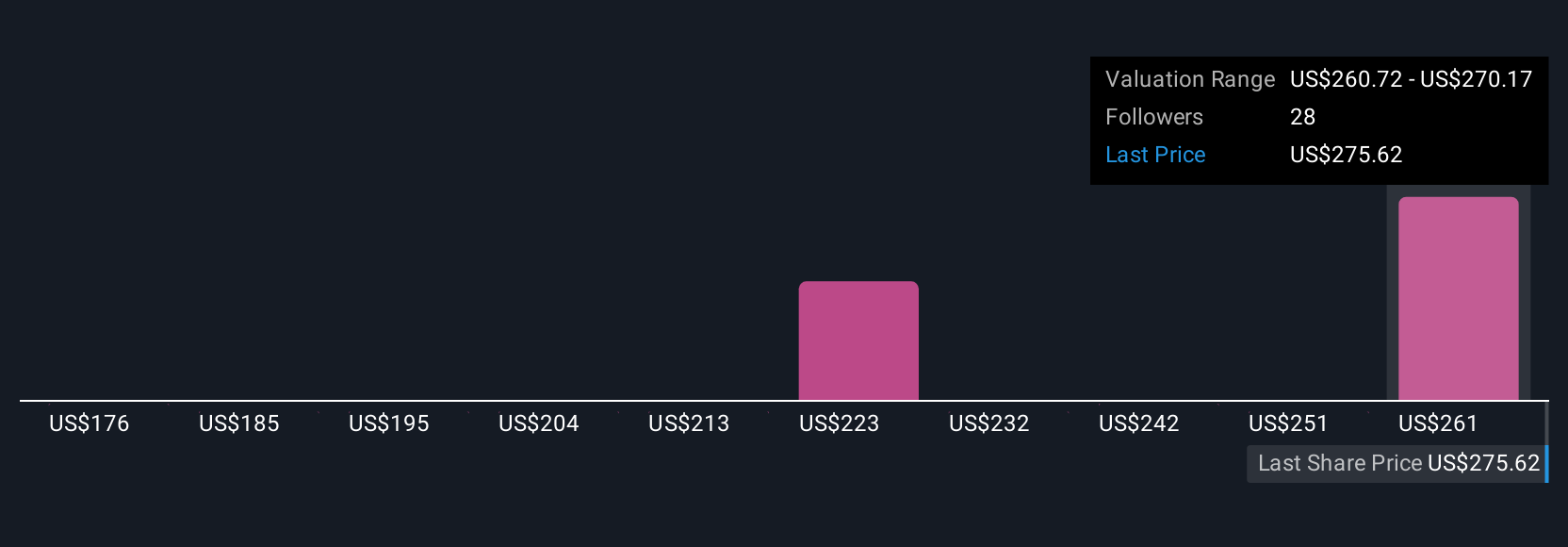

Four fair value estimates from the Simply Wall St Community span US$175.71 to US$270.17 per share. While many focus on product expansion, potential volume declines from increased margin requirements could influence future revenue in ways some market participants may not anticipate.

Explore 4 other fair value estimates on CME Group - why the stock might be worth as much as $270.17!

Build Your Own CME Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CME Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CME Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CME Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives