- United States

- /

- Consumer Finance

- /

- NasdaqGM:ANTA

3 Growth Stocks With High Insider Ownership To Consider

Reviewed by Simply Wall St

As global markets react to geopolitical tensions and fluctuating oil prices, the major U.S. stock indices have faced significant volatility, with the Dow Jones Industrial Average recently experiencing a notable decline. In such uncertain times, growth companies with high insider ownership can offer potential stability and alignment of interests between management and shareholders, making them an attractive consideration for investors seeking resilience amidst market turbulence.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| OS Therapies (OSTX) | 23.2% | 13.4% |

| FTC Solar (FTCI) | 27.9% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Eagle Financial Services (EFSI) | 15.9% | 82.8% |

| Duolingo (DUOL) | 14.3% | 40% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.7% | 44.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Antalpha Platform Holding (ANTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Antalpha Platform Holding Company offers financing, technology, and risk management solutions to the crypto asset industry with a market cap of $275.58 million.

Operations: The company's revenue segment is primarily from Data Processing, amounting to $47.45 million.

Insider Ownership: 18.4%

Earnings Growth Forecast: 40.2% p.a.

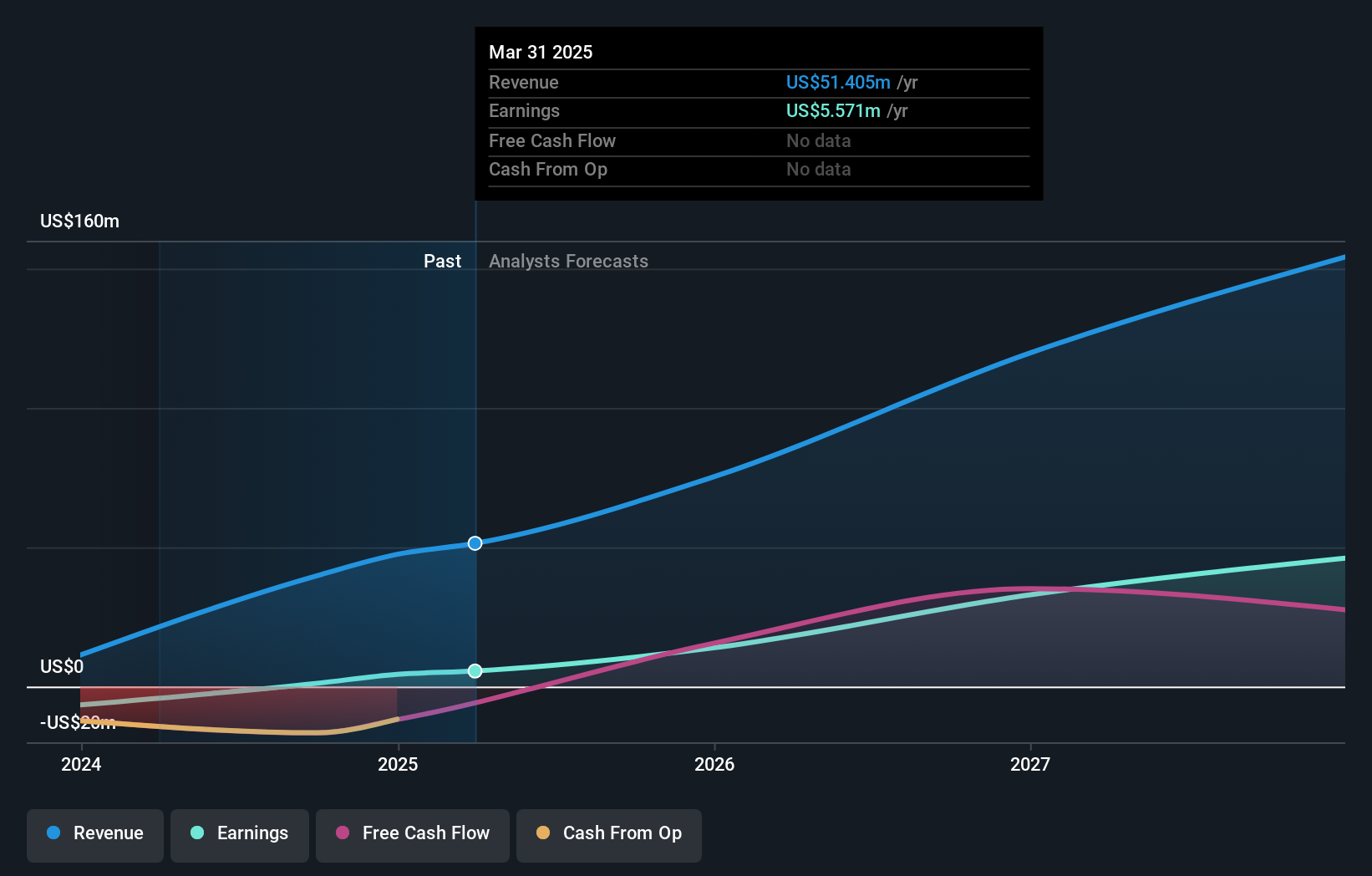

Antalpha Platform Holding, recently added to the NASDAQ Composite Index, is experiencing substantial growth with expected annual revenue and earnings increases of 24.6% and 40.2%, respectively, outpacing the US market. The company has completed a $49.28 million IPO and filed a $69.17 million shelf registration for ESOP-related offerings. Antalpha's strategic expansion into XAUt-collateralized loans and AI compute financing underscores its commitment to diversifying collateral options in digital asset lending despite illiquid shares and limited financial data availability.

- Click here to discover the nuances of Antalpha Platform Holding with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Antalpha Platform Holding's current price could be inflated.

Capital Bancorp (CBNK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capital Bancorp, Inc. is the bank holding company for Capital Bank, N.A., with a market capitalization of approximately $534.20 million.

Operations: The company's revenue is derived from three main segments: Opensky with $69.68 million, Commercial Bank contributing $99.97 million, and Capital Bank Home Loans (CBHL) generating $7.32 million.

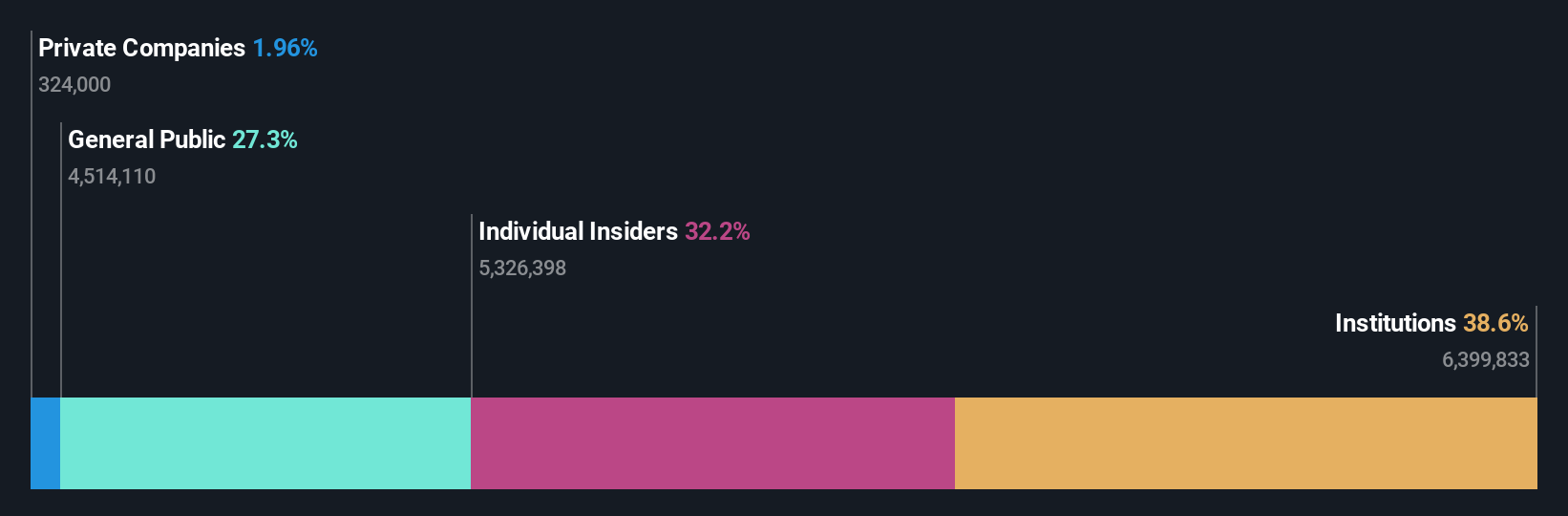

Insider Ownership: 32.2%

Earnings Growth Forecast: 23.3% p.a.

Capital Bancorp shows strong growth potential with forecasted earnings growth of 23.3% annually, outpacing the US market's 14.4%. Despite recent shareholder dilution, insider buying has been more frequent than selling over the past three months. The company reported significant earnings improvements for Q1 2025, with net income rising to US$13.93 million from US$6.56 million a year ago, and completed a modest share buyback valued at US$0.62 million in March 2025.

- Get an in-depth perspective on Capital Bancorp's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Capital Bancorp shares in the market.

Karman Holdings (KRMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Karman Holdings Inc., through its subsidiary, focuses on designing, testing, manufacturing, and selling mission-critical systems in the United States with a market cap of $6.08 billion.

Operations: The company's revenue is derived from the Space and Defense Industry, amounting to $362.37 million.

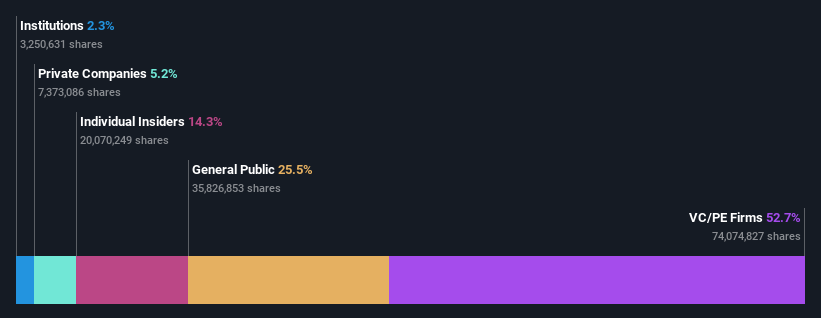

Insider Ownership: 14.8%

Earnings Growth Forecast: 59.2% p.a.

Karman Holdings is poised for significant growth, with earnings expected to increase by over 59% annually, surpassing the US market's average. Despite a recent net loss of US$4.8 million in Q1 2025, revenue rose to US$100.12 million from the previous year. The company recently secured a US$75 million term loan for strategic purposes and expanded its facilities in Decatur, Alabama, enhancing its capabilities in aerospace and defense solutions.

- Click to explore a detailed breakdown of our findings in Karman Holdings' earnings growth report.

- According our valuation report, there's an indication that Karman Holdings' share price might be on the expensive side.

Seize The Opportunity

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 195 companies by clicking here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ANTA

Antalpha Platform Holding

Provides financing, technology, and risk management solutions to the crypto asset industry.

High growth potential low.

Similar Companies

Market Insights

Community Narratives