Stock Analysis

- United States

- /

- Mortgage REITs

- /

- NasdaqGM:AFCG

3 High Insider Ownership US Growth Companies With At Least 14% Revenue Growth

Reviewed by Simply Wall St

As U.S. markets exhibit resilience with the S&P 500 marking its fifth consecutive week of gains, investors are keenly observing shifts in consumer inflation expectations and Federal Reserve policies. In this context, growth companies with high insider ownership present a compelling narrative, as such firms often demonstrate alignment between management’s interests and shareholder value, potentially offering stability amidst economic fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 24.4% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 27.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

| ZKH Group (NYSE:ZKH) | 17.7% | 102.8% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

| Establishment Labs Holdings (NasdaqCM:ESTA) | 11.2% | 68.2% |

We'll examine a selection from our screener results.

AFC Gamma (NasdaqGM:AFCG)

Simply Wall St Growth Rating: ★★★★☆☆

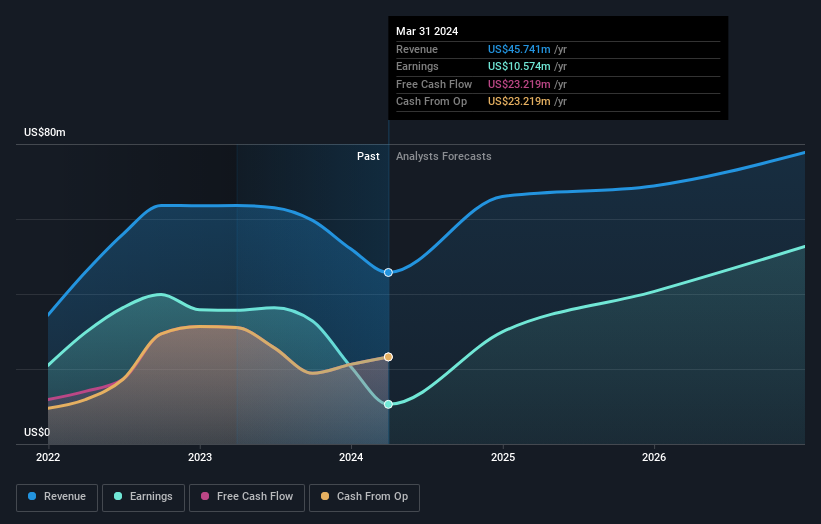

Overview: AFC Gamma, Inc. specializes in providing senior secured loans and other debt solutions to established companies in the cannabis industry, with a market capitalization of approximately $254.21 million.

Operations: The company generates revenue primarily through the provision of financing solutions, including senior secured loans, totaling $45.74 million.

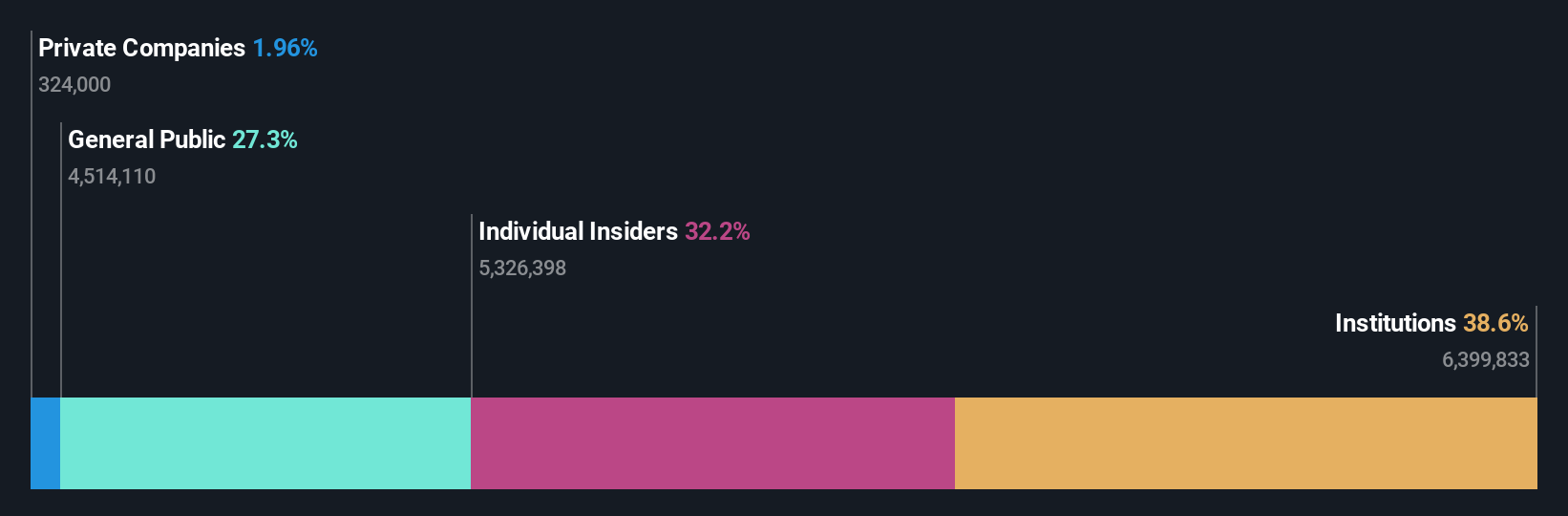

Insider Ownership: 18.9%

Revenue Growth Forecast: 14.2% p.a.

AFC Gamma, Inc. is experiencing significant growth with its earnings expected to increase by 26.34% annually, outpacing the US market's forecast of 14.6%. Despite this promising outlook, the company's recent financial performance raises concerns; it reported a net loss in Q1 2024 and its high dividend yield of 15.7% is not sufficiently covered by earnings or cash flows, indicating potential sustainability issues. Furthermore, AFC Gamma's profit margins have decreased from last year, and it trades at a substantial discount to estimated fair value. On the operational front, AFC Gamma has expanded its business footprint through strategic debt financing to support Grön Holdings' expansion into new states.

- Take a closer look at AFC Gamma's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that AFC Gamma is priced higher than what may be justified by its financials.

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capital Bancorp, Inc., functioning as the holding company for Capital Bank, N.A., has a market capitalization of approximately $288.96 million.

Operations: Capital Bancorp's revenue segments include Opensky at $70.61 million, Corporate at $3.04 million, Commercial Bank at $77.57 million, and Capital Bank Home Loans (CBHL) at $5.18 million.

Insider Ownership: 34.9%

Revenue Growth Forecast: 22.5% p.a.

Capital Bancorp, with high insider ownership, is poised for robust growth, forecasting a 22.5% annual revenue increase and 26.1% earnings growth—both well above market averages. Recent strategic moves include the expansion of its Charleston branch and the appointment of industry veterans like Jim Witty to drive sector-specific initiatives. However, its dividend track record remains unstable, and there's no recent data on insider trading activity which could indicate confidence levels among insiders.

- Click here to discover the nuances of Capital Bancorp with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Capital Bancorp's current price could be quite moderate.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★★

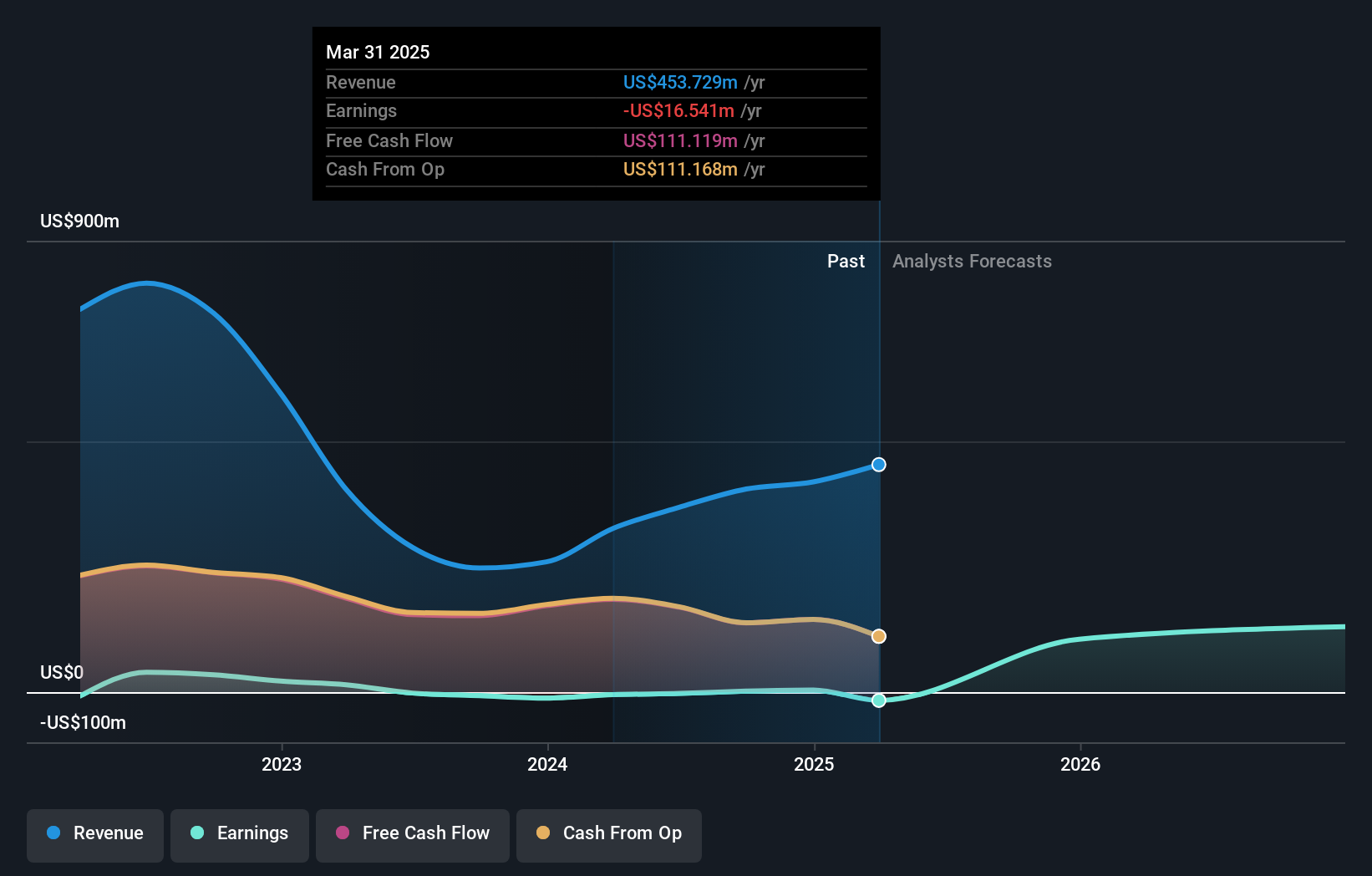

Overview: Bridge Investment Group Holdings Inc. operates in the real estate investment management sector in the United States, with a market capitalization of approximately $954.57 million.

Operations: The company generates its revenue primarily through its role as a fully integrated real estate investment manager, amounting to $326.32 million.

Insider Ownership: 11.6%

Revenue Growth Forecast: 23.7% p.a.

Bridge Investment Group Holdings has demonstrated significant growth, with a recent earnings report showing a substantial increase in net income and basic earnings per share. Despite this, the company is trading at 70.4% below its estimated fair value and has experienced shareholder dilution over the past year. It also carries a high level of debt which could impact future performance. However, revenue is expected to grow at 23.7% annually, outpacing the US market forecast of 8.4%, with profitability anticipated within three years.

- Dive into the specifics of Bridge Investment Group Holdings here with our thorough growth forecast report.

- Our expertly prepared valuation report Bridge Investment Group Holdings implies its share price may be lower than expected.

Taking Advantage

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 174 more companies for you to explore.Click here to unveil our expertly curated list of 177 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AFCG

AFC Gamma

AFC Gamma, Inc. originates, structures, underwrites, and invests in senior secured loans, and other various commercial real estate loans and debt securities for established companies operating in the cannabis industry.

Reasonable growth potential with mediocre balance sheet.