- United States

- /

- Capital Markets

- /

- NasdaqGS:BGC

Does BGC Group’s Transformation Justify Its Recent Multi Year Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether BGC Group at around $8.93 is a bargain or a value trap, you are not alone. That is exactly what we are going to unpack.

- Despite being down 0.6% over the last week and 4.3% year to date, the stock is still up 4.4% over the past month, 2.9% over the last year, and 138.9% over three years and 124.6% over five years, which naturally raises questions about what is already priced in.

- Recently, BGC Group has been in the spotlight for its ongoing transformation into a more streamlined, technology driven brokerage and financial services platform, including moves to simplify its structure and focus on scalable, high margin businesses. That strategic shift, along with improving capital markets activity and sector wide interest in electronic trading platforms, helps explain why the market has been willing to rerate the shares over the last few years.

- On our checklist style valuation framework, BGC Group currently scores just 0 out of 6 on undervaluation tests. Next we will break down what different valuation methods say about the stock today and then finish up with a more intuitive way to think about its real long term value.

BGC Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BGC Group Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above its cost of equity, and then projects how long it can sustain those superior returns on its existing book value.

For BGC Group, the starting point is a Book Value of $2.03 per share and a Stable EPS estimate of $0.24 per share, based on the median return on equity over the past five years. The Average Return on Equity of 13.10% is compared to a Cost of Equity of about 17%, implying an Excess Return of only $0.07 per share on a Stable Book Value of $1.84 per share.

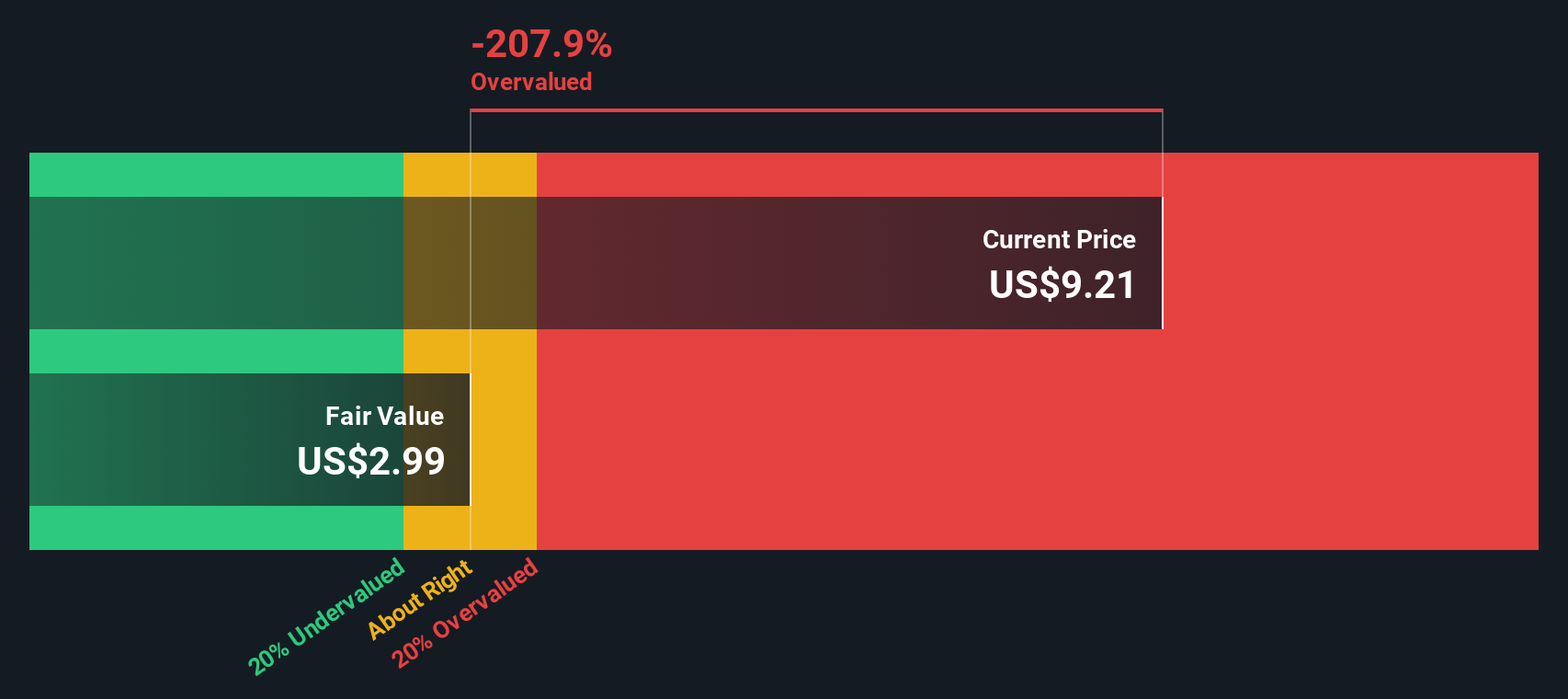

When these modest excess returns are capitalized, the model arrives at an intrinsic value of roughly $3.00 per share. With the stock currently trading around $8.93, the Excess Returns framework implies the shares are about 198.0% above their estimated fair value, which indicates overvaluation on this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests BGC Group may be overvalued by 198.0%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BGC Group Price vs Earnings

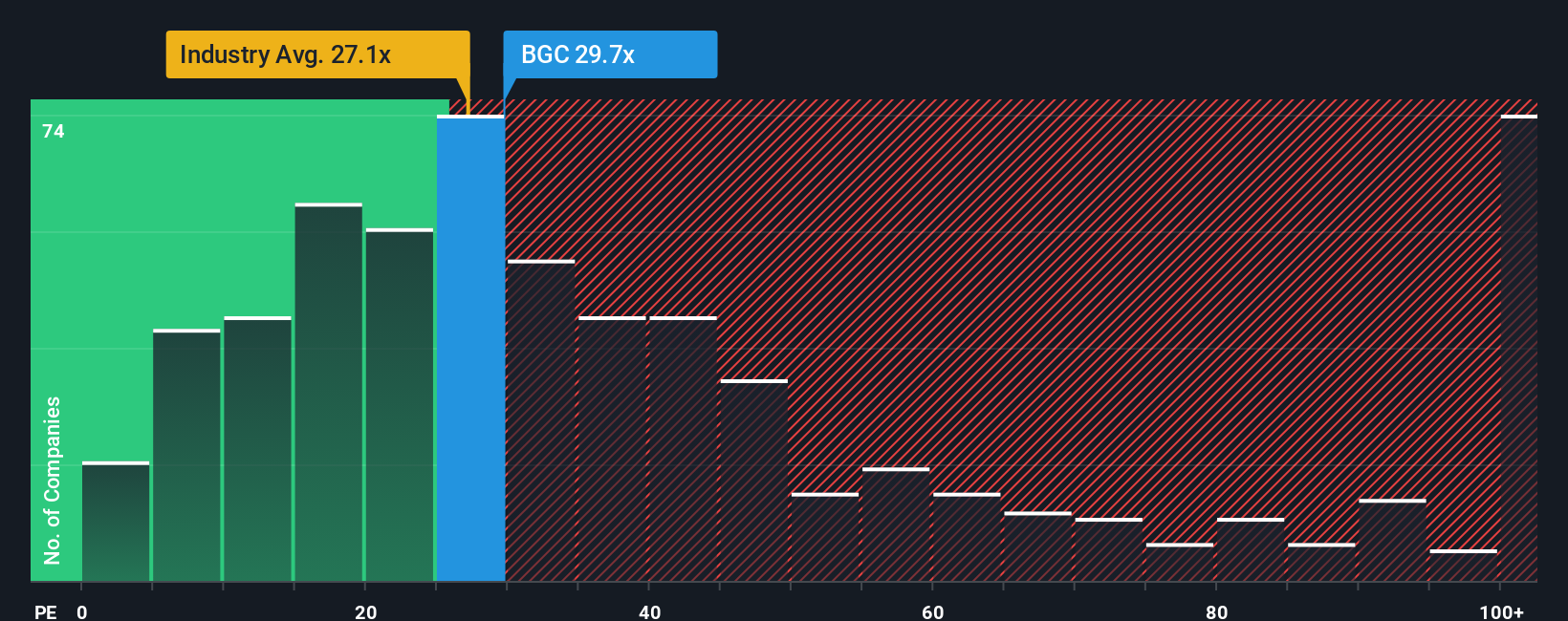

For a consistently profitable company like BGC Group, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It captures in a single number the market’s view on both the durability of profits and the company’s future growth prospects.

In general, faster growing and less risky businesses tend to trade on a higher, or more expensive, PE multiple. Slower growth or higher uncertainty usually commands a discount. With BGC currently trading on about 26.3x earnings, it is slightly above the broader Capital Markets industry average of roughly 25.3x but much richer than the peer group average of around 6.5x. That suggests the market is already pricing in stronger growth, better profitability, or lower risk than for many direct peers.

Simply Wall St’s Fair Ratio framework refines this comparison by asking what PE multiple BGC should trade on once factors like its earnings growth outlook, risk profile, margins, industry, and market capitalization are all accounted for. Because this proprietary Fair Ratio goes beyond simple peer or sector comparisons, it tends to give a more nuanced view of value. In BGC’s case, the current 26.3x PE sits well above its implied Fair Ratio, which points to a stock that looks expensive rather than mispriced on optimism alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BGC Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of BGC Group’s business to concrete numbers like future revenue, earnings, margins, and a fair value estimate. A Narrative is the story you believe about a company, translated into a financial forecast, and then linked directly to a fair value that you can compare with today’s share price to decide whether it looks like a buy, a hold, or a sell. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible, allowing you to see and create scenarios where your assumptions flow into an updated valuation that automatically refreshes when new information, such as earnings or major news, is released. For BGC Group, one investor might build a bullish Narrative that assumes analysts are right and the stock is worth about $14.50 per share, while another might take a far more conservative view with a much lower fair value, showing how the same company can support very different, but clearly quantified, perspectives.

Do you think there's more to the story for BGC Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BGC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BGC

BGC Group

Operates as a financial brokerage and technology company in the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion