- United States

- /

- Entertainment

- /

- NYSE:EB

AlTi Global And 2 Other US Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with the Dow Jones Industrial Average reaching record highs and the S&P 500 gaining for a sixth consecutive day, investors are exploring various opportunities to capitalize on this momentum. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain an intriguing area of investment. These stocks can offer surprising value and potential growth when backed by solid financial foundations, making them worth considering in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.79 | $6.1M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.29B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2376 | $8.57M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.40 | $557.36M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8999 | $80.04M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $4.08 | $445.26M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

AlTi Global (NasdaqCM:ALTI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AlTi Global, Inc. offers wealth and asset management services to individuals, families, foundations, and institutions across the United States, the United Kingdom, and internationally with a market cap of approximately $403.79 million.

Operations: AlTi Global's revenue is primarily derived from its Wealth & Capital Solutions segment, which generated $148.11 million, and its International Real Estate segment, contributing $98.72 million.

Market Cap: $403.79M

AlTi Global, Inc. demonstrates a solid financial position with short-term assets of US$306.4 million exceeding both short and long-term liabilities, indicating strong liquidity. Despite being unprofitable with a net loss of US$68.64 million in Q3 2024, the company reported revenue growth to US$53.34 million from the previous year’s US$48.19 million, showcasing potential in its Wealth & Capital Solutions segment and International Real Estate operations. However, significant insider selling and an inexperienced management team may raise concerns about internal confidence and strategic direction moving forward in this volatile penny stock environment.

- Click to explore a detailed breakdown of our findings in AlTi Global's financial health report.

- Evaluate AlTi Global's prospects by accessing our earnings growth report.

TrueCar (NasdaqGS:TRUE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TrueCar, Inc. is a U.S.-based company providing internet-based information, technology, and communication services with a market cap of $367.83 million.

Operations: The company generates revenue of $170.68 million from its Internet Information Providers segment.

Market Cap: $367.83M

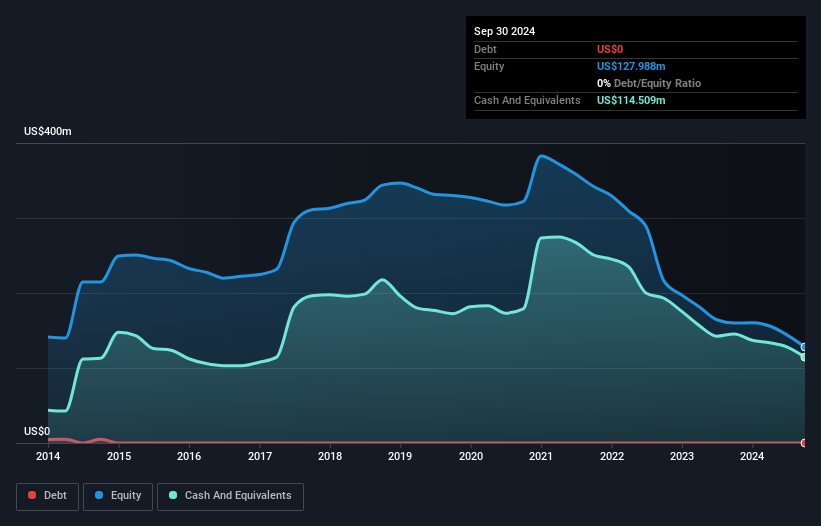

TrueCar, Inc. is navigating the penny stock landscape with a market cap of US$367.83 million and revenue of US$170.68 million from its Internet Information Providers segment, despite ongoing unprofitability and a negative return on equity of -21.17%. Recent earnings show improved sales at US$46.54 million for Q3 2024 compared to the previous year, though net losses persist at US$5.83 million for the quarter. The company remains debt-free with short-term assets covering liabilities comfortably, while takeover rumors could influence future strategic directions amid stable weekly volatility and a sufficient cash runway exceeding three years.

- Take a closer look at TrueCar's potential here in our financial health report.

- Explore TrueCar's analyst forecasts in our growth report.

Eventbrite (NYSE:EB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eventbrite, Inc. operates a two-sided marketplace offering self-service ticketing and marketing tools for event creators globally, with a market cap of approximately $349.74 million.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $336.37 million.

Market Cap: $349.74M

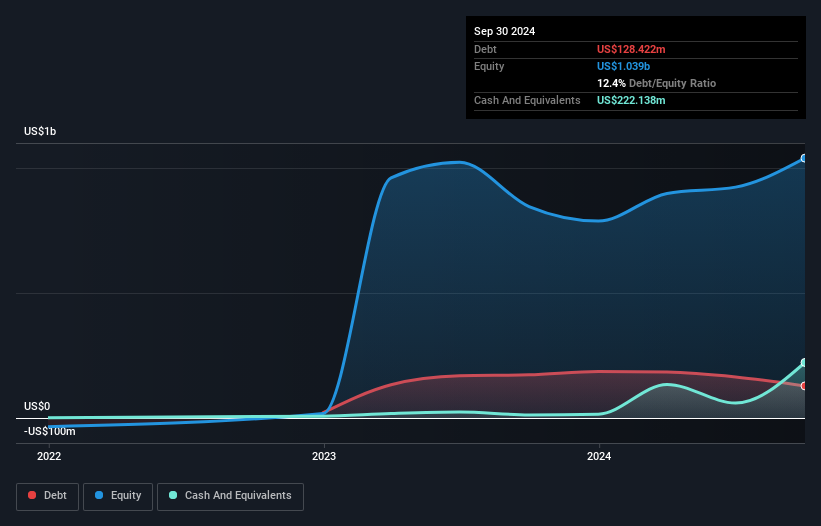

Eventbrite, Inc. is positioned within the penny stock arena with a market cap of US$349.74 million and revenue of US$336.37 million from its Internet Software & Services segment. Despite unprofitability and a negative return on equity of -4.52%, the company has reduced losses over the past five years by 37.6% annually, reflecting some positive momentum in financial performance. Recent executive changes include Anand Gandhi's appointment as CFO, potentially strengthening financial leadership amid ongoing strategic shifts. The company's short-term assets exceed both short-term and long-term liabilities, ensuring a stable cash runway for over three years despite insider selling activity recently noted.

- Jump into the full analysis health report here for a deeper understanding of Eventbrite.

- Learn about Eventbrite's future growth trajectory here.

Taking Advantage

- Take a closer look at our US Penny Stocks list of 720 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eventbrite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EB

Eventbrite

Operates a two-sided marketplace that provides self-service ticketing and marketing tools for event creators in the United States and internationally.

Good value with adequate balance sheet.