- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:HFFG

HF Foods Group Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a recent tech rout, investors are increasingly seeking opportunities beyond the well-trodden paths of large-cap stocks. Penny stocks, despite their somewhat outdated moniker, continue to hold relevance as they represent smaller or newer companies with potential for significant growth. These investments can offer hidden value when backed by strong financials, and this article will explore three such penny stocks that demonstrate balance sheet resilience and long-term potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.75 | $377.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $603.98M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.38 | $731.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.93 | $56.46M | ✅ 5 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.945 | $246.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.08 | $25.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.75 | $1.06B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.90 | $6.63M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.08 | $67.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 369 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

HF Foods Group (HFFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HF Foods Group Inc., with a market cap of $119.35 million, operates as a marketer and distributor of specialty food products, seafood, fresh produce, frozen and dry food, and non-food products to Asian restaurants and other foodservice customers in the United States.

Operations: The company generates revenue primarily through the sale of food and non-food products, amounting to $1.22 billion.

Market Cap: $119.35M

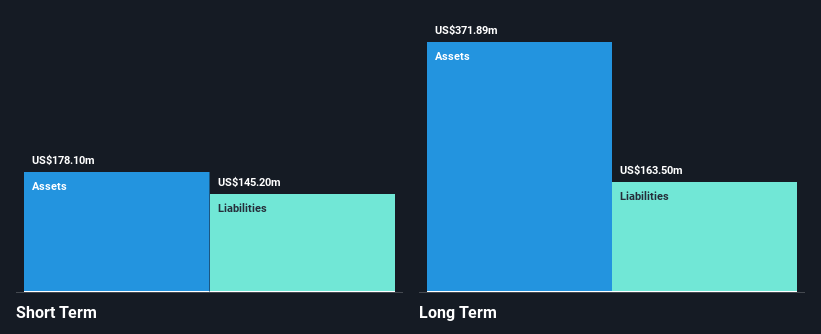

HF Foods Group, with a market cap of US$119.35 million, is navigating financial challenges typical of penny stocks. The company is unprofitable with a negative return on equity and high debt levels, yet it maintains a cash runway exceeding three years and has not seen significant shareholder dilution recently. Despite an inexperienced board and management team, recent strategic appointments like CFO Paul McGarry and director Jeffery Taylor aim to bolster governance and financial oversight. HF Foods continues to pursue growth through M&A opportunities while trading significantly below its estimated fair value, reflecting potential for future strategic gains.

- Click here and access our complete financial health analysis report to understand the dynamics of HF Foods Group.

- Gain insights into HF Foods Group's outlook and expected performance with our report on the company's earnings estimates.

Acacia Research (ACTG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acacia Research Corporation is an acquirer and operator of businesses in the industrial, energy, and technology sectors across various global regions, with a market cap of $316.34 million.

Operations: Acacia Research Corporation does not report specific revenue segments.

Market Cap: $316.34M

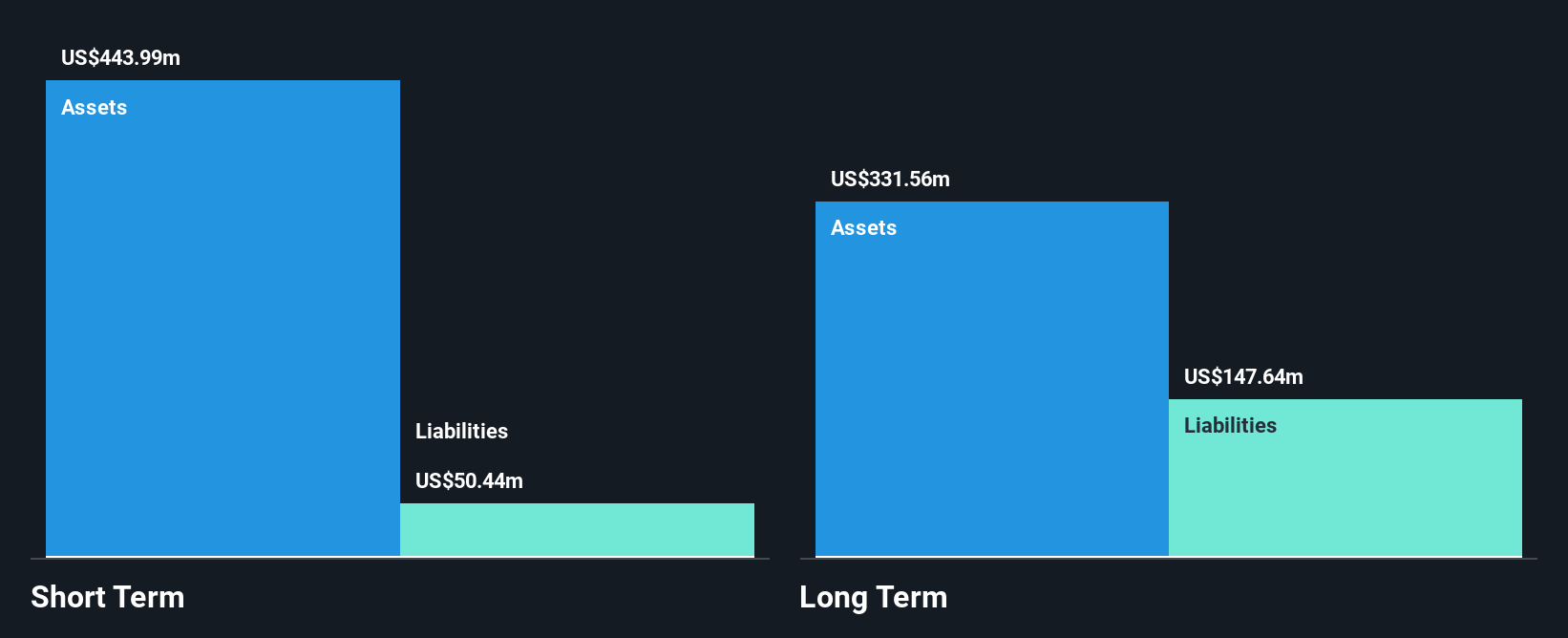

Acacia Research Corporation, with a market cap of US$316.34 million, has shown remarkable revenue growth, reporting US$59.45 million for Q3 2025 compared to US$23.31 million the previous year. Despite being unprofitable with a negative return on equity and an inexperienced board, the company maintains financial stability through a strong balance sheet and cash reserves exceeding its debt levels. Acacia is actively pursuing M&A opportunities in industrial sectors while focusing on free cash flow and strategic acquisitions to drive shareholder value amidst increasing valuation multiples in its target geographies.

- Dive into the specifics of Acacia Research here with our thorough balance sheet health report.

- Learn about Acacia Research's historical performance here.

Perfect (PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company offering AI and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of approximately $193.51 million.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, totaling $66.90 million.

Market Cap: $193.51M

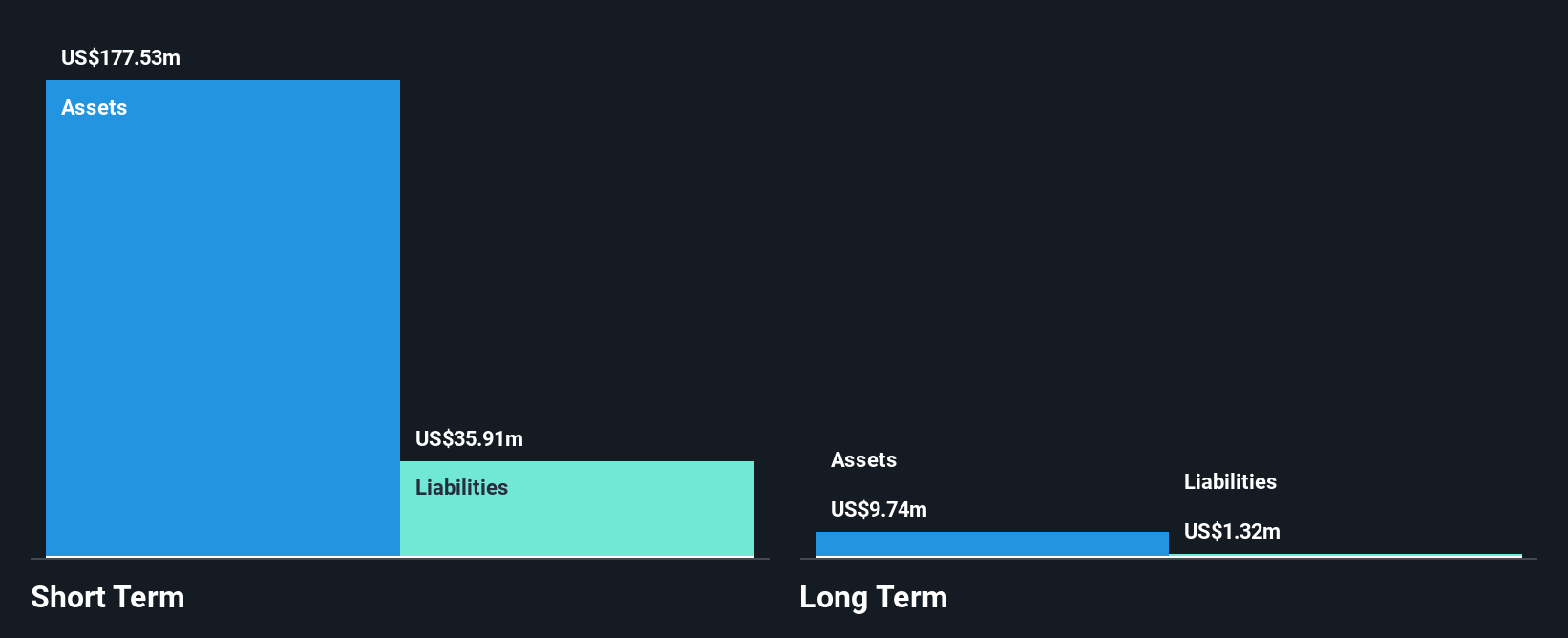

Perfect Corp., with a market cap of US$193.51 million, is leveraging its AI and AR solutions to expand in the beauty, fashion, and skincare sectors. Recent collaborations with Louis Vuitton and Erborian highlight its innovative virtual try-on technology. The company reported Q3 2025 sales of US$18.66 million, up from US$16.13 million the previous year, although net income slightly decreased to US$2.08 million from US$2.53 million year-over-year. Despite trading below estimated fair value and having no debt, Perfect's return on equity remains low at 3.7%. Earnings are forecasted to grow annually by 23.69%.

- Get an in-depth perspective on Perfect's performance by reading our balance sheet health report here.

- Explore Perfect's analyst forecasts in our growth report.

Seize The Opportunity

- Take a closer look at our US Penny Stocks list of 369 companies by clicking here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HF Foods Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HFFG

HF Foods Group

Operates as a marketer and distributor of specialty food products, seafood, fresh produce, frozen and dry food, and non-food products to Asian restaurants and other foodservice customers in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives