- United States

- /

- Consumer Finance

- /

- NasdaqGS:ATLC

Why Atlanticus Holdings (ATLC) Is Up 5.4% After $400M Debt Raise and New Acquisition Plans

Reviewed by Simply Wall St

- Atlanticus Holdings Corporation recently completed a US$400 million private offering of 9.750% senior notes due 2030, outlining plans to use proceeds for refinancing debt and potential acquisitions, and approved a quarterly preferred dividend to Series B shareholders payable in September 2025.

- This large-scale debt issuance and the company’s stated pursuit of acquisition opportunities mark an important shift in Atlanticus Holdings’ financial strategy and growth ambitions.

- We’ll explore how Atlanticus Holdings’ expanded debt financing and acquisition ambitions influence its evolving investment narrative and growth outlook.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Atlanticus Holdings' Investment Narrative?

To see Atlanticus Holdings as a compelling investment, you need faith in a company that’s rapidly evolving both its capital structure and growth strategy. The recent US$400 million issuance of 9.750% senior notes is a pivotal move, arming management with resources for targeted acquisitions and aggressive debt refinancing. This fresh funding could accelerate expansion plans, which had already been flagged as a key catalyst. However, the higher interest burden meaningfully alters the risk profile, balancing anticipated revenue and earnings growth with higher fixed charges and greater execution pressure. Previous risks like market perception after index removals and substantial insider selling remain, but now investors must weigh the company’s ability to deploy its newly raised capital efficiently, especially in a competitive M&A environment, without overextending itself. Whether these shifts are a catalyst or a complication remains the central question. But watch closely: leveraging debt for growth can backfire if returns don't materialize as expected.

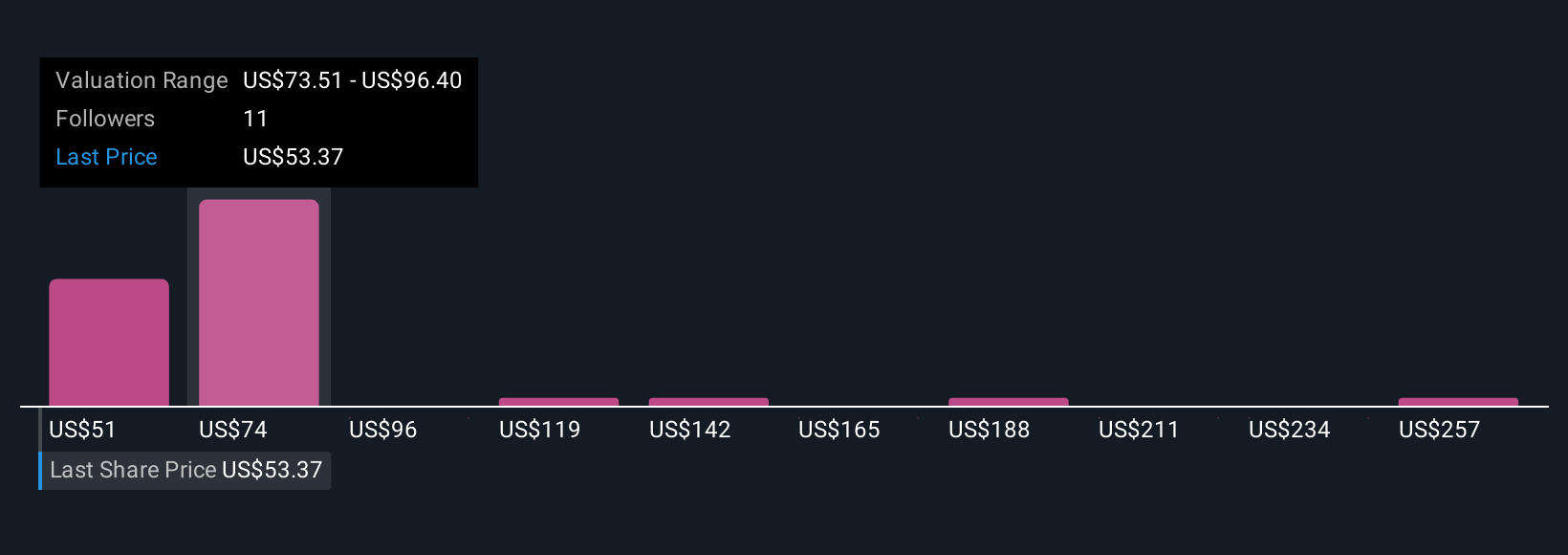

Atlanticus Holdings' shares are on the way up, but they could be overextended by 29%. Uncover the fair value now.Exploring Other Perspectives

Explore 5 other fair value estimates on Atlanticus Holdings - why the stock might be worth 23% less than the current price!

Build Your Own Atlanticus Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlanticus Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atlanticus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlanticus Holdings' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATLC

Atlanticus Holdings

A financial technology company, provides products and services to lenders in the United States.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives