- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Carlyle Group (CG): Assessing Valuation After a Recent Cool-Off in Share Price Momentum

Reviewed by Simply Wall St

Carlyle Group (CG) has seen its shares shift modestly over the past week, with a slight dip following broader market movements. Investors are weighing the company’s fundamentals against current valuations, particularly in light of the share price’s recent declines.

See our latest analysis for Carlyle Group.

While Carlyle Group’s share price has slipped more than 10% in the past month, it is still up over 5% since the start of the year. This short-term cooling comes after steady gains, with long-term investors enjoying a 9.3% total shareholder return over the past year and triple-digit total returns over three and five years. The current pause has some investors re-evaluating whether recent momentum is fading or simply taking a breather before the next leg higher.

If you’re looking to broaden your scope, now is a smart time to discover fast growing stocks with high insider ownership.

With shares now trading more than 20 percent below analyst targets but still well above last year’s lows, investors must ask: Is Carlyle Group undervalued, or is the market accurately pricing in all future growth prospects?

Most Popular Narrative: 18.7% Undervalued

Despite Carlyle Group’s last close of $53.33, the most widely followed narrative estimates fair value at $65.56, suggesting significant upside. However, this perspective depends on several ambitious assumptions and one transformative growth thesis.

Expanding global wealth and broader retail investor participation, including new evergreen products (e.g., CAPM, CPEP) and strategic partnerships (e.g., UBS), are driving robust and recurring fundraising. This positions Carlyle to further broaden its AUM base and capture a greater share of the growing demand for private market solutions, which is likely to boost fee revenues and long-term earnings growth.

What secret formula fuels this bullish outlook? Part of it is rapid product innovation, with another focus on bold financial strategies for growth and profitability. The full narrative reveals which future milestones drive this valuation and whether they stand up to Wall Street's toughest forecasts.

Result: Fair Value of $65.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry competition and rising regulatory pressures could still challenge Carlyle’s ability to sustain its current growth and profit margin expectations.

Find out about the key risks to this Carlyle Group narrative.

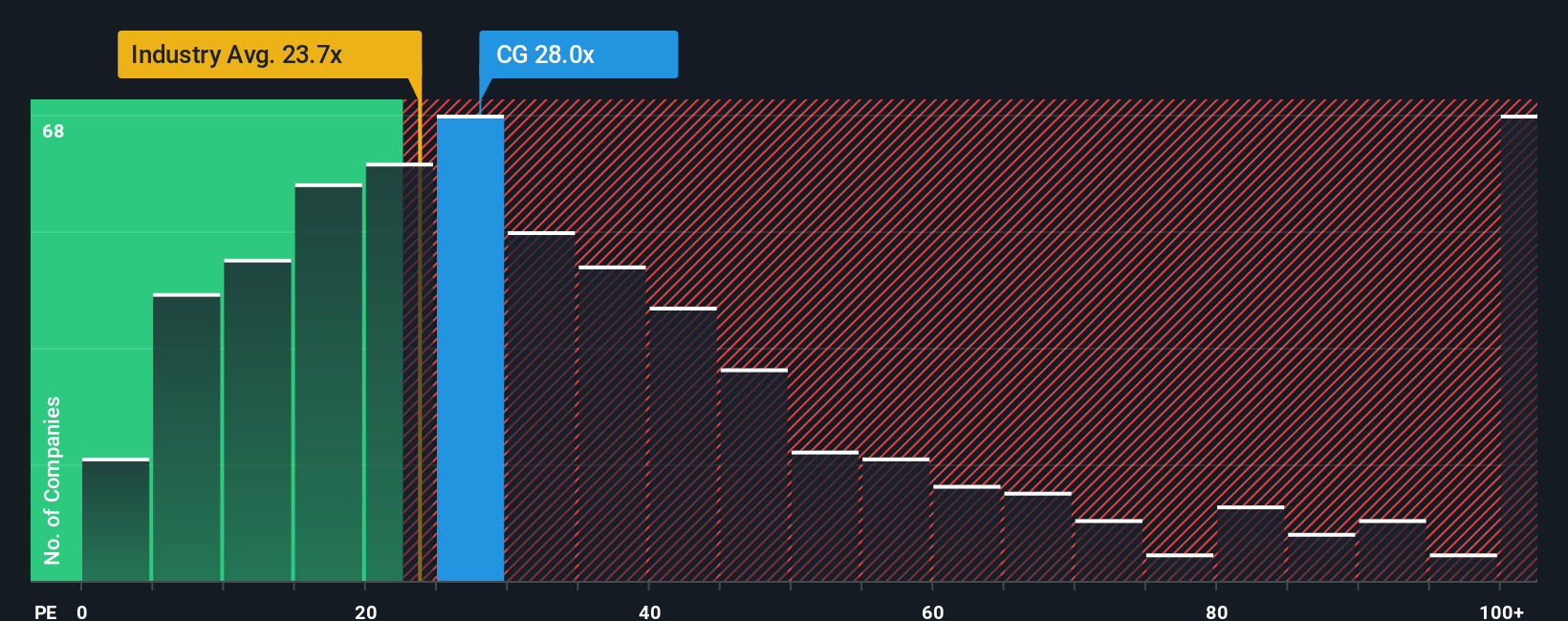

Another View: Multiples Tell a Different Story

Looking at Carlyle's valuation from another perspective, the company's price-to-earnings ratio stands at 29.1x. This is higher than both the US Capital Markets industry average of 24x and peers at 48.5x, while also being well above the fair ratio of 18.4x. This suggests investors may be paying a significant premium for growth. Could the stock be priced too high relative to its true earning power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carlyle Group Narrative

If you want to dig deeper or have a different perspective, you’re invited to explore the data and craft your own insight in just a few minutes with Do it your way.

A great starting point for your Carlyle Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one story. Elevate your investing game by tapping into more standout stock opportunities picked by Simply Wall Street’s powerful screener tools.

- Capitalize on potential growth and momentum by scanning these 3593 penny stocks with strong financials with strong financials and attractive risk-reward profiles.

- Boost your strategy with robust income options as you browse these 16 dividend stocks with yields > 3% offering yields above 3 percent, perfect for steady cash flow.

- Be at the forefront of innovation by targeting the leaders in digital currency and tech trends through these 82 cryptocurrency and blockchain stocks now capturing investor attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives