- United States

- /

- Hospitality

- /

- OTCPK:LNWO

Is Light & Wonder's Major Buyback and Index Shuffle Reshaping the Case for LNWO?

Reviewed by Sasha Jovanovic

- Light & Wonder announced in mid-November 2025 that its Board of Directors had authorized a substantial share repurchase program, enabling the company to buy back up to 80,234,110 shares through June 11, 2027.

- This announcement came shortly after the company was both dropped from several major Russell and NASDAQ indices and added to the S&P Global BMI and FTSE All-World Index, highlighting a significant transition in its index inclusion profile.

- Given the launch of a significant share buyback alongside sweeping index changes, we'll explore how these shifts affect Light & Wonder's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Light & Wonder Investment Narrative Recap

To own shares in Light & Wonder, one needs confidence in the company’s ability to expand its digital and regulated gaming offerings while managing debt and adapting to rapid industry change. The recent share repurchase program and sweeping index transitions are significant signals but do not materially shift the company’s most important short-term catalysts, continued digital growth and favorable regulatory changes remain central, while rising leverage continues as the biggest risk to near-term financial flexibility.

Among recent developments, the newly authorized share buyback program, set to retire up to 80,234,110 shares over the next 19 months, stands out as the most relevant and could support earnings per share if sustained. However, given ongoing regulatory headwinds and pressure from unregulated alternatives, the impact and timing of this initiative warrant careful monitoring for shareholders seeking long-term growth through digital expansion and disciplined capital management.

However, the risk of heavier debt levels constraining future actions is something investors should be especially mindful of because if interest costs...

Read the full narrative on Light & Wonder (it's free!)

Light & Wonder's outlook anticipates $4.0 billion in revenue and $698.8 million in earnings by 2028. This is based on a 7.8% annual revenue growth rate and a 2x increase in earnings from $349.0 million currently.

Uncover how Light & Wonder's forecasts yield a $105.73 fair value, a 17% upside to its current price.

Exploring Other Perspectives

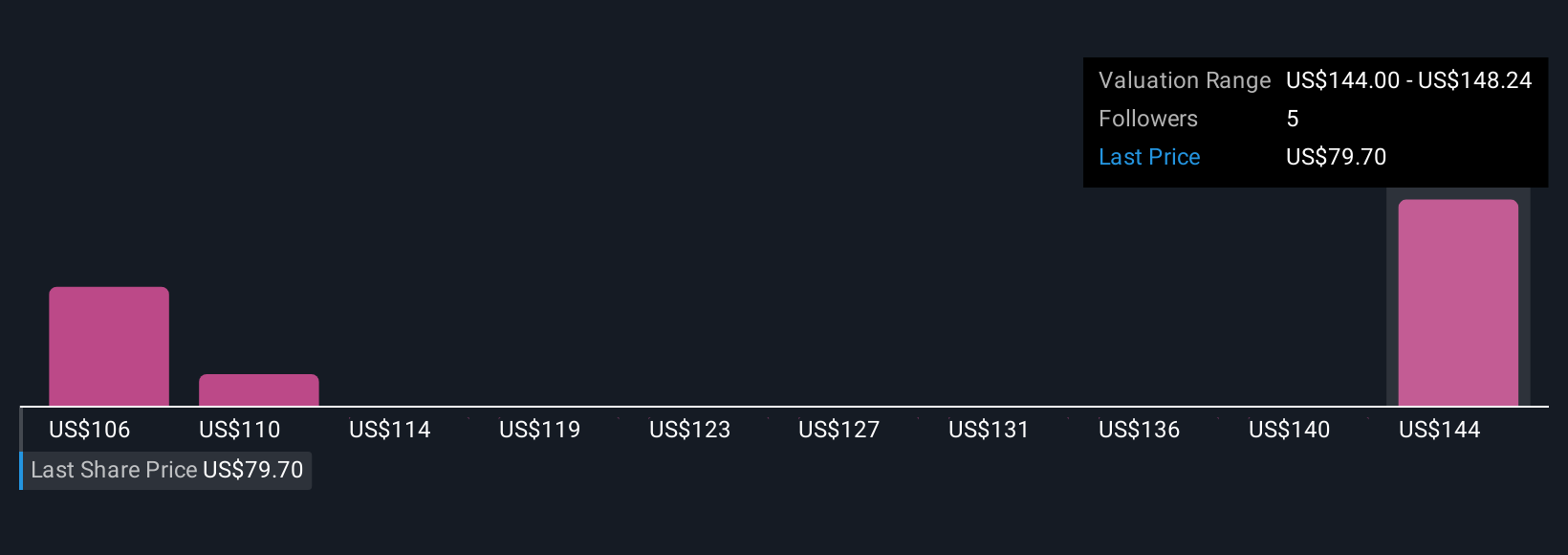

Fair value estimates from three Simply Wall St Community contributors span US$105.73 to US$158.23 per share. While community views differ widely, continued investment in digital content and market expansion may be key in shaping Light & Wonder’s performance over time, check out several perspectives to see how your own view compares.

Explore 3 other fair value estimates on Light & Wonder - why the stock might be worth as much as 75% more than the current price!

Build Your Own Light & Wonder Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Light & Wonder research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Light & Wonder research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Light & Wonder's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LNWO

Light & Wonder

Operates as a cross-platform games company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives