- United States

- /

- Mortgage REITs

- /

- NasdaqGS:AGNC

Is AGNC Set for More Gains After Three-Year 99% Surge?

Reviewed by Bailey Pemberton

If you are wondering what to do with AGNC Investment right now, you are not alone. This stock has been top of mind for both income-focused investors and those looking for signs of value, especially after some big price swings in recent years. Let’s start with the most eye-catching number: AGNC’s shares are up nearly 99% over the past three years. That’s a remarkable run, especially when you consider that the real estate and mortgage space has seen its share of turbulence. Even though the stock has slipped a little in the past week (down 0.8%) and month (down 2.1%), it’s still sitting on solid year-to-date gains of 6.9% and a strong 10.3% return over the past year. The growth isn’t just a fluke either, as investors are starting to rethink risk in this corner of the market, particularly as interest rates and monetary policy continue to drive big moves in mortgage REITs like AGNC Investment.

But is AGNC Investment actually undervalued, or has the recent price run left it looking less attractive? When you break it down using six key valuation checks, the company scores a 3, meaning it’s undervalued in half of them. That’s far from a value trap, but not a slam dunk either. In the next section, we’ll unpack each of these valuation approaches, weighing where AGNC looks like a bargain and where the numbers call for caution. And as we dig deeper, I’ll share the lens that investors often miss when judging whether a stock’s truly undervalued.

Approach 1: AGNC Investment Excess Returns Analysis

The Excess Returns model evaluates how much profit a company generates above its cost of equity, focusing on the efficiency of its invested capital. For AGNC Investment, this approach asks whether the business consistently delivers more for shareholders than it costs to finance its equity. This can signal a strong long-term value proposition.

Based on recent data, AGNC Investment holds a Book Value of $8.36 per share and is projected to achieve a stable Earnings Per Share (EPS) of $1.64, according to consensus estimates from six analysts. The company’s Cost of Equity is $0.90 per share, while the Excess Return, the amount by which returns exceed that cost, is $0.74 per share. Its average Return on Equity is a robust 18.37%, and its Stable Book Value is projected at $8.90 per share, as estimated by five analysts. This strong return on invested capital highlights AGNC’s capacity to earn persistently above-average profits.

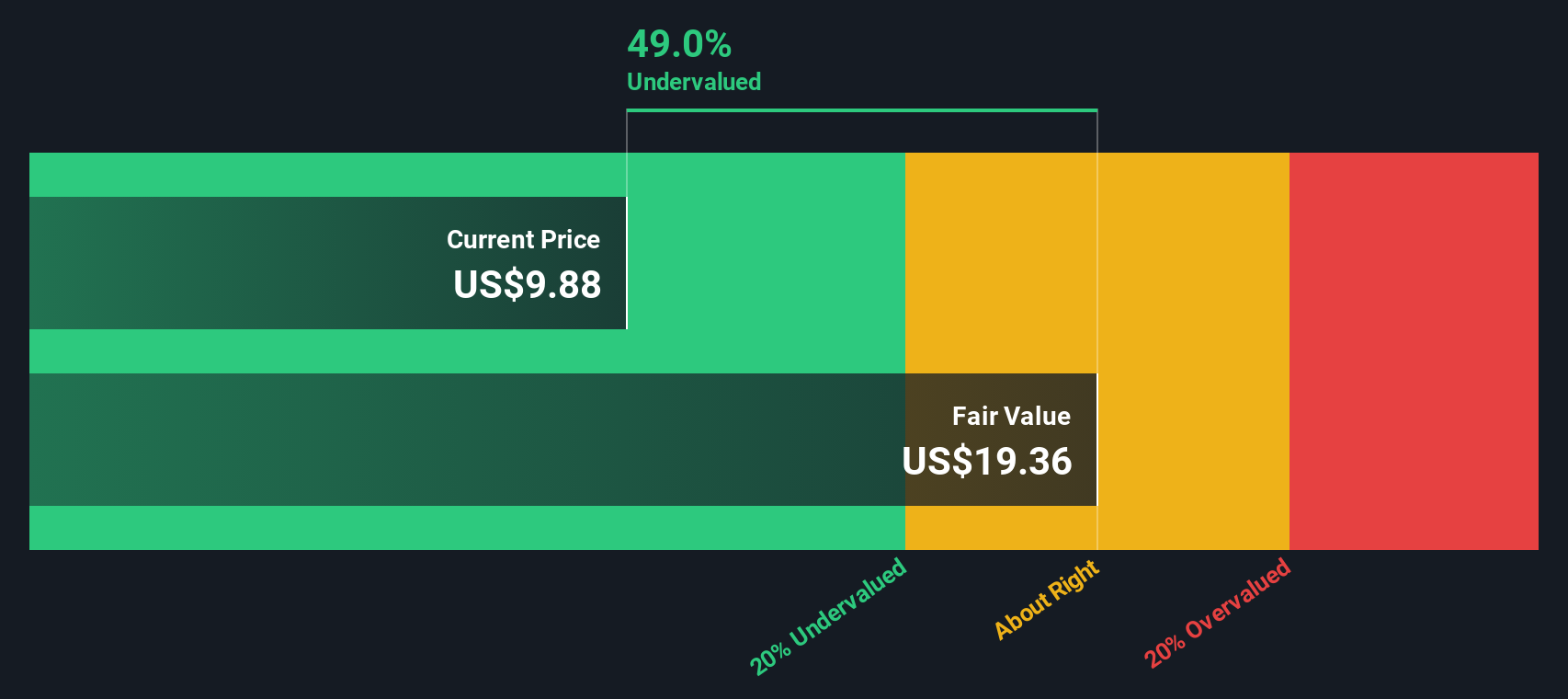

The Excess Returns model estimates AGNC’s intrinsic value at $19.51 per share. Given that this is 49.2% above the current market price, the stock appears significantly undervalued according to this metric.

Result: UNDERVALUED

Our Excess Returns analysis suggests AGNC Investment is undervalued by 49.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

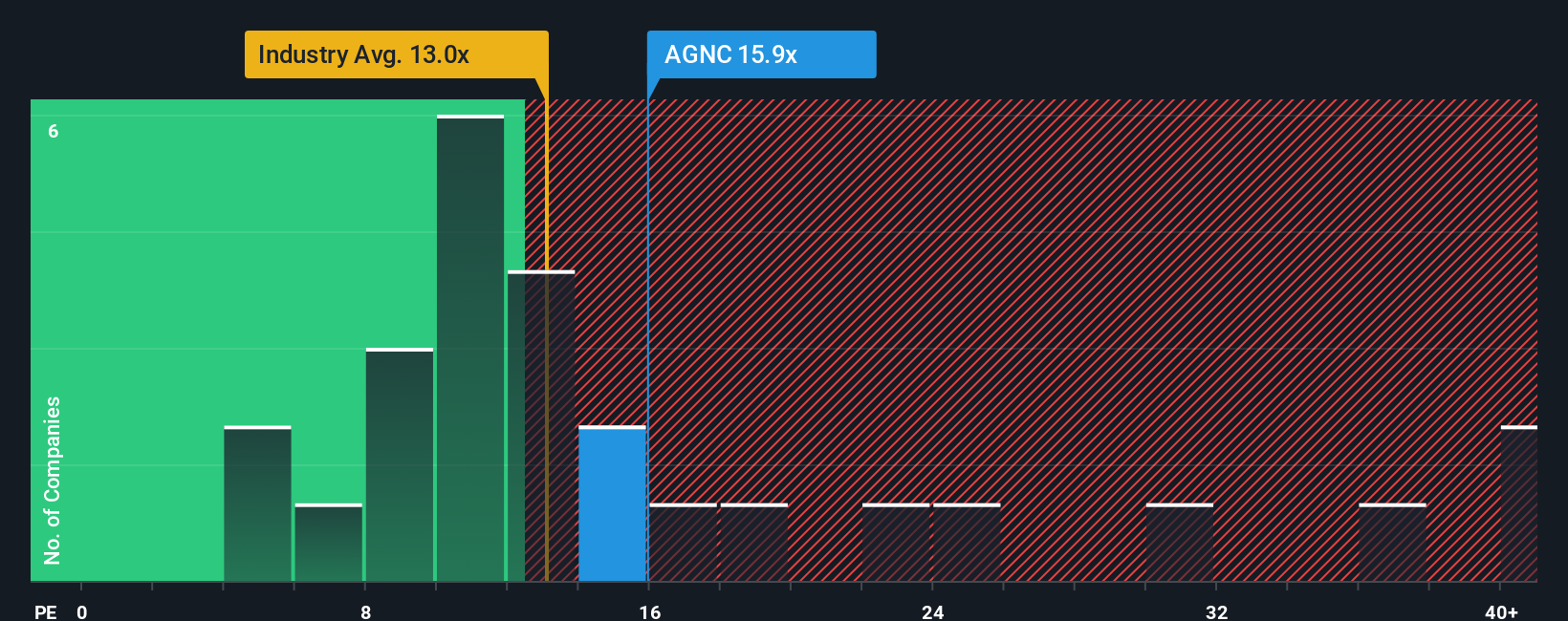

Approach 2: AGNC Investment Price vs Earnings

For companies like AGNC Investment that are consistently profitable, the Price-to-Earnings (PE) ratio is a widely used and effective metric. The PE ratio allows investors to assess how much they are paying for each dollar of a company’s earnings, making it a straightforward gauge of relative value. Growth expectations and perceived risk both weigh heavily on what investors view as a “normal” or “fair” PE. Rapidly growing companies or those with more resilient earnings can often justify a higher PE, whereas more volatile or lower-growth companies typically trade at lower multiples.

Currently, AGNC Investment trades at a PE ratio of 43.8x. This is significantly higher than the mortgage REIT industry average of 12.8x and also tops the peer average of 49.1x, though not by much. However, headline numbers do not tell the full story. AGNC’s “Fair Ratio,” as calculated by Simply Wall St, is 25.8x. The Fair Ratio goes beyond basic comparisons by reflecting the company’s unique earnings growth profile, profit margins, industry trends, market capitalization, and specific risks. As such, it gives a more nuanced and accurate sense of what multiple is justified for AGNC today.

Given that AGNC’s actual PE of 43.8x sits notably above its Fair Ratio of 25.8x, the stock appears overvalued on an earnings basis according to this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AGNC Investment Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about AGNC Investment, capturing your beliefs about where the company is headed and combining them with your own assumptions for future revenue, profit margins, and fair value. Instead of only relying on past numbers, Narratives link the company’s big picture to a personalized financial forecast and a dynamic estimate of fair value. This approach makes investing more accessible and hands-on, and it is available right now on Simply Wall St’s Community page where millions of investors create and follow Narratives every day.

With a Narrative, you can quickly compare your view of AGNC’s fair value to its current share price, making buy or sell decisions feel more grounded. The best part is that Narratives update automatically as soon as new information, like earnings or news, becomes available, allowing your perspective to adapt in real time. For AGNC, for instance, the highest community Narrative currently sees a price target of $11.00, anticipating strong margin improvement and revenue growth, while the lowest expects just $8.25, reflecting more cautious assumptions about interest rate risks and policy uncertainty.

Do you think there's more to the story for AGNC Investment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGNC

AGNC Investment

Provides private capital to housing market in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives