- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

A Look at Affirm (AFRM) Valuation Following Major Partnerships With Wayfair, Worldpay, and Fanatics

Reviewed by Simply Wall St

Affirm Holdings (AFRM) has just struck a series of new partnerships with Worldpay, Wayfair, Fanatics, and FreshBooks. This move expands its buy-now-pay-later offering across major software and retail platforms. These integrations come as the holiday shopping season approaches.

See our latest analysis for Affirm Holdings.

A wave of these high-profile partnerships has come just as investors have started to bet on Affirm’s ability to scale. After a volatile year marked by both executive share sales and upbeat sector news, the stock’s momentum is building. With a 21% share price return year-to-date and an impressive 77% total shareholder return over the past year, sentiment is shifting on the company’s growth prospects.

If you want to spot what other tech-enabled disruptors are gathering steam, check out See the full list for free..

With the stock up strongly over the past year, the key question for investors now is whether Affirm’s recent partnerships and growth are already reflected in its share price or if there is still untapped upside left to capture.

Most Popular Narrative: 21% Undervalued

Affirm Holdings’ most followed narrative points to a fair value of $96.31, which is significantly above the latest closing price of $75.92. This sets the stage for a closer look at the assumptions powering such a high upside potential.

“Affirm’s embrace of point-of-sale and wallet integrations (such as with Stripe Terminal and other PSPs) unlocks large untapped offline retail and cross-platform opportunities. This aligns Affirm’s growth trajectory with broader industry trends in digitization and embedded finance, with a probable positive impact on future revenue scalability and market share.”

Curious about why this narrative commands such a strong premium? The foundations rest on bullish projections for revenue growth, expanding profit margins, and a future profit multiple that would make even industry leaders envious. The full story behind these bold forecasts awaits in the complete narrative.

Result: Fair Value of $96.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the loss of a major partner or a sharper than expected slowdown in consumer spending could quickly change Affirm’s growth trajectory and valuation outlook.

Find out about the key risks to this Affirm Holdings narrative.

Another View: The Market’s Pricing Signals

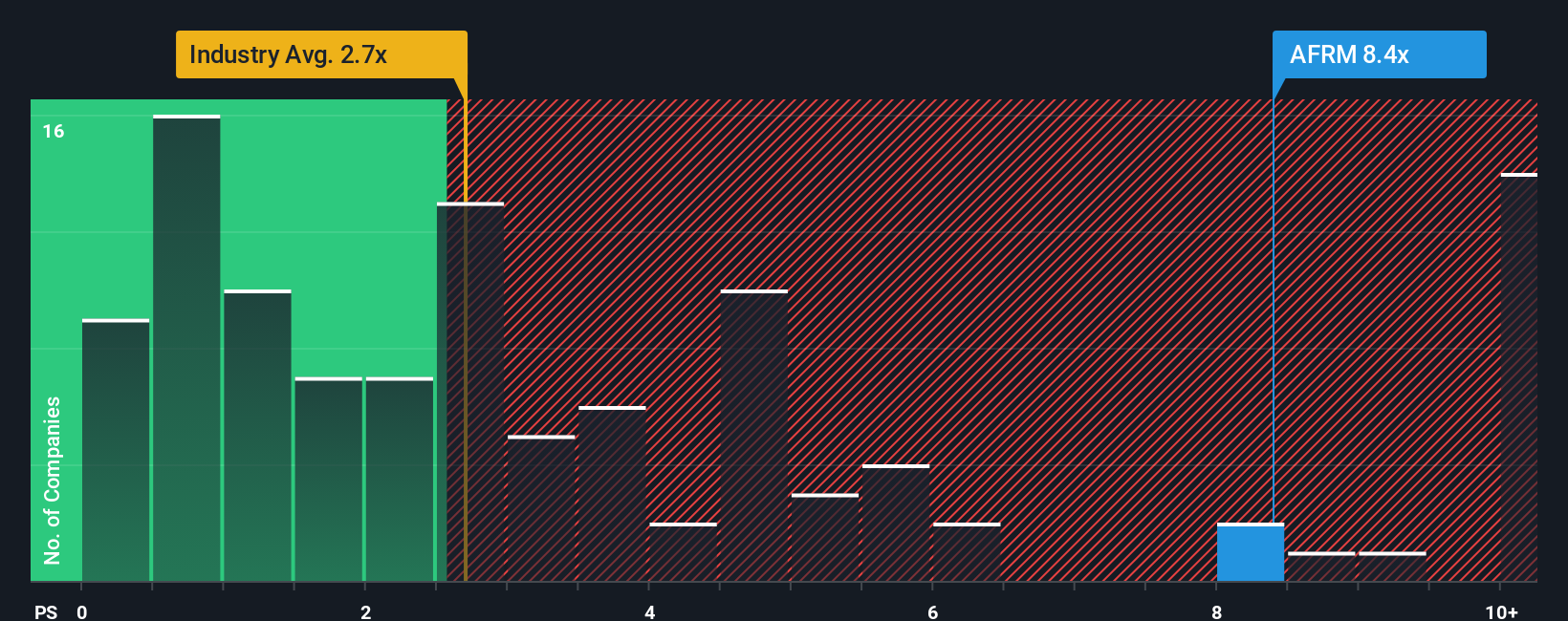

While analyst forecasts see Affirm Holdings as undervalued, a different approach using its price-to-sales ratio tells a more cautious story. Affirm is currently valued at 7.7 times sales, which is well above both the peer average of 3.9 and the industry benchmark of 2.5. The fair ratio, what the market could eventually price in, is just 4.3.

This gap signals that current optimism might be driving the stock further ahead than its fundamentals suggest. Will investors continue to pay a premium, or could a shift in sentiment quickly narrow the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you want to take a different view or prefer diving into the numbers yourself, you can build your own custom narrative for Affirm Holdings in just a few minutes, and Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve and uncover fresh opportunities beyond Affirm Holdings. These standout screening tools can help you find stocks shaking up their industries today:

- Unlock high-potential growth by starting your search with these 3575 penny stocks with strong financials. These are poised for breakout performance and market-defying results.

- Boost your income while investing smartly by checking out these 21 dividend stocks with yields > 3%. These offer yields above 3% and robust fundamentals for long-term stability.

- Catch the wave in advanced computing by jumping into these 28 quantum computing stocks. These are set to benefit from breakthroughs in quantum technology and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives