- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Surge in Big-Money Options Trades Could Be a Game Changer for Affirm Holdings (AFRM)

Reviewed by Sasha Jovanovic

- In recent weeks, Affirm Holdings attracted heightened interest from institutional investors, as evidenced by a surge in unusual options trades and a mixture of bullish and bearish positions among large capital players.

- This activity has coincided with upward revisions to earnings estimates and sustained analyst optimism, reflecting market anticipation of strong earnings delivery following consistent past outperformance of consensus expectations.

- We'll explore how signs of increased large investor activity might influence Affirm's future growth narrative and market outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Affirm Holdings Investment Narrative Recap

Affirm Holdings appeals to investors who believe in the continued expansion of buy-now-pay-later services, ongoing merchant adoption, and the strength of its technology platform. While recent institutional options trading has captured attention, the most important short-term catalyst remains Affirm’s ability to maintain revenue growth amid the holiday season, especially with the loss of a major enterprise merchant looming, a risk that still overshadows near-term positive sentiment and was not impacted by this news event.

Among recent company announcements, Affirm’s Q1 FY2026 earnings stand out: the company reported a sharp year-over-year revenue rise alongside a swing to profitability. This financial turnaround is particularly relevant given market focus on sustained earnings momentum, as highlighted by upward revisions to earnings estimates. Investors focused on growth catalysts may view these results as a foundation for Affirm’s ongoing efforts to offset upcoming headwinds, but...

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings' outlook anticipates $6.0 billion in revenue and $756.6 million in earnings by 2028. This projection requires 22.9% annual revenue growth and an increase in earnings of $704.4 million from the current $52.2 million.

Uncover how Affirm Holdings' forecasts yield a $96.14 fair value, a 40% upside to its current price.

Exploring Other Perspectives

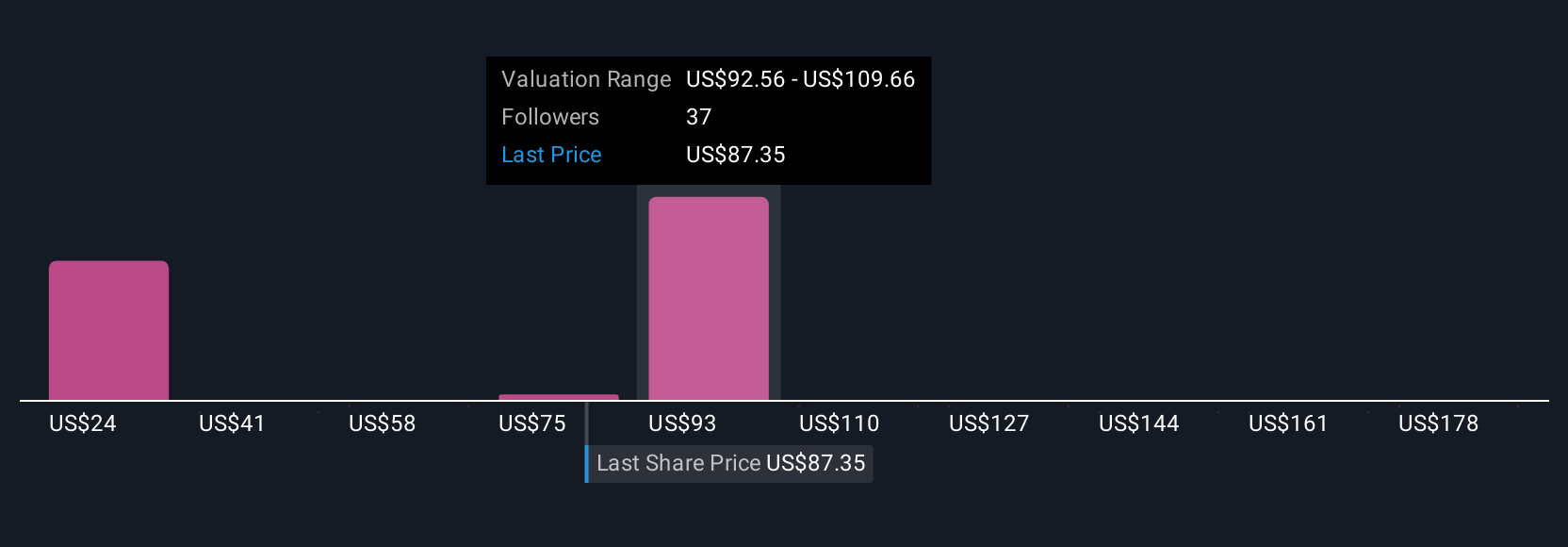

Fair value estimates from 19 Simply Wall St Community members run from US$25.09 to US$140 per share. While projections for accelerated earnings growth underpin optimistic outlooks, some market participants remain focused on the risk of lost merchant partnerships and its effect on revenue concentration, making it essential for you to compare these viewpoints before making any decisions.

Explore 19 other fair value estimates on Affirm Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success