- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM): Evaluating Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Affirm Holdings.

Momentum has been gathering steadily for Affirm Holdings, with the latest jump adding to a year marked by strong sentiment shifts. The 1-year total shareholder return of 44% highlights that optimism goes beyond just short-term trading. The stock’s latest move suggests investors are starting to see signs of growth potential take hold.

If this kind of momentum has you curious about other opportunities, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership.

With Affirm’s strong returns and renewed momentum, the key question is whether its current valuation leaves room for upside, or if investors have already priced in all of its future growth potential.

Most Popular Narrative: 17.9% Undervalued

Affirm Holdings is trading at $78.95 while the most widely followed narrative places its fair value much higher. This suggests investors breaking down the latest numbers may see substantial room to run. What exactly is fueling their optimism?

Affirm's differentiated technology and underwriting, evidenced by the success with 0% APR loans and high user repeat rates, should improve customer lifetime value and reduce credit losses. This supports enhanced net margins and sustained earnings as more users graduate to interest-bearing products. Rapid growth and strong engagement with Affirm Card, an actively invested product moving toward high attach rates and greater offline usage, expands Affirm's addressable market beyond online retail, diversifies revenue streams, and drives higher frequency of transactions. This should accelerate GMV and contribute to margin improvement.

Want to understand the bold math behind this bullish call? The real secret driving this valuation is a set of ambitious financial targets, projecting a leap in profits and top-line growth that would be the envy of nearly any fintech. Which financial assumptions unlock this much upside? Click through to see which numbers are making analysts bet big on Affirm.

Result: Fair Value of $96.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks that could upset this outlook, such as losing key merchant partners or facing increased competition in digital lending.

Find out about the key risks to this Affirm Holdings narrative.

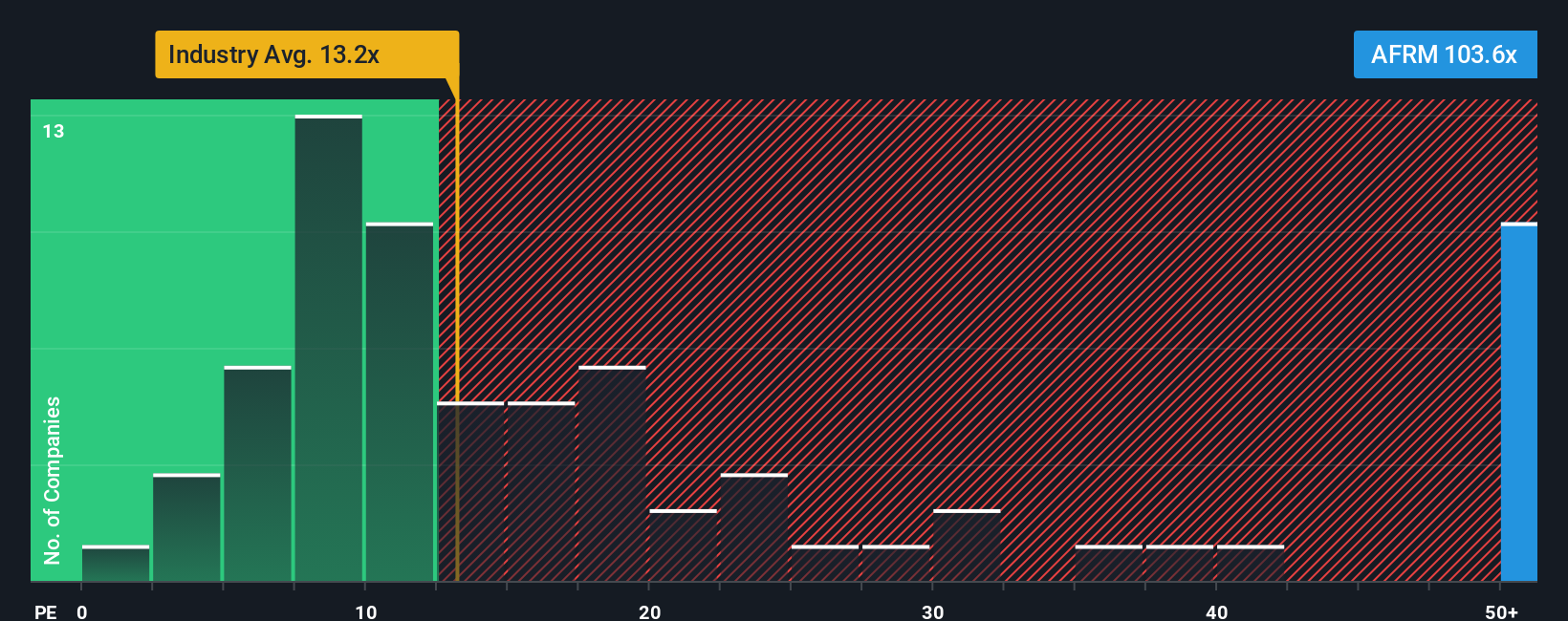

Another View: Price-to-Earnings Tells a Different Story

Looking through the lens of price-to-earnings, Affirm appears far more expensive than its peers and the broader industry. Its current ratio stands at 111.8x, compared to an industry average of 13.3x and a peer average of 30.6x. The fair ratio, a potential market normalization point, is even lower at 36.4x. For investors, this wide gulf suggests there is valuation risk if the market cools on future growth expectations. Could the sentiment shift just as quickly in the other direction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you have your own take or want to investigate the numbers firsthand, you can easily craft a personal Affirm narrative in just a few minutes. Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Seize More High-Potential Opportunities?

Set your sights higher and gain an edge by tracking investment ideas most investors overlook. Don’t miss out on trends shaping tomorrow’s winners. Take action today.

- Unlock powerful long-term income streams and evaluate companies with strong yields as you browse these 14 dividend stocks with yields > 3% offering more than 3% returns.

- Tap into the AI boom by spotting businesses poised for significant growth. Explore these 27 AI penny stocks making real-world breakthroughs in artificial intelligence.

- Catch promising market mispricings early by tracking these 880 undervalued stocks based on cash flows, where deep value and future upside converge with the support of hard data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives