- United States

- /

- Retail Distributors

- /

- NasdaqGS:AMRK

The total return for A-Mark Precious Metals (NASDAQ:AMRK) investors has risen faster than earnings growth over the last five years

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. For example, the A-Mark Precious Metals, Inc. (NASDAQ:AMRK) share price is up a whopping 404% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 17% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

In light of the stock dropping 6.3% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for A-Mark Precious Metals

SWOT Analysis for A-Mark Precious Metals

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Dividends are covered by earnings and cash flows.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Diversified Financial market.

- Good value based on P/E ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

- Annual earnings are forecast to decline for the next 3 years.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

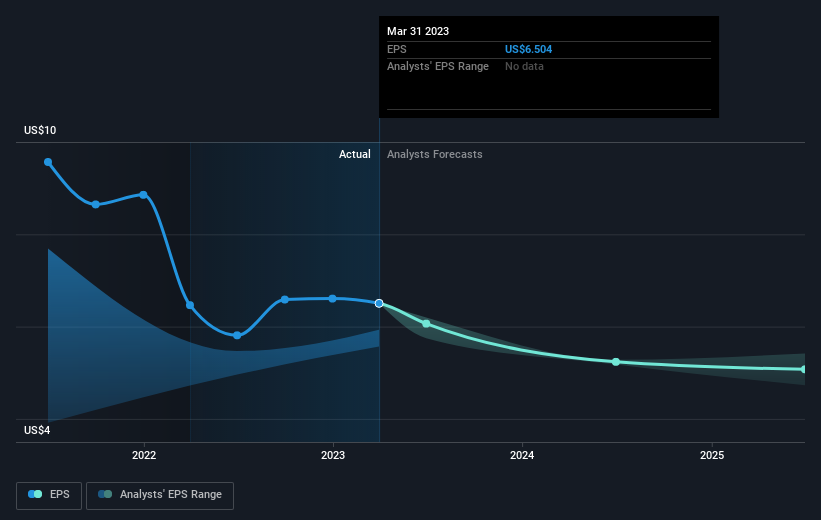

Over half a decade, A-Mark Precious Metals managed to grow its earnings per share at 154% a year. This EPS growth is higher than the 38% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.32.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of A-Mark Precious Metals' earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for A-Mark Precious Metals the TSR over the last 5 years was 504%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

A-Mark Precious Metals shareholders are down 8.5% for the year (even including dividends), but the market itself is up 2.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 43% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for A-Mark Precious Metals (2 are a bit concerning) that you should be aware of.

Of course A-Mark Precious Metals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade A-Mark Precious Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMRK

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives