- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Does Carlyle Group’s (CG) Steady Dividend Amid Weaker Earnings Reveal Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- The Carlyle Group Inc. recently reported its third quarter 2025 earnings, revealing quarterly revenue of US$332.7 million and net income of US$0.9 million, both down sharply from the same period in 2024; for the nine months ended September 30, revenue was US$2.88 billion and net income was US$450.6 million.

- Despite the drop in earnings, Carlyle declared a quarterly dividend of US$0.35 per share, signaling its ongoing commitment to shareholder returns during a period of weaker financial results.

- With significant year-on-year declines in both revenue and net income, we'll examine how these earnings results reshape Carlyle Group's investment narrative going forward.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Carlyle Group Investment Narrative Recap

To invest in Carlyle Group, you need to believe in the firm's ability to expand its assets under management and derive steady long-term fee income, built on strong demand for private market solutions. The sharp revenue and net income decline in the most recent quarter does not significantly alter the importance of maintaining fundraising momentum as the primary catalyst or elevate competition as the biggest present risk; these remain paramount considerations.

Among recent announcements, Carlyle’s reaffirmed quarterly dividend of US$0.35 per share stands out in this context, as it signals the firm's intent to preserve returns to shareholders despite near-term financial headwinds. Consistent dividend payouts may offer some reassurance, but the company’s continued push for growth in alternative assets, secondaries and new channels will be vital for future performance.

Yet, in contrast to resilient dividend payments, the continued risk from intensifying competition, and its potential to pressure margins and fees, remains something investors should be aware of as...

Read the full narrative on Carlyle Group (it's free!)

Carlyle Group's narrative projects $5.1 billion in revenue and $1.7 billion in earnings by 2028. This requires a 2.6% annual revenue decline and a $0.4 billion increase in earnings from the current $1.3 billion.

Uncover how Carlyle Group's forecasts yield a $69.25 fair value, a 30% upside to its current price.

Exploring Other Perspectives

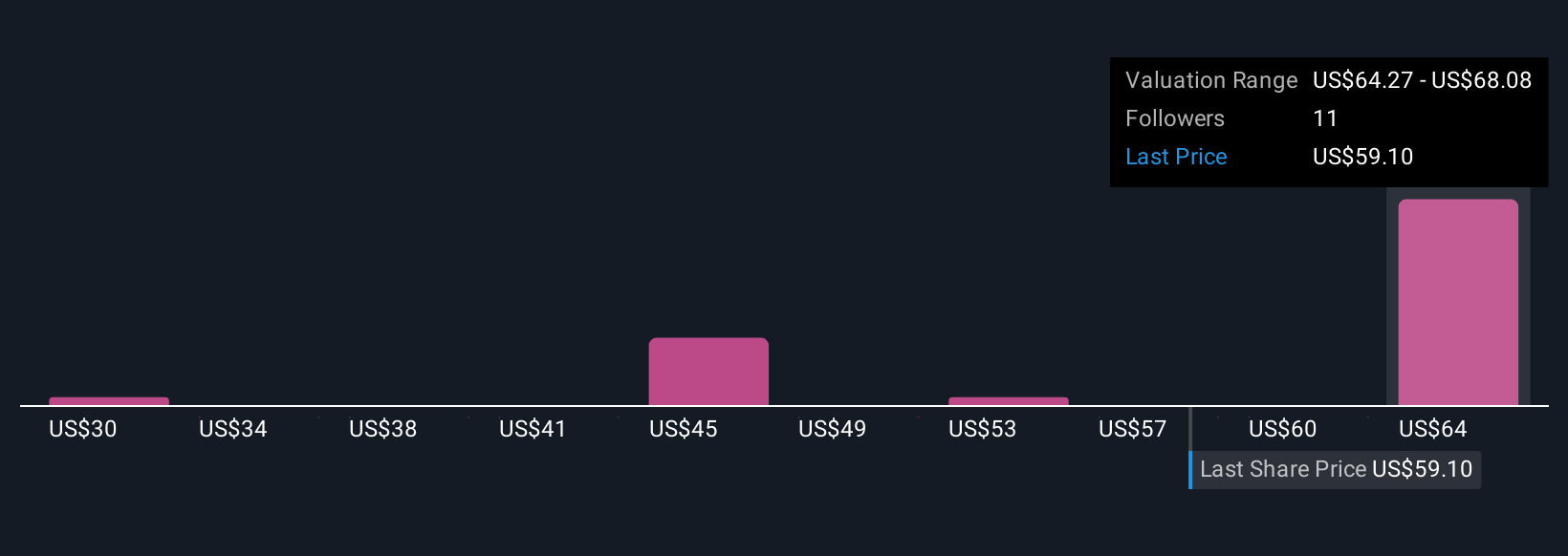

Three fair value estimates from the Simply Wall St Community span US$45.37 to US$69.25 per share, reflecting a broad range of opinion on Carlyle’s upside. Against the backdrop of tough quarterly results and competitive pressures, you are invited to compare these varied perspectives on the company’s future.

Explore 3 other fair value estimates on Carlyle Group - why the stock might be worth 15% less than the current price!

Build Your Own Carlyle Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlyle Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carlyle Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlyle Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives