- United States

- /

- Mortgage REITs

- /

- NasdaqGS:AGNC

A Fresh Look at AGNC Investment's (AGNC) Valuation as Rate Cut Prospects Drive New Investor Interest

Reviewed by Kshitija Bhandaru

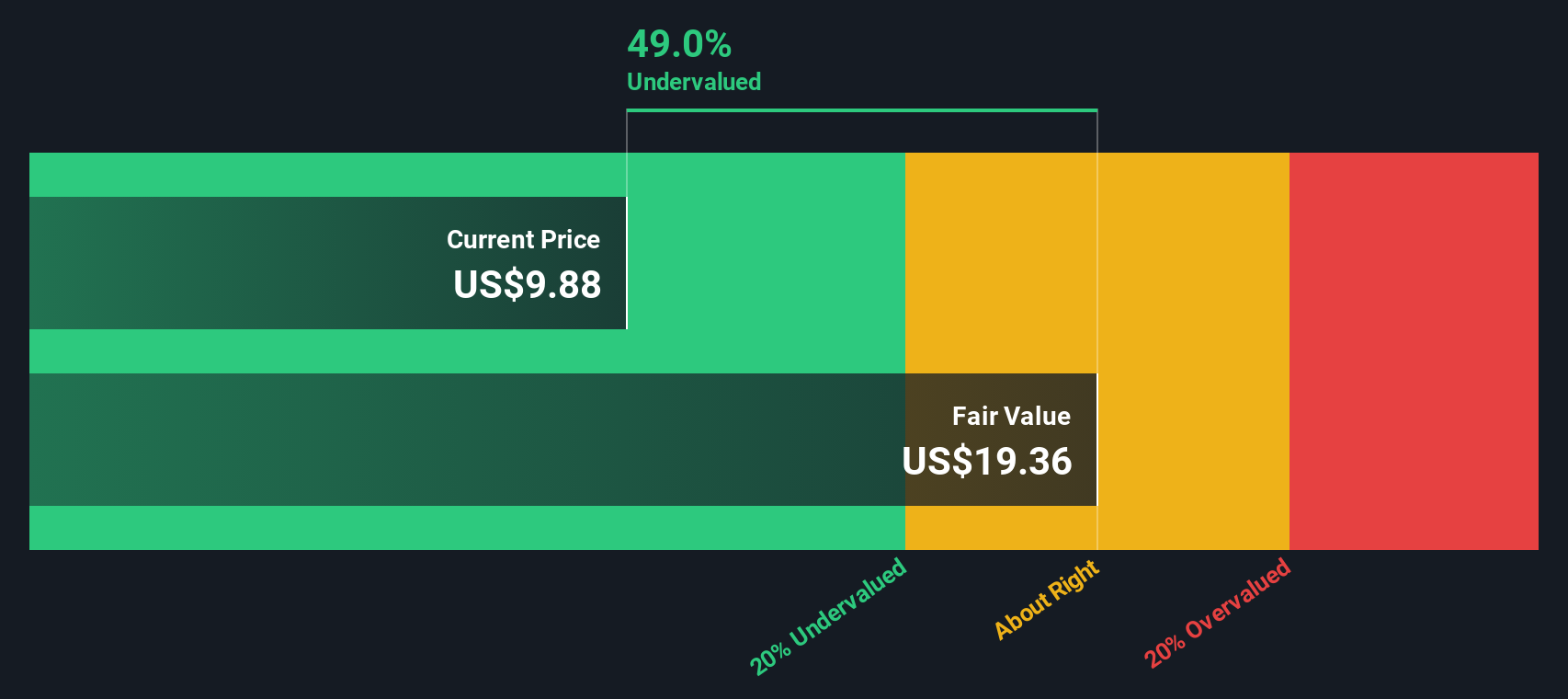

AGNC Investment (AGNC) has come back into focus as markets weigh the likelihood of rate cuts, which could lower the company’s borrowing costs and boost its profitability. Investors are watching closely with earnings just around the corner.

See our latest analysis for AGNC Investment.

AGNC Investment’s share price has seen a mix of minor moves lately, but investors are eyeing momentum as the company holds steady near $10, with the prospect of rate cuts on the horizon. In the longer term, its 1-year total shareholder return of 13% confirms the stock’s appeal for income-focused investors even with occasional volatility.

If news about potential rate cuts got your attention, this might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Given AGNC’s strong dividend track record and the potential for rate cuts to improve profitability, is the market underestimating its value? Or has Wall Street already fully priced in future growth prospects, leaving little room for a bargain?

Most Popular Narrative: 90% Overvalued

The most widely followed narrative places AGNC Investment's fair value far below its last close price, painting a cautionary picture as to whether recent optimism is justified. Analysts have pieced together future earnings projections, margin expectations, and a long-term discount rate to reach this figure.

The Fed's accommodative monetary policy and declining inflationary pressures have reduced interest rate volatility and steepened the yield curve. This environment may enhance AGNC's revenue and earnings, as stable interest rates can improve the predictability of returns on mortgage-backed securities. The supply and demand outlook for Agency MBS is expected to be well balanced in 2025, with potential positive surprises from bank demand due to less onerous regulation. This could support revenue growth and stabilization of earnings by maintaining attractive investment yields.

Want to know what powers this sky-high valuation call? Learn which bold analyst projections for revenue growth, earnings margin, and future multiples underlie the narrative’s numbers. The surprising assumptions may challenge your expectations. Discover the ingredients behind this headline fair value in the full narrative.

Result: Fair Value of $5.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing interest rate volatility and uncertainty around U.S. fiscal policy could quickly undermine the assumptions supporting this optimistic outlook for AGNC.

Find out about the key risks to this AGNC Investment narrative.

Another View: Discounted Cash Flow Tells a Different Story

While analyst price targets lean cautious, our DCF model paints a much more optimistic picture. According to this valuation approach, AGNC shares are trading at a steep discount to their estimated fair value. Does this gap signal opportunity, or is it a warning about the risks behind the assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AGNC Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AGNC Investment Narrative

If the current outlook doesn’t fit your view, or you want to chart your own path, you can run your own analysis in just a few minutes, and Do it your way.

A great starting point for your AGNC Investment research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities rarely wait. Get ahead by using the Simply Wall Street Screener to uncover stocks that match your strategy before the crowd catches on.

- Unlock hidden potential by checking out these 896 undervalued stocks based on cash flows for companies trading below their real worth based on future cash flows.

- Stay ahead in the tech race by pinpointing these 24 AI penny stocks with game-changing artificial intelligence innovations that are powering tomorrow’s industries.

- Reap reliable returns by browsing these 19 dividend stocks with yields > 3% with attractive yields for steady income in any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGNC

AGNC Investment

Provides private capital to housing market in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives