- United States

- /

- Capital Markets

- /

- NasdaqCM:BULL

Webull (BULL): Evaluating Valuation Following Recent Share Price Declines

Reviewed by Kshitija Bhandaru

See our latest analysis for Webull.

After a tough few months, Webull’s 30-day share price return of -13.6% and 90-day return of -34.8% underscore fading momentum. Even so, its three-year total shareholder return is still positive. Steep recent drops suggest investors are recalibrating their outlook, perhaps in response to shifting expectations for growth or risk.

If you’re looking to expand your opportunities, now is an interesting moment to discover fast growing stocks with high insider ownership.

With shares now trading well below analyst targets despite healthy underlying growth, the question becomes clear: is Webull undervalued at these levels, or is the market already accounting for all of its future potential?

Most Popular Narrative: 40.5% Undervalued

Webull’s narrative fair value sits well above its last close, indicating a significant gap between market pricing and analyst projections. Let’s take a closer look at a key driver behind this consensus view.

Rapid adoption and reintroduction of crypto trading, coupled with the platform's ability to quickly add new digital asset classes and prediction markets, positions Webull to capture growing demand for broad, mobile-accessible investment options. This supports potential revenue growth and market share expansion.

Want to see what’s powering this narrative? Analysts highlight strong revenue, customer growth, and ambitious margin gains as driving factors. The details lie in the growth math behind that price target. Ready to explore assumptions that make this valuation notable? Dive in for the key figures supporting this view.

Result: Fair Value of $18.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting market cycles or tighter global regulations could quickly cool trading activity and revenues. These factors pose key risks to Webull's optimistic outlook.

Find out about the key risks to this Webull narrative.

Another View: Is the Market Telling a Different Story?

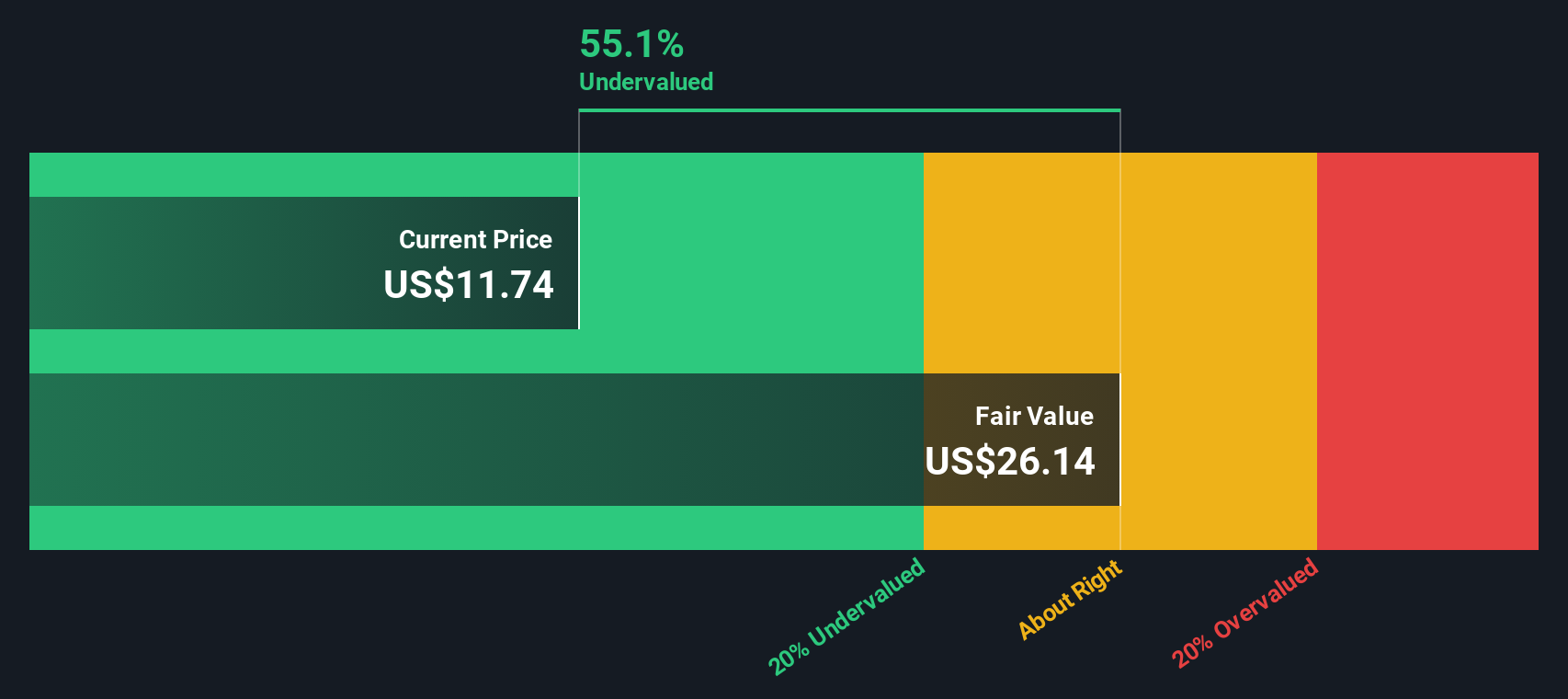

When we turn to the SWS DCF model, the result stands out: Webull's current share price of $11.01 is about 58% below our estimate of fair value at $26.25. This model builds off future cash flows, suggesting the market may be too pessimistic for now. But how likely is it that the market closes this gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Webull Narrative

If our analysis does not match your perspective or you want to dive deeper, you can build your own Webull narrative using the same data in just a few minutes. So why not Do it your way?

A great starting point for your Webull research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Move beyond Webull and give yourself an edge. Take just a minute to unlock fresh opportunities that could shift your perspective and help maximize your returns.

- Tap into rapid tech growth by checking out these 24 AI penny stocks, which are poised to reshape industries with artificial intelligence advancements.

- Supercharge your portfolio with potential hidden gems by seeking out these 878 undervalued stocks based on cash flows, offering value-driven investing opportunities the market may be overlooking.

- Capitalize on market volatility and spot diamonds in the rough by exploring these 3596 penny stocks with strong financials, which offer strong financial credentials in a dynamic landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webull might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BULL

High growth potential with adequate balance sheet.

Market Insights

Community Narratives