- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACTG

Some Shareholders Feeling Restless Over Acacia Research Corporation's (NASDAQ:ACTG) P/S Ratio

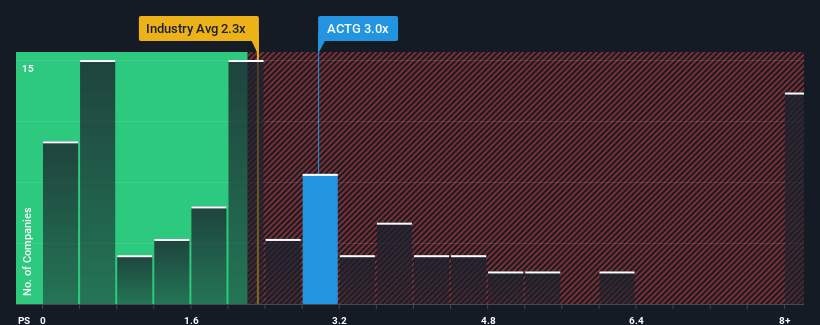

When you see that almost half of the companies in the Diversified Financial industry in the United States have price-to-sales ratios (or "P/S") below 2.3x, Acacia Research Corporation (NASDAQ:ACTG) looks to be giving off some sell signals with its 3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Acacia Research

How Acacia Research Has Been Performing

While the industry has experienced revenue growth lately, Acacia Research's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Acacia Research's future stacks up against the industry? In that case, our free report is a great place to start.How Is Acacia Research's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Acacia Research's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next year should generate growth of 4.3% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 8.3% growth forecast for the broader industry.

With this information, we find it concerning that Acacia Research is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Acacia Research's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Acacia Research, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Acacia Research has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ACTG

Acacia Research

Operates as an acquirer and operator of businesses across industrial, energy, and technology sectors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026